24th February 2023

Regular readers will know that my colleague Ben Conway, along with a few other hardy campaigners, have written extensively on the topic of cost disclosure rules, highlighting how they impact multi-asset funds investing in investment trusts and how well-meaning regulations might result in poorer investor outcomes and an unlevel playing field.

The issues are myriad and it’s certainly not the intention to revisit all of the arguments here. Instead, this week’s Crescendo zooms in on the specific issue of how two operating companies with similar cost bases and business models can be treated completely differently under the cost disclosure rules, just because one is classified as an Alternative Investment Fund and the other isn’t. I give you the curious case of Land Securities (ticker LAND) and Urban Logistics (ticker SHED).

Land Securities is an internally managed Real Estate Investment Trust (REIT) offering diversified exposure to predominantly UK commercial property. Stating the obvious, Land Securities has a management team and other employees who are paid salaries as well as numerous other operational costs associated with doing business. As a ‘Chapter 6’ commercial company (requiring 3 years of trading history prior to listing) none of these costs need to be disclosed and Land Securities can be held within investor’s portfolios at zero cost. The REIT has historically had significant exposure to shopping centres and high street retail, property sub-sectors that have performed poorly in recent years.

Urban Logistics is an externally managed Real Estate Investment Trust managed by a high-quality team that invest only in warehouses and last-mile logistics units, a sector with attractive supply-demand fundamentals underpinned by secular growth in ecommerce. Urban Logistics, due to UKLA listing rules, is classified as a ‘Chapter 15’ Closed-Ended Investment Fund and as a result must disclose costs and charges. A further complication is the fact that these costs are expressed as a percentage of net asset value (NAV), yet as with all investment trusts, when buying Urban Logistics, investors own the share price as opposed to the NAV and transact at the market’s valuation of the company, just as you would when buying or selling Land Securities or any other equity. So why list via Chapter 15 if it results in onerous cost disclosure? Firstly Chapter 15 companies don’t require 3 years of trading history making them a popular listing route for companies operating in nascent sectors or in more established areas where a particular opportunity presents itself at a point in time. From the investors perspective Chapter 15 companies also have distinct advantages, including an independent Board who are able to sack external management should the latter not be behaving in the best interests of shareholders.

The absurdness of the situation is highlighted further by analysing the EPRA cost ratio of our two REITs which expresses overheads and operating expenses as a proportion of gross rental income. On this measure the management and operational costs incurred by Urban Logistics (21.6% EPRA cost ratio) are lower than those of the ‘zero cost’ Land Securities (26.2%), yet under the PRIIPs regime the former has to report its ongoing cost ratio of 1.6% whilst the latter does not. These underlying costs are then rolled into the all-encompassing ongoing charge figure quoted by certain funds. This bundled OCF forms a critical part of fund buyers’ due diligence and analysis. Interestingly, some fund providers have elected not to include underlying investment trust costs in their OCFs, creating an unlevel playing field and making it difficult for end investors to make objective judgements between different funds, an incredibly important issue we’ll return to in more detail in a future blog.

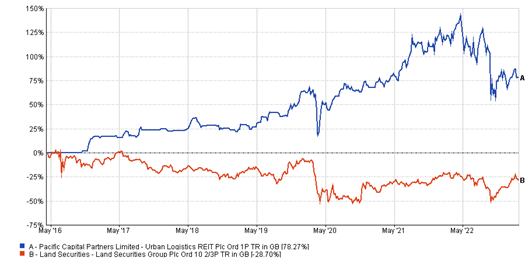

So, cost conscious investors should invest in Land Securities, right? Well perhaps not, especially if they care about net performance.

Source: FE Fundinfo, 13/04/2016 to 21/02/2023.

With an ever-larger cohort of investors whose primary focus is cost, and with the regulatory push for multi-asset funds to publish a headline OCF inclusive of investment trust costs, it might be tempting to move away from investing in fantastic, externally managed niche REITs like Urban Logistics and indeed investment trusts in general. We strongly believe, however, that this would be at the detriment of client outcomes and can point to our own performance attribution where investments in alternative real assets via closed-ended funds has been a significant driver of positive returns over the years. Despite the commercial headwinds we face as a result of the new cost disclosure guidelines, we at Hawksmoor will not be changing our investment process and remain unwaveringly focussed on delivering the best risk-adjusted returns net of all costs and charges as possible.

Ben Mackie – Fund Manager

For professional advisers only. This article is issued by Hawksmoor Fund Managers which is a trading name of Hawksmoor Investment Management (“Hawksmoor”). Hawksmoor is authorised and regulated by the Financial Conduct Authority. Hawksmoor’s registered office is 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. Company Number: 6307442. This document does not constitute an offer or invitation to any person, nor should its content be interpreted as investment or tax advice for which you should consult your financial adviser and/or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. Any opinion expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represents the views of Hawksmoor at the time of preparation and may be subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. FPC875.