Hawksmoor has been at the forefront of the development of risk-based Model Portfolios, working in partnership with many of the leading adviser platforms since 2010.

Hawksmoor has been at the forefront of the development of risk-based Model Portfolios, working in partnership with many of the leading adviser platforms since 2010.

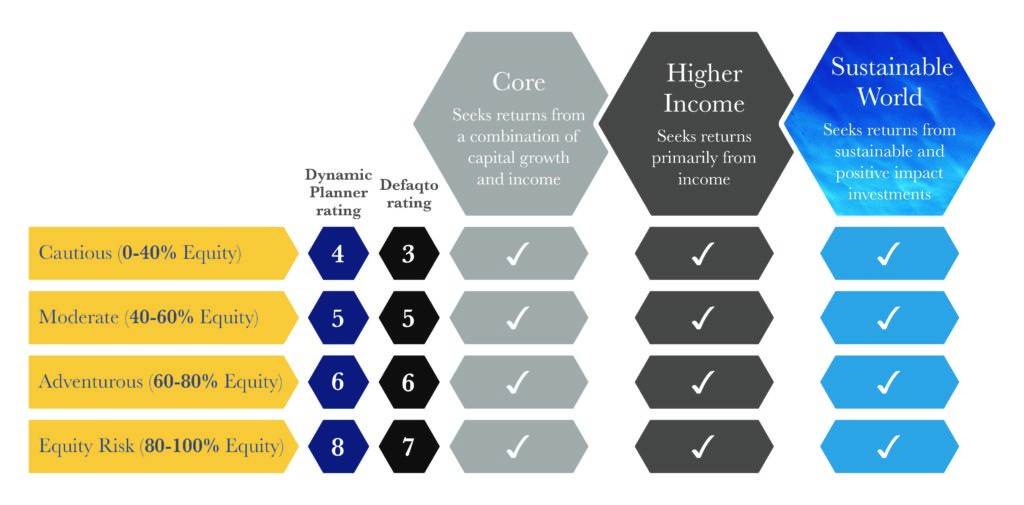

Twelve portfolios: a solution for every client

Our range of Model Portfolios spans twelve options: four risk levels, each with three portfolio choices.

A fuller range of portfolio mandates means that you can be confident of finding the most appropriate portfolio for your clients’ needs.

Three portfolio choices

Our Model Portfolio Service has three portfolio choices to cater for a wider range of client needs.

Core range

Our Core range seeks a balance of growth and income through the best ideas within our fund universe. Hawksmoor has been managing these Core portfolios since 2010 and has a track record to demonstrate the reliability of our investment process.

Higher Income range

The Higher Income range is intended for clients seeking a greater level of income from their investments. The funds selected in these portfolios will be tilted to those that produce above average levels of income. The Moderate (40-60% Equity) Higher Income portfolio has a performance track record since 2010.

Sustainable World range

The Sustainable World range provides clients with the means to reflect and promote their commitment to environmental and sustainability issues through their investment choices. It is an ideal solution for Financial Advisers who wish to respond to this demand. The Sustainable World range benefits from our award-winning in-house Research team’s rigorous approach to investment selection, which supports the aims of the United Nations Sustainable Development Goals, and uses the following categories:

Impact:

Funds which invest in companies that aim to make a positive impact on the environment and/or society, e.g. water management or social inclusion.

Integration:

Funds which invest in companies that embrace the best practices of sustainability, including ESG issues, e.g. energy efficiencies or sustainable supply chains.

Exclusion:

Funds which exclude investment in companies that are involved in contentious or harmful issues, e.g. armaments or gambling.

Four risk levels

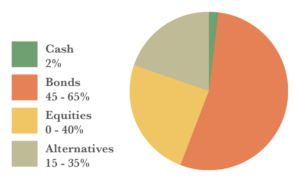

Cautious (0-40% Equity):

This Portfolio is intended for clients where a degree of equity risk is appropriate through an investment cycle, but where the longer-term preservation of capital is of primary importance.

This Portfolio is intended for clients where a degree of equity risk is appropriate through an investment cycle, but where the longer-term preservation of capital is of primary importance.

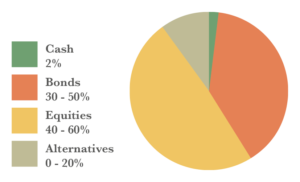

Moderate (40-60% Equity):

This Portfolio is intended for clients seeking returns in excess of inflation, typically with an equity content of close to 50%. These returns are not to the exclusion of the longer-term preservation of capital. The Portfolio value will tend to rise and fall with equity markets, but to a lesser degree. The Portfolio will be sensitive to changes in expectations for inflation and interest rates.

This Portfolio is intended for clients seeking returns in excess of inflation, typically with an equity content of close to 50%. These returns are not to the exclusion of the longer-term preservation of capital. The Portfolio value will tend to rise and fall with equity markets, but to a lesser degree. The Portfolio will be sensitive to changes in expectations for inflation and interest rates.

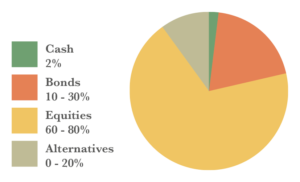

Adventurous (60-80% Equity):

This Portfolio is intended for clients seeking returns similar to global equity markets, though not to the exclusion of capital preservation. The Portfolio value will tend to rise and fall with equity markets.

This Portfolio is intended for clients seeking returns similar to global equity markets, though not to the exclusion of capital preservation. The Portfolio value will tend to rise and fall with equity markets.

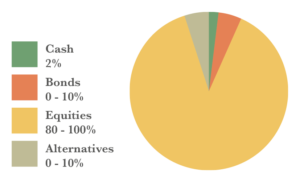

Equity Risk (80-100% Equity):

This Portfolio is intended for clients seeking returns similar to global equity markets. The Portfolio value will tend to rise and fall with equity markets.

This Portfolio is intended for clients seeking returns similar to global equity markets. The Portfolio value will tend to rise and fall with equity markets.

Our Model Portfolios are available on the following platforms: