Multi Asset Funds

How we invest

We have a disciplined investment process which has consistently delivered superior risk-adjusted returns for investors since the launch of each Fund:

- We identify significant trends and themes affecting the world economy and its financial markets

- We apply common sense to identify attractive investments

- We then manage our funds to benefit from these trends and themes.

As part of our process, we look at comparative values across asset classes, recognising that valuation at the time of purchase is the key determinant of future success. Investment can never be an exact science, so we favour investments with an attractive ‘margin of safety’ as one means of limiting risk. In addition, we constantly look to identify the major risks in the prevailing market environment and then find investments that guard against them.

Benefits of active management

We are unashamedly ‘Active Managers.’ We invest into actively-managed funds believing that, over the long term, good active managers are able to outperform the markets in which they are invested.

Once we have identified our favoured investment areas and themes, we carefully research the fund universe to establish the best funds to provide the required exposure. This is a highly labour-intensive process, with frequent and regular engagement with fund managers and analysts. Over the course of each year, our team will attend over 500 meetings and conference calls.

Benefits of a multi-asset approach

Our Funds are ‘multi-asset’ which means that they have exposure to a broad range of asset classes, including bonds, equities and ‘alternative assets’ such as commodities, property, infrastructure and private equity. As a result, they are highly diversified.

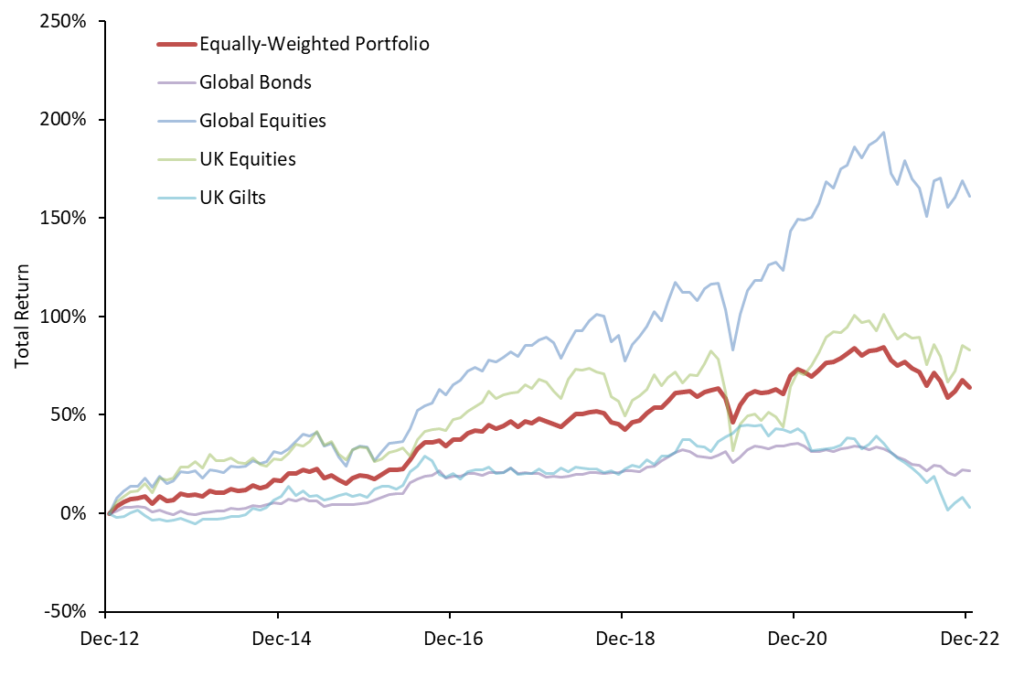

While all investments are chosen to provide an attractive level of total return over the long term, the spread of assets is also designed to reduce the level of volatility in the Funds’ performance. A simple equally-weighted portfolio split between different assets, as shown by the red line in the chart below, generates a superior risk-adjusted return than investors can achieve by investing in any single asset class.

Source: FE fundinfo. Global Bonds – IA Global Mixed Bond; Global Equities – IA Global; UK Equities – IA UK All Companies; UK Gilts – IA UK Gilts; Equally-Weighted Portfolio rebalanced monthly. Data from 31/12/2012 to 31/12/2022 on a monthly basis.

Benefits of closed-ended funds

We have proven experience in the closed-ended fund arena, including investment trusts. This is an area frequently ignored by other fund-of-funds managers, but it has been a source of significant value for our Funds. Closed-ended funds not only provide exposure to specialist assets that can be hard to access via open-ended funds, but they also frequently give the opportunity to invest in the shares of funds at a discounted price to the market value of the investments in the funds’ portfolios (normally referred to as ‘standing at a discount to net asset value’).

We look to achieve additional value by choosing funds run by talented managers who are able to deliver superior returns over and above those achieved by their asset class average.