11th June 2021

For some reason, industry convention is to judge funds based on cumulative performance at a point in time. Typically, funds are judged on 1/3/5 year cumulative performance, and a verdict of “this fund is worth investing in or not” is given. We think this is very dangerous.

Ideally, a fund should outperform its peers all the time. So whenever you looked at cumulative performance, it would always be first quartile. Thus it would be first quartile over every cumulative period going back to inception, and also top quartile over every discrete period. After all, to be top quartile over all cumulative periods, the fund would have to keep performing well over every discrete period too.

If you know of such a fund, please could you let me know? That fund management team has solved investment and we’d like to meet them.

After that rather chippy opening, let me further explain why judging funds on cumulative performance is dangerous. If you accept that no fund can outperform all the time, then it follows that it will underperform some of the time. That period of underperformance is most likely to occur just after the 1/3/5 year cumulative numbers are looking best. Thus when we are assessing funds, we are actively dissuaded from investing when a fund’s numbers look that good. We put it to the fund managers as well: “your numbers are fantastic, why do you think they will stay that way? Have you got any evidence to support your claim?”

No matter the sector – multi-asset, European equities, Emerging Market Bonds etc – the same argument applies. All funds go through periods of underperformance. The key is to identify those that can deliver superior through-the-cycle returns: funds that reward you for being patient. Such funds are best purchased when their numbers are looking poor, not good.

This subject has been much on our minds lately. Our Funds have a track record that stretches back to 2009. Our Vanbrugh Fund is the top performing fund in its sector since launch. But 2019 and 2020 were tough for us for reasons we have explained in depth previously and we performed poorly on a relative basis. Towards the end of 2020, we argued vociferously that the value in our portfolios, relative to the mainstream, was now ridiculously cheap. We argued that it would be a good time to invest. Thankfully, performance has indeed picked up and over shorter periods out to 1 year our Funds are all top quartile.

But here is where the use of cumulative performance analysis gets really silly. Take our 3 year numbers. We had a very good 4th quarter of 2018. This will drop out of our 3 year cumulative numbers (which investors monitor very closely) at the end of this year. Even if we continue to deliver top quartile performance, if those returns are not sufficient to make up for losing that excellent period, our 3 year cumulative numbers will worsen. Let me repeat that. Even if we perform well in Q4 2021, then an investor’s perception of us may deteriorate over that 3 month period, because our 3 year cumulative numbers will have worsened.

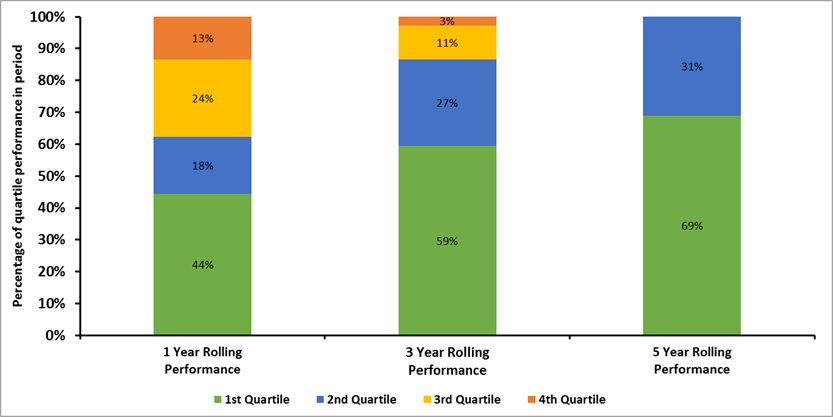

We therefore like to present cumulative performance over multi periods. Take Vanbrugh, which has over 12 years of track record. We take 1/3/5 year periods at the end of every quarter (thus Vanbrugh has 48 quarters of data and 29 five year periods, 37 three year periods and 45 one year periods). We then look at the percentage of each of these groups of cumulative periods that are 1st / 2nd / 3rd / 4th quartile. Here are the results:

Source: FE Analytics GBP Total Return. Quarterly from 31/03/2009 to 31/03/2021. Relative to IA Mixed Investment 20-60% Shares Sector. May not sum to 100% due to rounding error.

So you will see that 13% of our 1 year cumulative performance periods are 4th quartile, 24% 3rd quartile, 18% 2nd quartile and 44% 1st quartile. The 3 and 5 year stats are also shown. You will see that the longer you hold Vanbrugh the more likely your returns are going to be sector-beating. In fact, so far, we have never delivered a 5 year period where we underperformed. If you owned Vanbrugh since day 1, you’d have the best fund in the sector. We think this is proof of a successful disciplined process and should give our investors the confidence to hold us through periods of poorer relative performance. We also suggest that a good time to invest in us might be after a period of poor performance – just as we saw in 2019 and 2020. Indeed, this is exactly the way we analyse the funds in which we invest on behalf of our own investors.

We will soon be issuing a more formal note on this, so please keep an eye out or ask any of the team to be put on the formal email distribution list.

Ben Conway – Head of Fund Management

This financial promotion is issued by Hawksmoor Fund Managers which is a trading name of Hawksmoor Investment Management (“Hawksmoor”). Hawksmoor is authorised and regulated by the Financial Conduct Authority. Hawksmoor’s registered office is 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. Company Number: 6307442. This document does not constitute an offer or invitation to any person, nor should its content be interpreted as investment or tax advice for which you should consult your financial adviser and/or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. Any opinion expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represents the views of Hawksmoor at the time of preparation and may be subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. HA4375.