Blow, blow thou winter wind

Sometimes it is important just to focus on the simple and the nice message. Investment markets have, by and large, behaved well in the past three months. Phew. There is a predictable myriad of complications, nuances and exceptions around this, but the world is adapting quickly to the threats, challenges and opportunities of the COVID-19 pandemic, and markets have been reasonably calm.

The performance of global markets in the third quarter can be summarized very quickly. Equities rose, again led by the United States, and again with the UK being a notable laggard. Bond markets were placid; yields have been anchored by the gargantuan buying of bonds by the world’s Central Banks, and ‘spreads’ (the difference in yield between government and other, riskier bonds) have narrowed slightly. The price of gold rose a little further, but the benefit to portfolios was softened by a fall in the US dollar against the pound.

Investment markets have behaved well in the past three months

Let us put some flesh on these unadorned bones. It is not by accident that homo sapiens has come to dominate Planet Earth. We are a highly adaptable species, built for survival. COVID-19 is just one more hurdle to overcome and we are already showing that we are going to do so, ultimately very successfully. That may mean that a number of the parts of what we used to call ‘normal’ will no longer hold true for a while. For many, this will be uncomfortable. That will not last forever. Just as horse traders eventually had to embrace the age of the motor car, so the successful businesses of now are already embracing social distancing, working from home, learning from home, internet retailing, and so on. This is just as they have to adapt to and embrace everything that comes with decarbonization: renewable power, electric vehicles, recycling, circular business models, waste elimination, energy efficiency, and so on.

Many are pinning the success of the future on vaccines, treatments or cures for COVID. We tend not to agree. Yes, all or any of these will help in the short-term, but they do not change the very powerful transitioning that is already well in motion. What we have seen is that what we might call Capitalism-19 was dangerously vulnerable to pandemic. It was fragile in ways that few had appreciated. The world that is evolving from this will not be immune to another, maybe more deadly, disease, but it will be much better placed to deal with it.

You may be forgiven for thinking that these are the random and irrelevant musings of someone who ought to spend more time outside Cornwall. They are, though, the primary reason behind the ongoing and, some may argue, surprisingly good recovery in equity markets. Not only that, but this line of thinking underscores why certain parts of the American market – notably the very large software businesses – have performed so well, and why the UK equity market, loaded with the stocks of yesteryear (literally) continues to lag so painfully.

The implications for portfolios is more complex than just spotting that the leading stocks continue to lead and that the laggards lag. There is the very thorny and difficult issue of income. With bond yields so low (and effectively zero for almost all sovereign bonds), equity has been the natural pond in which to seek income. The trouble is that – as a generalization that could sweep the Albert Hall – shares that have paid attractive dividends have been old economy laggards, while the shares of the transition leaders yield precious little. A portfolio trying to provide a yield of 3%, 4% or even higher will almost certainly have been invested in old world stocks. Not only have these unloved share prices largely failed to recover from the COVID lows of spring, but the lockdowns (or regulators, in the case of the banks) have seen them cut or even stop paying their dividends.

The autumn months bring renewed challenges. Whilst COVID remains a fact of life, the reaction of authorities to the worsening second wave is a major unknown. No one will choose a repeat of a nationwide lockdown to rival spring of this year; what is more probable is that we shall see a series of local measures on a stop-go basis. The juddering is a little like a learner driver’s clutch control. It is easy but wrong to put too much blame on governments; we are all on the same learning curve and the policies will be to muddle through until the better weather next spring in the Northern Hemisphere.

Against this backdrop, we have the US presidential election and Brexit to contend with. As I type, there are clear favourites in both, being Biden and No Deal. By the time you read this, both are likely to have changed. But let us deal with each. Investors traditionally fear a Democrat president. This time, we believe this is less so. Biden does not have aggressive tax plans, and has outlined a multi-trillion dollar investment into decarbonization. He is presenting a forward thinking and largely business friendly face. Brexit-wise, honestly, who knows? The incumbent government shows every sign of wishing to achieve No Deal and to blame the European Union for any hurt that may be caused by this. But in this painfully long saga of more bluffs than Frank Muir and Patrick Campbell combined, we are just as much in the dark as everyone else. We assume a No Deal conclusion, anything else will be a bonus. Either way, what the market and business needs is the certainty of knowing what they will need to deal with.

The worst that could happen is that the US election ends up in the Supreme Court

By the time we write again, both issues will be past. Probably. The worst that could happen is that the US election ends up in the Supreme Court. Markets will hate that and would fall, probably quite sharply, if we have to go down that road.

We also have the issue of money printing and inflation to deal with. This brings us back to the upcoming COVID winter as well. If economies run out of steam, or even turn down again, as a result of tightening social restrictions, we should expect that the Central Banks will again have to promise to set the presses rolling again. And that will re-stoke the fears that drove the gold price over $2000/oz earlier in the summer. Inflation is the mouse that has not yet turned into a lion. It is also a mouse that we continue to watch very closely, and our trap is deliberately baited with gold.

It is fair reflection on the past six months that both economies and investment markets could have fared very significantly worse than they have. The responses of the Central Banks have been conspicuous short-term successes, with the caveat that the long-term implications of quite so much money remain very much open to question. Governments continue to muddle through quite exceptional circumstances and will occasionally get some things terribly wrong. In the meantime, as was always the case, good businesses are adapting to and embracing the challenges, and turning these into opportunities. And to complete the titular quotation “Blow, blow thou winter wind, thou are not so unkind as man’s ingratitude”. (As You Like It, Act II, Scene VII).

Jim Wood-Smith – Chief Investment Officer, Private Clients

Jim Wood-Smith – Chief Investment Officer, Private Clients

Every Cloud

According to The World Economic Forum we are on the brink of Industry 4.0, a ’Fourth Industrial Revolution’ that will fundamentally alter the way we live, work, and communicate with one another. Found at the heart of this transformation, cloud technology has a unique position as an enabler for other technologies to flourish.

Cloud computing

Cloud computing is simply the delivery of computing services via the internet. For example, cloud storage services give users password-protected access to online storage space, meaning data in the form of photos, messages, and documents can be stored here. Apple fans will be familiar with iCloud. There are three types of cloud: public, private and hybrid. The most popular of which are public clouds, which are owned and operated by third-party cloud service providers. Spotify, a popular music and podcast streaming application, uses a public cloud that is managed by Google. On the other hand, a private cloud can be located on a company or organisation’s data centre for exclusive use by themselves. Hybrid clouds combine both public and private clouds with technology that allows data and applications to be shared between the two.

IaaS, PaaS, and SaaS

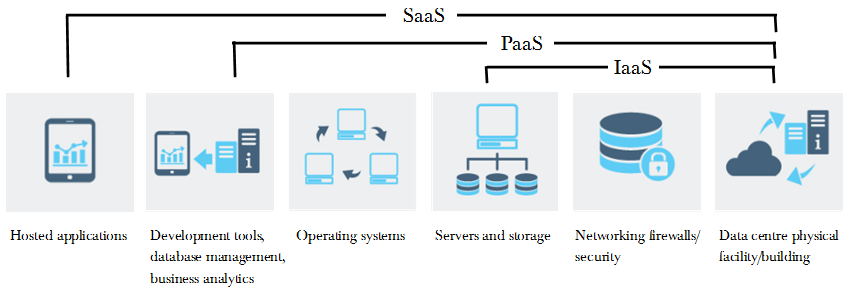

Cloud service providers offer three levels of cloud technology, sometimes referred to as the cloud computing stack (see Diagram 1) as each level builds upon the last.

Diagram 1: Cloud computing stack

(Source: Hawksmoor Research)

Infrastructure as a Service (IaaS) is essentially a rental service of IT resources from a cloud. Clients will receive instant computing infrastructure that is managed over the internet by a third-party cloud service provider, avoiding the expense and complexity of buying and managing a physical data centre. Infrastructure use can be scaled up and down with demand, letting clients pay only for what they use, a function that is essential for businesses to respond more quickly in rapidly changing business environments.

Platform as a Service (PaaS) not only offers IT infrastructure but also a cloud ecosystem for developing, testing, delivering and managing software applications. Middleware, business intelligence services and database management systems are all examples of what is included within a PaaS offering. Clients can use platform resources on a pay-as-you-go basis to deliver cloud-based applications much more easily and efficiently.

Software as a Service (SaaS) is a method of delivering software applications over the internet. This essentially means that organisations can rent the use of an app which its users can then connect to using their own device, without the hassle of hosting and managing the app. An end-user friendly application is available on the spot for organisations to subscribe to.

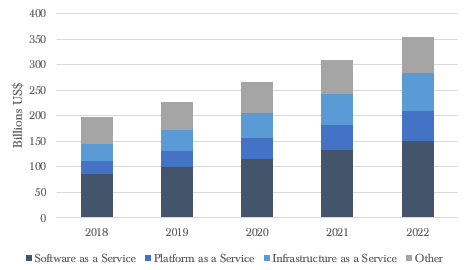

SaaS is currently the largest market segment in terms of revenue, though is still expected to grow by c.16% p.a. This growth is partly due to the scalability of the subscription-based model used, which is also attractive for companies offering SaaS as it gives greater visibility over revenues and generally means long-term contracts are signed by clients. IaaS is the second largest and also the fastest growing segment, expected to grow 24% this year. The demand for modern applications is continually increasing and it is becoming harder for traditional data centres to meet these needs, creating a perfect environment for cloud infrastructure providers to grow.

Clouds everywhere

Cloud computing has grown significantly in the last decade to a stage where the majority of people in developed economies use the cloud every day, whether we realize it or not. Simple day-to-day activities, such as online banking, email, social media and online shopping have become much more accessible. Users simply log on from their device and instantly have the ability to perform tasks. This is cloud technology in action.

Take Outlook, Microsoft’s webmail application, as an example. Outlook fits into the SaaS camp, it’s a software application that is managed entirely by Microsoft. Once subscribed, users can access their emails and stored messages from any web browser or device. The benefits for an organisation using this service are three fold – cost efficient, accessible and scalable – it receives access to sophisticated applications for all employees, paying only for what it uses.

Sky high growth potential

Cloud technology is essential to the scalability of new economy ideas. The integration of smart meters and eventual development of a smart grid would utilize cloud-based technology. Even the future of cars will be shaped by the cloud, autonomous vehicles generate a myriad of data that relies on cloud computing to transfer and store it. This interconnection of devices is a growing development known as the Internet of Things, it sits side by side with the cloud as it enables computing devices embedded in everyday objects to send and receive data. It is therefore not a surprise that the cloud market is expected to account for over 70% of all technology and software spending this year.

But what does this mean in numbers? Gartner, a leading IT research and advisory company, forecasts that cloud revenues will be $350 billion by 2022 (see Chart 1), an increase from $230 billion in 2019 giving a 3 year compound annual growth rate of 16%. This growth potential of the cloud market thus far has been captured predominantly by the major technology players in the US: Amazon, Microsoft and Google.

Chart 1: Global Public Cloud Service Revenue Forecast

(Source: Hawksmoor Research)

The COVID-19 pandemic has accelerated the pace at which cloud technology has been adopted. Not only is the cloud’s flexible subscription-based pricing model accommodative for businesses making the shift to remote working, but increasing pressure on cybersecurity and data protection can be mitigated through secure, reliable cloud connections. Companies are beginning to realize the importance of utilizing IT resources and cloud technology offers a one-stop shop to do so. In terms of IaaS, revenue will likely flow predominantly to the large players within the market which can offer the best pricing solutions and have the most advanced data centres. However, the growth potential and opportunities within PaaS and SaaS are ever increasing as the evolution of cloud is moving beyond simple back office tasks and towards the outsourcing of more sophisticated analytics and middle office operations.

Conclusion

Cloud computing is becoming ever present in a world that is more digitally-connected and reliant on the storage and communication of data. It has transformed from once being a background operation to running companies’ remote office setups. Technologies of the future are more memory-intensive and data-intensive which will require huge data centres with enormous processing power to flourish, which is exactly what cloud technology can provide.

Ben Luck – Research Assistant

Ben Luck – Research Assistant

Hawksmoor Investment Management Limited is authorised and regulated by the Financial Conduct Authority (www.fca.org.uk) with its registered office at 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. This document does not constitute an offer or invitation to any person in respect of the securities or funds described, nor should its content be interpreted as investment or tax advice for which you should consult your independent financial adviser and or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. The information and opinions expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represent the views of Hawksmoor at the time of preparation and may be subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested.