September 2019

Is it possible for any investor to achieve enduringly good performance? Feelings of disillusionment about the investment industry are commonplace such that many might argue Enoch Powell could have had fund managers rather than politicians in his sights when he wrote “All political lives, unless they are cut off in midstream at a happy juncture, end in failure, because that is the nature of politics and of human affairs.” 1

At Hawksmoor Fund Managers we believe recognising the scale of the challenge in having an investment process that can prove lastingly successful helps avoid pitfalls that have undermined many in the investment industry. It is also essential for fund managers and their clients to have a clear mutual understanding about what constitutes ‘good performance’ and how it can be achieved sustainably. Without such an understanding, fund managers and their clients are prone to lose sight of their objectives and how they can be achieved.

Successful investment requires discipline, holding fast to an agreed plan to be able to master your emotions and thereby navigate the unavoidable turbulence in markets.

In this article we define ‘good performance’, and how our investment process is designed to achieve it. Also, by explaining the pattern of our Funds’ past performance we seek to guide investors as to how we hope our Funds will perform in the future.

A means to an end – not an end in itself

We frequently remind our investors that our objective is simple to state while irritatingly harder to achieve; namely to increase the value of their wealth over time, fully incorporating the impact of all costs and inflation. Put simply this means that ‘good performance’ is delivering real returns, or to cut out the jargon, to provide the ability to forgo consumption now, to have the ability to consume more in the future.

Time and time again forgetting this universal investment-raison d’être leads fund managers and their clients astray because they forget why they are investing in the first place. Many forget that investment is a means to an end, not an end in itself. You should never feel compelled to invest in something just because others do.

All investments should contribute towards achieving your objective, and for us that is simply to increase the real value of our clients’ wealth over time in the most consistent and responsible way possible.

Greed and fear

Investors lose sight of the primacy of achieving real returns influenced by the timeless human emotions of greed and fear. When financial markets are performing well greed causes many investors to be discontent with good performance because they see others doing better. By contrast, when asset prices are falling even fund managers whose portfolios prove relatively resilient are often criticised as any loss strikes fear into the hearts of most investors.

The consequence of these emotions of greed and fear creates pressure on fund managers to provide consistently positive real returns which are also always better than peers regardless of the nature of the prevailing investment environment. Fund managers end up chasing returns when they should be becoming more cautious, and acting defensively when they should instead be taking advantage when weakness in markets creates excellent investment opportunities. These pressures are exacerbated by commercial imperatives that lead many fund management companies to take advantage of their clients’ emotions by marketing funds at just the wrong times.

Recent research by Vanguard2 showed that in any five-year period between 2008 and 2017 the average investment in a UK equity fund underperformed that fund’s return by 2% per year. In other words, most investors have a worse experience than their fund’s performance statistics would imply. This is because investors tend to buy funds following a period of good performance, which is inevitably when the fund providers are marketing them most prominently. Then many disillusioned investors sell after a period of poor performance when they find good performance has not been repeated.

The implications of these facts are self-evident. Good fund managers should not just do their utmost to avoid mistakes caused by their own greed and fear, but they also need to be communicating well with clients to create realistic performance expectations.

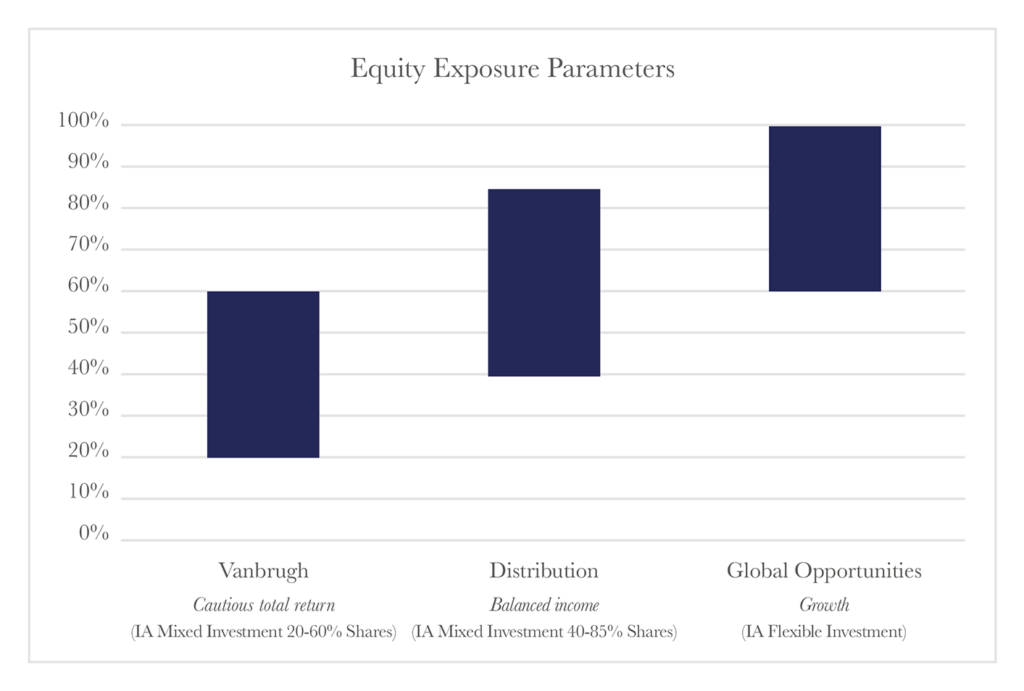

This has a number of implications for us, and one has been that the development of our three Funds has been a direct consequence of talking to our investors. The launch of The Distribution Fund and The Global Opportunities Fund catered to the needs of those requiring more income or prepared to accept a higher degree of risk than investors in our first fund, The Vanbrugh Fund.

Short term vs. long term

We believe the best way of reconciling the conflicting objectives of producing attractive real returns and outperforming peers is to recognise that it is impossible to reconcile these objectives over short periods.

Indeed, we don’t regard outperforming peers as an objective, but see it as the inevitable consequence if we succeed in our goal of increasing the real value of our investors’ wealth over time.

It’s not that we don’t care about short term performance relative to peers. It’s that we care about our clients’ wealth too much to allow short term performance concerns to undermine how to be best invested for our clients’ well-being.

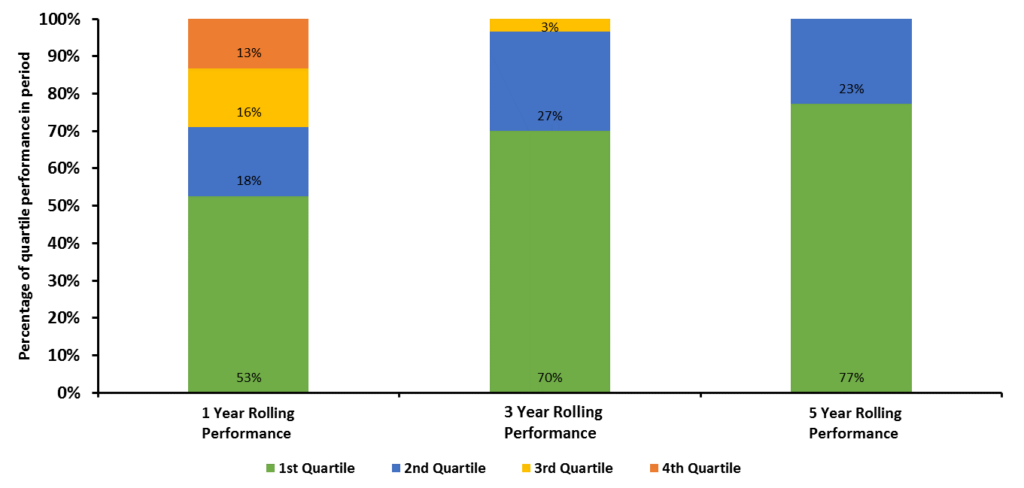

This approach has required accepting uncomfortable times when our Funds’ performance has been disappointing particularly during periods when our Funds’ performance has looked relatively pedestrian in strong markets, or when we have reacted to market sell-offs to buy cheapening investments which have taken time to work. Thus, even though The Vanbrugh Fund has won several awards since it was launched in February 2009, over rolling one-year periods it has ranked in the bottom 25% of its peers3 13% of the time. However, over rolling five-year periods Vanbrugh has outperformed a majority of its peers 100% of the time.

Source: Financial Express Analytics GBP Total Return B Acc. Quarterly from 31/03/2009 to 30/06/2019. Relative to IA Mixed Investment 20-60% Shares Sector.

Our investment process

The pattern of our Funds’ performance is inevitably determined by our investment process, and the distinctive traits of our process explain the pattern of our Funds’ performance both in absolute terms and relative to their peers. In seeking to grow the real value of our investors’ wealth over time we do our utmost to avoid investments that risk a permanent loss of capital by favouring those with a reasonable margin of safety.

Our starting point is assessing an investment’s value relative to its future prospects. We recognise that changes in the environment cause all investments’ values to fluctuate in ways that are impossible to predict, and this often causes us to have to adjust our initial assessment of an investment. However, this uncertainty can be mitigated by building a diversified portfolio of investments, each with distinct drivers, which are not dependent on a particular set of circumstances playing out.

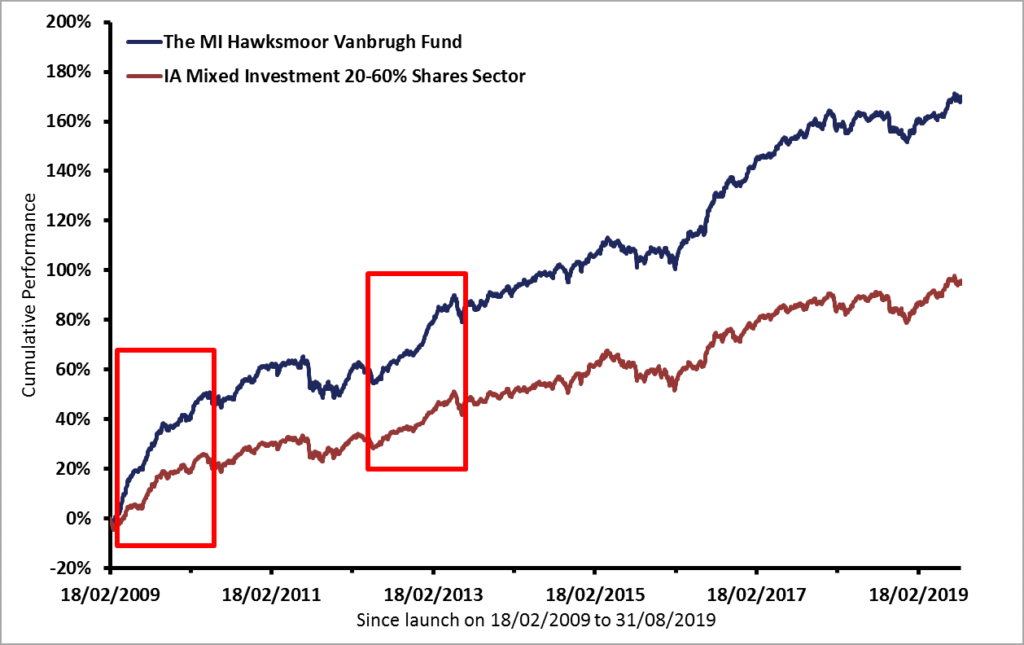

Putting this into practice usually means we are moving our Funds’ portfolios contrary to many of our peers. The most popular investments are usually those that are already highly valued relative to their future prospects, while the best time to invest in something is frequently when others are fearful to do so. The positive impact of buying cheap and unpopular investments can be illustrated in looking at Vanbrugh’s record when strong performance in 2009-10 and 2012 reflected buying unpopular investment trusts, which offered an excellent margin of safety through attractive discounts to the trusts’ net asset values, during previously weak markets.

Source: Financial Express Analytics GBP Total Return C Acc (performance history extended where required).

Fund resilience

Over the past few years we have been steadily reducing exposure to those strongly performing investments with good momentum whose valuation relative to their prospective returns has deteriorated.

Our Funds have continued to deliver positive real returns over most periods, and performance relative to peers has not suffered as much as our unwarranted caution might have implied. This is because performance relative to peers has been helped by the strong returns from several specialist funds providing exposure to attractive areas ignored by most others. To use industry jargon, our Funds’ performance has been sustained by a high level of ‘alpha’, (fund management stock-picking skill), rather than ‘beta’ (changes in value due to the general direction of asset markets).

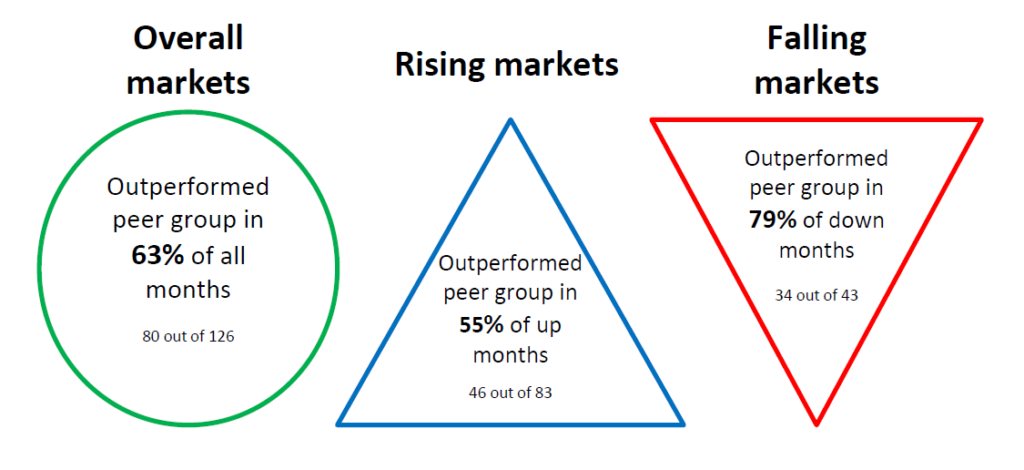

Our success in identifying cheap investments and scaling out of positions in expensive areas has also resulted in the pattern of our Funds’ performance being less volatile than most peers. Our Funds have proved more resilient than most in poor markets while more often than not participating in buoyant markets. Since Vanbrugh’s launch it has lost less than its peers 79% of the time in months when the average fund has lost money, while performing better than peers 55% of the time in months when the average fund has risen in value.4

Source: Financial Express Analytics GBP Total Return C Acc 31/08/2019

Going forwards

The pattern of our Funds’ performance relative to peers evolves over an investment cycle, although exactly how can only be known in retrospect. Performance over the past year has shown an increasing tendency for our Funds to lag peers in months when markets are strong. This is because of our response to the increasingly expensive valuation of most mainstream bonds and equities by making portfolios more divergently positioned compared to those of our peers.

We now have less exposure to mainstream government bonds and equities, and we have strengthened our Funds’ defensive characteristics and have broadened diversification with greater exposure to well-managed funds with fundamentals that are less correlated to overall movements in the world economy and financial markets. We are always seeking to balance a need to stick firmly within our ‘circle of competence’ while constantly endeavouring to make that circle as large as we can.

The expansion of the closed ended fund universe has helped with this. It has provided us with the opportunity to invest in a growing range of assets allowing us to enhance the potential performance of our Funds until such time conventional bonds and equity markets provide better value than they do at the moment. Above all our focus remains unwavering on achieving ‘good performance’ by increasing the real value of our investors’ wealth over time through a disciplined investment process.

Each of our Funds is run with a differing level of risk. Within each risk profile, our aim is to offer Funds which give their investors the greatest ability to sleep at night – after all, the fund managers, the fund managers’ families and their colleagues are all investors too!

1 Joseph Chamberlain by Enoch Powell Thames & Hudson 1977

2 Source; The Times 24th August 2019

3 IA Mixed Investment 20% to 60% Shares Sector

4 Discrete monthly returns for The Vanbrugh Fund relative to the IA Mixed Investments 20% to 60% Shares Sector from launch, 18th February 2009 to 30th June 2019. Source: FE Analytics.

This financial promotion is issued by Hawksmoor Fund Managers which is a trading name of Hawksmoor Investment Management (“Hawksmoor”). Hawksmoor is authorised and regulated by the Financial Conduct Authority. Hawksmoor’s registered office is 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. Company Number: 6307442. This document does not constitute an offer or invitation to any person, nor should its content be interpreted as investment or tax advice for which you should consult your financial adviser and/or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. Any opinion expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represents the views of Hawksmoor at the time of preparation. They are subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. HA3467