January 2021

At the most basic level, the minimum objective of any investor is to deliver a positive return after the impact of inflation and charges over the long run. Elevated valuations in many traditional asset classes undermine the probability of achieving this goal in the future.

In this article we explore how this problem has evolved and suggest that investors perhaps need to adopt a more innovative and differentiated approach to portfolio construction in order to meet their objectives going forward.

In constructing our award winning multi-asset fund range, we take advantage of a broad investment universe spanning both open and closed ended funds. We adopt an unconstrained approach that allows us to zero-weight expensive markets and embrace non-traditional asset classes to ensure that we can always construct portfolios capable of growing the real wealth of our clients over the long term.

The traditional “diversified” multi-asset portfolio

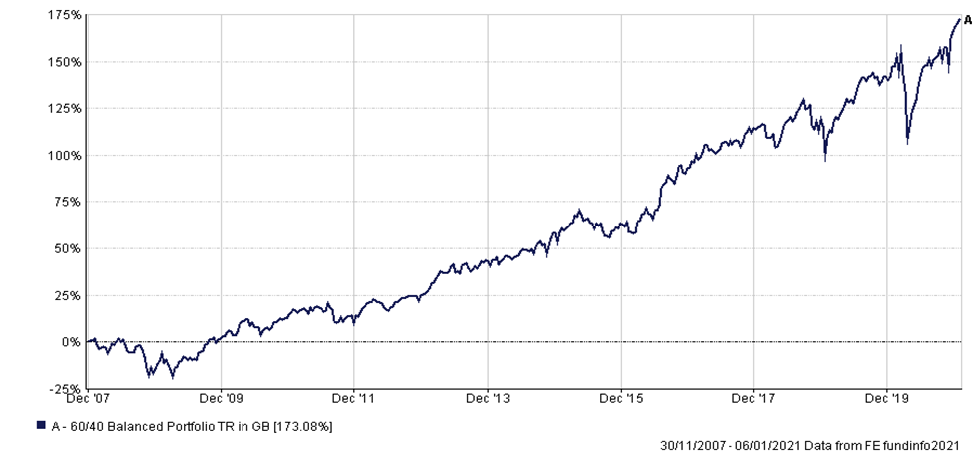

The traditional 60% equity 40% bond (60/40) portfolio has been a mainstay of portfolio construction for decades and on most measures has been an unequivocal success story. Publicly listed equities over the past 40 years or so have delivered inflation busting growth, whilst government bonds have acted as an effective hedge to equity risk, generating positive returns in times of stress and dampening volatility, whilst also providing an attractive level of income.

Source: FE Analytics. 60% equities represented by MSCI World All Cap, 40% bonds represented by ICE BofA Global Broad Market Hedge GBP. See full disclaimers at end of article.

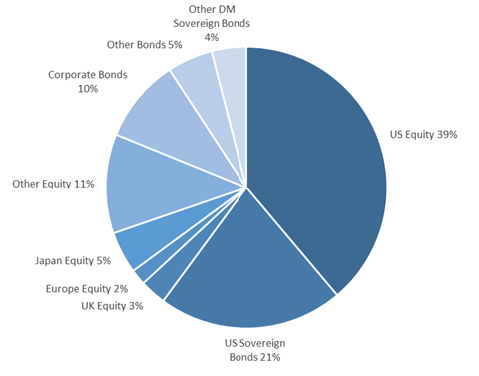

Many multi-asset investment strategies continue to allocate using this traditional framework, including passive solutions where the deep, liquid nature of mainstream equity and bond markets is particularly suited to large multi-asset index tracking funds. Such benchmark driven and market capitalization weighted approaches to asset allocation can, however, result in concentrated underlying exposures with a significant bias to US large-cap equities and developed market government bonds.

Source: MSCI and ICE, 31/12/2020. Portfolio of 60% equities represented by MSCI World All Cap, 40% bonds represented by ICE BofA Global Broad Market Hedge GBP. See full disclaimers at end of article.

Both of these asset classes have enjoyed protracted bull markets, delivering returns in recent years well in excess of long term averages, which has resulted in ever higher valuations.

Government bonds – more risk, but less return

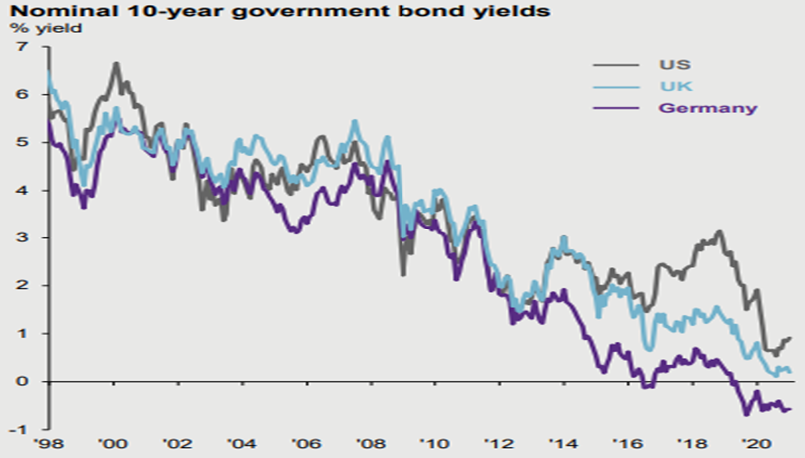

Turning to government bonds first, yields have fallen steadily over the past 40 years and remain close to historic lows. Investors in 10 year UK government debt, for example, are compensated with a paltry nominal gross redemption yield of 0.25%, a level of return that fails to satisfy that most basic of investment objectives of achieving positive returns after inflation and costs. The picture is true elsewhere with US, European and Japanese sovereign debt all delivering negative yields when adjusted for inflation.

Source: JPMorgan Guide to the Markets, January 2021.

As yields have fallen there has been a concurrent increase in the interest rate sensitivity of developed market government bond indices, with issuers incentivized to extend maturities and lock in low finance costs for as long as possible. For investors however, lower yields and longer duration means less return and more risk – a dual deterioration in the investment thesis that all investors should be wary of. The margin of safety associated with owning the asset class today has compressed significantly, with the positive income returns generated by government bonds quickly overwhelmed by the capital losses associated with even the smallest of increases in yield.

Perhaps more importantly, the efficacy of government bond yields as a hedge to equity risk is also diminished by todays starting yields, with the bond maths demanding nominal yields would have to go deeply negative from here to offset future equity corrections. Interestingly, in the pandemic-inspired equity drawdown of February and March 2020, government bonds in already negative yielding markets like Japan and Germany actually lost money during the peak to trough equity fall.

It is important to state that our caution on conventional government bonds is not predicated on an expectation that yields rise from here. Indeed our investment process leads us away from making such bold macro forecasts. Our concerns instead are founded on the view that current yields mean the asset class is no longer capable of generating an attractive level of return or of providing the diversification benefits government bonds have historically delivered.

Equity markets – priced for perfection

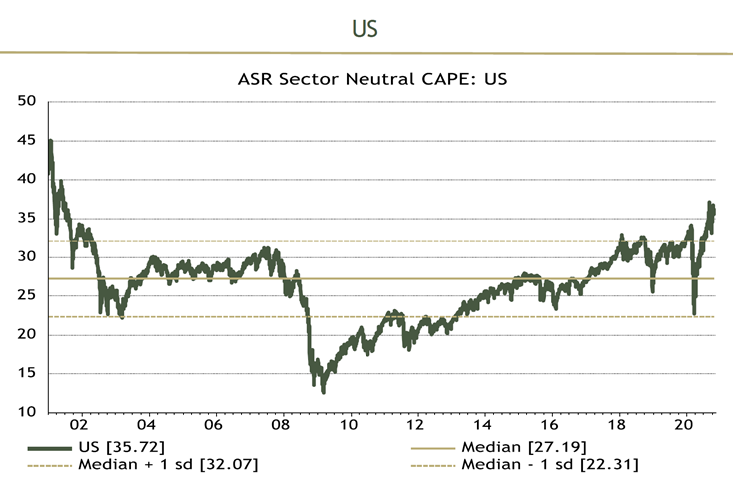

If the low returns and diminished hedging qualities of government bonds are posing problems for traditional asset allocators then so too are prevailing equity market valuations which, following a bull market that has vastly outpaced the underlying corporate earnings growth, currently stand at some of the most extreme levels in history. This is particularly true of the US market which on a host of metrics, including our favoured sector-neutral cyclically adjusted price earnings ratio (CAPE), looks unequivocally expensive. Broader measures of valuation, including Warren Buffett’s favourite which compares US stock market capitalization with the size of the US economy, have recently broken through all-time highs, whilst other signals that equity markets might be in the throes of speculative excess abound. The word ‘bubble’ is certainly being used with increasing frequency to describe recent market action and whilst we would not comment on that, we do believe that many equity markets are priced for perfection and offer little in the way of margin of safety, particularly when considering how elevated economic and geo-political uncertainty is today.

Source: Absolute Strategy Research, November 2020.

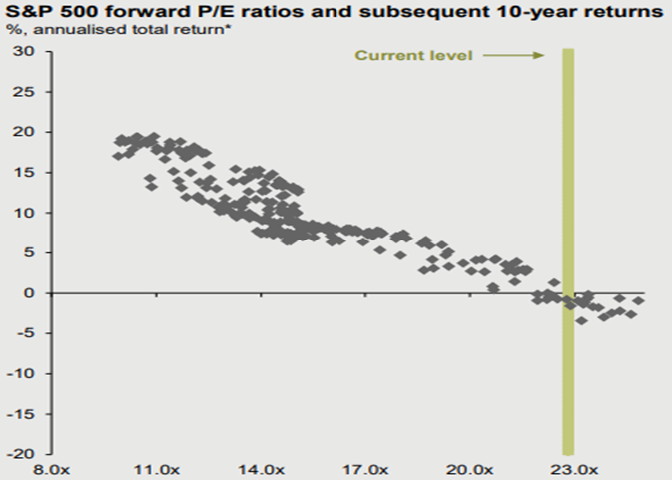

We fully accept that valuation is not a particularly good market timing tool but observe the empirical data that suggests that valuation is the key determinant of subsequent long term returns. As the chart below highlights, equity valuations at current levels imply negative annualized returns over the next 10 years. Importantly, the distribution of these returns is unlikely to be linear with excessive valuations rarely resolving themselves in an orderly fashion. Indeed, referencing the work of market historian and Yale professor Robert Shiller, past episodes of ‘irrational exuberance’ in the equity market have typically resulted in heightened volatility, sharp drawdowns and in many cases protracted bear markets.

Source: JP Morgan Guide to the Markets, January 2021.

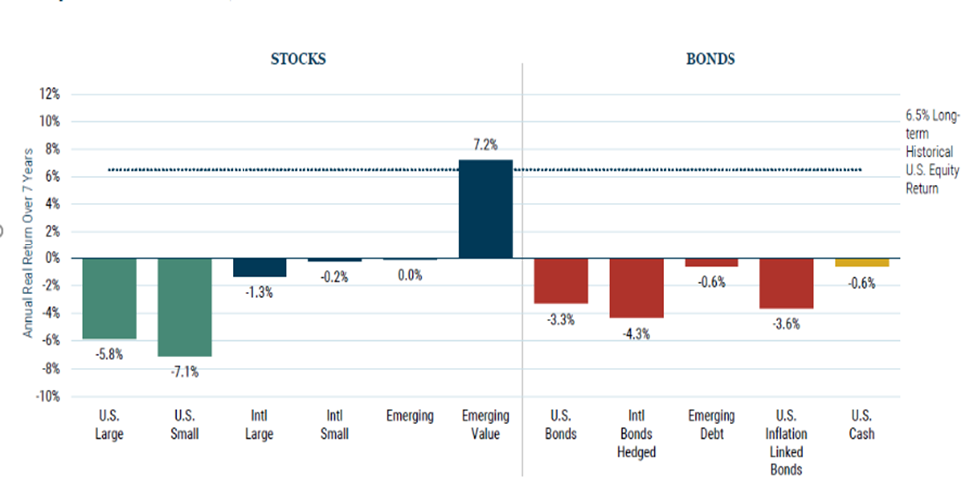

Against this backdrop of incredibly low government bond yields and elevated equity valuations the future return prospects for a traditional equity-bond portfolio look uninspiring. Indeed, applying US asset manager GMO’s valuation-led framework and assumptions to a market-cap weighted 60/40 portfolio implies annualized real returns over the next 7 years of -4%. Clearly such forward-looking return estimates are just that – estimates, but any way you cut it: with valuations where they are today it is hard to formulate a scenario where traditional portfolios continue to deliver the level of returns seen in recent years.

Source: GMO Asset Management, December 2020.

The portfolio construction problem

The problems posed by expensive equity and bond markets have profound implications for portfolio construction and they present multi-asset investors with a number of important questions. Is it possible, for example, to identify other instruments capable of fulfilling the traditional role of government bonds? If equity returns are likely to be lower going forward, how do savers and investors protect their wealth?

On the diversification point there are of course other ways of hedging equity risk with put options and net short equity absolute return funds being two such alternatives investors might consider. However unlike the positive income returns generated by government bonds, both of these options are zero yielding, carry an explicit cost of insurance and are likely to have negative return profiles in the long run.

For those operating within the confines of a traditional asset allocation framework, tolerating more risk and greater drawdowns could be considered. At the other end of the spectrum a reduction in equity exposure might seem the appropriate response to the diminished hedging qualities of government bonds, but neither measure is a particularly elegant solution that adequately addresses the present day dilemma of how to harvest an acceptable level of return without incurring an unacceptable increase in risk.

Furthermore, we also worry that low interest rates are being used to justify high equity valuations and that a rise in bond yields could be the catalyst that ends the current equity market complacency. In such a scenario the negative correlation between equities and bonds that underpins the portfolio construction principles of the 60/40 portfolio would be wholly undermined.

There is another way

With this in mind, we think it sensible for investors to look beyond mainstream equities and bonds. We believe that achieving attractive risk-adjusted returns in the years ahead will require an approach that embraces alternative and real assets. Investments in this space include less liquid investments like property, alternative credit, private equity and infrastructure as well as precious metals and other commodities. Some of these have low to negative correlations with other financial assets and so bring diversification benefits to a multi-asset portfolio, whilst many are also generous income generators which help address the problem posed by low bond yields. Inflation hedging qualities and the ability to generate idiosyncratic returns in some of these private markets are further attributes.

Even more esoteric asset classes such as music royalties, battery storage and life science debt capital, whose risk and return drivers are almost entirely independent of the economic cycle and financial markets, are available to those willing to look beyond the mainstream.

An unconstrained approach to asset allocation and a willingness to zero weight very expensive markets, regardless of how big they might be, will also be important. The corollary of this is an adoption of a more targeted approach within public markets in identifying opportunities and an appetite to invest actively and with conviction. Pockets of value certainly still exist: such as in UK small caps, Japanese cyclicals, Asian high yield and US structured credit but these on the whole are under-represented in passive and other benchmark orientated multi-asset approaches.

As nimble, benchmark agnostic investors and as long-time proponents of the closed-ended fund universe we are able to access these less liquid alternative and real assets, which in turn allows us to construct truly multi-asset portfolios. Beyond the income and diversification benefits discussed above, each investment in this space is assessed on its own merit in terms of valuation and return potential with a typical investment expected to deliver high single digit to low double digit IRRs, an attractive rate of return relative to low bond yields for sure, but also when compared with the average nominal returns produced by equities over the long run.

It should be recognised that investing in investment trusts and less liquid assets is not a one way street, with the drawdowns experienced by many closed-end funds in the market chaos of last February and March a timely reminder of the short run damage that discount volatility can inflict, including on our own Funds’ performance. Underpinned by extensive due diligence and targeted stock selection, we remain confident however, that there are plenty of opportunities in this space where the underlying assets will eventually fulfil expectations, helping long term investors meet their investment objectives.

The Hawksmoor Funds: truly multi-asset

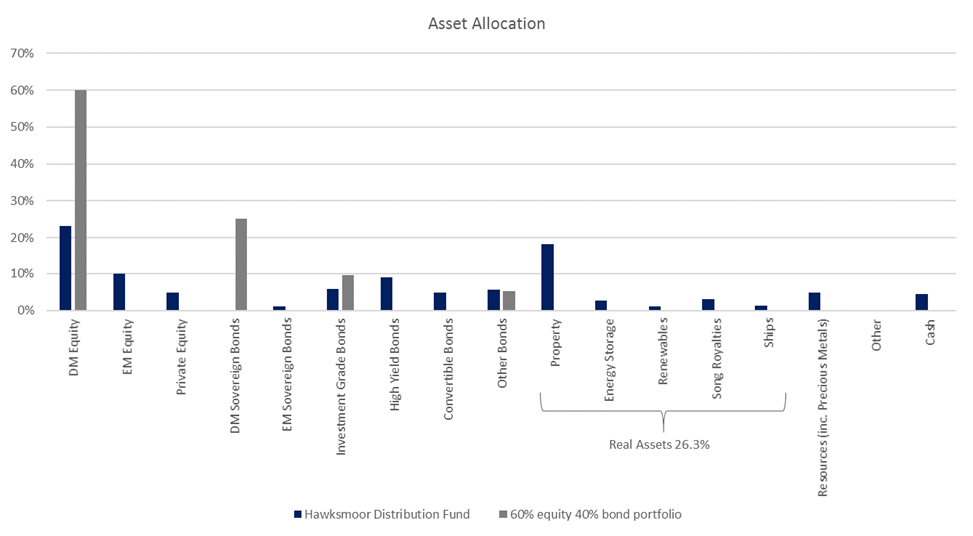

The chart below compares the Hawksmoor Distribution Fund’s asset allocation with that of a market-cap weighted 60/40 portfolio, starkly illustrating the highly diversified nature of the former and the concentrated exposure of the latter. In a world of elevated asset prices, having access to a fuller set of investments not only increases our opportunity set when scouring the globe for attractive opportunities, but just as importantly helps dampen portfolio volatility, effectively replacing the once effective hedging capabilities of government bonds. As multi-asset fund managers, carefully combining different holdings and focusing on inter-stock correlations is as central to what we do as identifying attractively valued individual investments.

Source: Internal, MSCI and ICE, 31/12/2020. Portfolio of 60% equities represented by MSCI World All Cap, 40% bonds represented by ICE BofA Global Broad Market Hedge GBP. See full disclaimers at end of article.

Our award winning, highly diversified multi-asset fund range can be used as standalone portfolios for clients. In addition, with their current low allocations to mainstream equity and bond markets and significant exposure to alternative and more idiosyncratic assets, they can also act as an excellent complement to other active and passive multi-asset funds that invest using a more traditional framework.

Similarly, we strongly believe that the combination of our differentiated investment process and our current portfolio positioning is the best way to protect and grow our client’s wealth in the years ahead, but equally recognize that humility in investing is important and that we might be wrong. Perhaps equity markets will continue to defy gravity and maybe government bond yields will continue to head lower, in which case the trusty 60% equity 40% bond portfolio might have life in it yet. Following the longest equity and bond bull markets in history however, it might be reasonable to take a few chips off this particular table and consider, in part at least, a different, more creative approach.

Ben Mackie – Fund Manager

This financial promotion is issued by Hawksmoor Fund Managers which is a trading name of Hawksmoor Investment Management (“Hawksmoor”). Hawksmoor is authorised and regulated by the Financial Conduct Authority. Hawksmoor’s registered office is 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. Company Number: 6307442. This document does not constitute an offer or invitation to any person, nor should its content be interpreted as investment or tax advice for which you should consult your financial adviser and/or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. Any opinion expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represents the views of Hawksmoor at the time of preparation and may be subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. HA4195.

Source: MSCI. Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent.

The index data referenced herein is the property of ICE Data Indices, LLC, its affiliates (“ICE Data”) and/or its Third Party Suppliers and has been licensed for use by Hawksmoor Investment Management Limited. ICE Data and its Third Party Suppliers accept no liability in connection with its use. See https://www.hawksmoorim.co.uk/ice-data-indices-disclaimer/ for a full copy of the Disclaimer.