Asset Risk Consultants (ARC) provide investment consulting, manager research and performance reporting to private clients, charities, family offices, professional trustees and their advisers.

Asset Risk Consultants (ARC) provide investment consulting, manager research and performance reporting to private clients, charities, family offices, professional trustees and their advisers.

Their Private Client Indices (PCI) are a peer group comparison tool designed to provide  an understanding of performance generated by discretionary private client investment managers. With over 70 investment companies contributing to the indices, performance can therefore be assessed against a realistic and sizeable peer group.

an understanding of performance generated by discretionary private client investment managers. With over 70 investment companies contributing to the indices, performance can therefore be assessed against a realistic and sizeable peer group.

The Indices have four categories based on risk-profile relative to equity markets:

- Cautious

- Balanced Asset

- Steady Growth

- Equity Risk

“For private clients and their professional advisers, PCI provides an objective means of placing investment performance into context.” (Source: ARC website)

Every quarter, Hawksmoor receives a report containing detailed information about performance against different criteria, in addition to separate reports about the performance of portfolios in each of the risk categories.

ARC Sterling PCI Report – December 2019

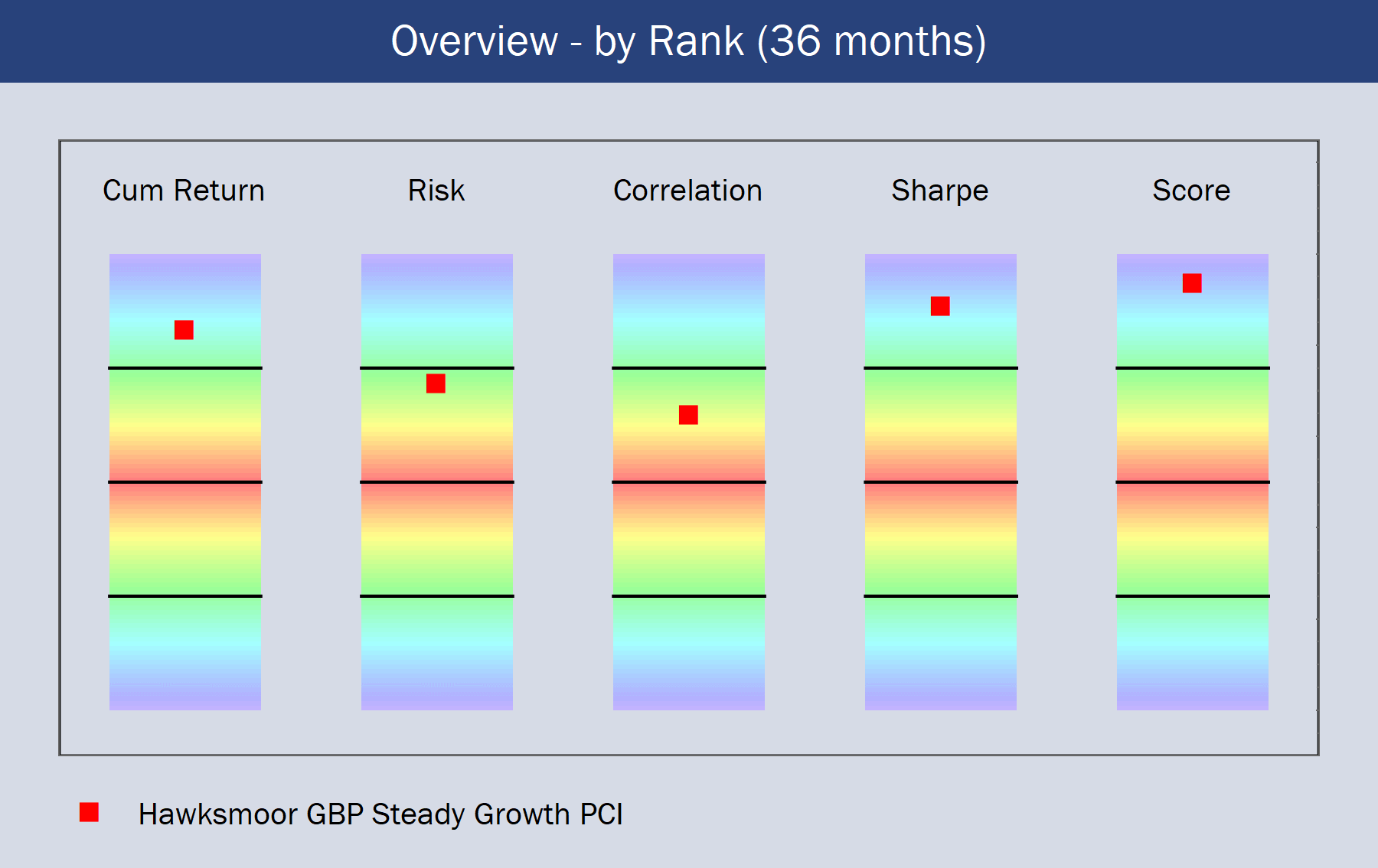

“In markets like these, it is nice to see that the latest ARC PCI report confirms that Hawksmoor delivers both performance and top quality risk control. In all 4 Sterling categories (Cautious, Balanced Asset, Steady Growth and Equity Risk), our risk adjusted returns are either first or second quartile over the past three years. Balanced Asset and Steady Growth, which account for over 80% of our portfolios, are both firmly top quartile. The rainbow (below) is the ARC Overview of our Steady Growth portfolios.”

Jim Wood-Smith CIO Private Clients & Head of Research

You can read more highlights from our December 2019 ARC Sterling PCI Report here, or click on the Useful Downloads below.