Shock! Horror! Run for the hills. Get the guns, water and beans. Lock up your grandmother and your children. OMG. The price of oil is back to where it was in July. Oh no, oh no, oh no. Where will it all end?

I suppose it is tomato – toemaytoe. One man’s record rise in the price of oil is the next man’s ‘back to where we were six weeks ago’. So let’s not over-dramatize the attack on Saudi’s facilities at the weekend. Yes, it has some implications but it is hardly a repeat of the invasion of Kuwait or the Iranian revolution.

The attack was arguably made more credible by John Bolton’s sacking, meaning that the US was less likely to jerk its military knee in defence of its great Saudi ally. In terms of valuation of Aramco and US-Iranian relations, my best guess is that it will blow over fairly quickly. What it probably means is that the Saudis will need to buy more American missile type thingies to defend themselves from the pesky Houthis/Yemenis/Iranians.

Staying with the theme of mispronounced fruit and veg, if you can contain your excitement we are going to have a look at gilt yields. So how would you usually react to a theoretical situation of ‘gilt yields have doubled’? In fact, not only have they doubled, but they’ve done that in a tad under three weeks.

But there is an ordinary world, somehow I have to find. Now I never ever would have thought I would cite Duran Duran, a combo that would usually make me turn the radio off. Sorry, I don’t know what has come over me this morning. Still, the other spin on bond yields is that the ten year gilt yield has merely risen 37 basis points, to where it was in July.

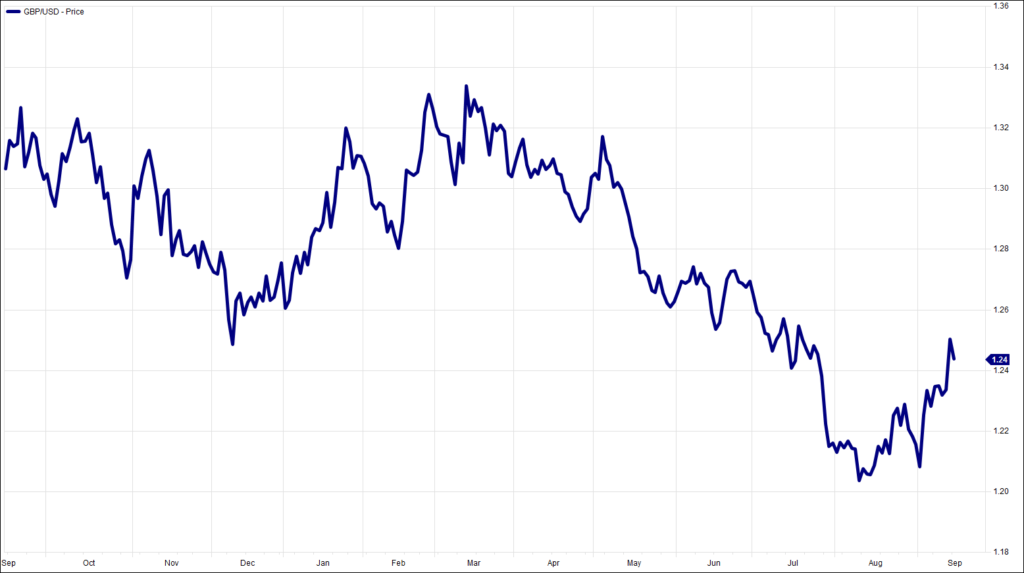

So let us come onto sterling. Everyone knows, I hope, that it is currently bouncing with joy. You will already have worked out that, yes, it is back to where it was in July.

Boris is going to do a deal, so clever voices say. It’s all been overdone. Corbyn has fluffed his chance. Value stocks and funds are on a rip. Or so it is reported. Yes, they have had a much better week or so, but again let’s not get over-excited, welcome though this is. You know what is coming now – prices are pretty much back to where they were in July. Groundhog Day.

BP and Royal Dutch Shell’s share prices have opened slightly higher this morning, but it is nothing to write home about. The broader market is in a subdued mood ahead of the main event for the week: Wednesday’s conclusion of the next meeting of the Federal Open Markets Committee.

The mood is slightly edgy. Last week’s cut in Eurozone rates and restarting of bond purchases left everyone strangely flat. It was welcome, but you cannot escape the feeling of ‘so what?’. It was all as expected, together with the voices of dissent and calls for governments to cut taxes.

The same is true of the Fed. It will disappoint markets if it does not cut the fed funds rate, but equally there is a realization that, actually, it is not going to make any difference. The markets’ fixation is more with the US-China trade talks. There is logic to this: the perceived slowdown is perceived to be caused by the perceived loss of confidence as a result of the trade war. The solution to this should be to change the perceptions by resolving (in shape or form) the trade dispute. The Fed only has one weapon, and needs to fire it. It is just that it won’t make any difference.

I have tried to ignore David Cameron. It has not worked and in a Wildean way I am yielding to temptation. It is rum, shall we say, for the erstwhile Prime Minister to be critical of others for using the Referendum for personal political gain. Perhaps he has not seen the pot and kettle irony of the soundbites being used to flog his book.

I shall very unfairly blame Eric Anderson, headmaster of Eton throughout the 1980s. The country is caught in a massive powerfest between rivalling Old Etonians and the rest of us can go hang. Anderson, for the record, was Tony Blair’s housemaster at Fettes. It is quite a CV. For fairness, I need to add that he also taught Prince Charles at Gordonstoun. Establishment? What establishment?

Apparently last week’s reference to I Fought The Law was too easy. It seems there were a lot of us public school wanna-be punks. But we like easy ones: today, to what song did Bill Murray wake up every morning in Groundhog Day?

Chart of the Week:

Cable rate, past year.

HA804/227

All charts and data sourced from FactSet

Jim Wood-Smith – CIO Private Clients & Head of Research

Hawksmoor Investment Management Limited is authorised and regulated by the Financial Conduct Authority (www.fca.org.uk) with its registered office at 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. This document does not constitute an offer or invitation to any person in respect of the securities or funds described, nor should its content be interpreted as investment or tax advice for which you should consult your independent financial adviser and or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. The editorial content is the personal opinion of Jim Wood-Smith, CIO Private Clients and Head of Research. Other opinions expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represent the views of Hawksmoor at the time of preparation and may be subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. Currency exchange rates may affect the value of investments.