4th July 2025

Say it quietly, but discounts in the investment trust sector are starting to narrow. Stifel’s Iain Scouller outlines a few reasons behind this in his note dated 24th June 2025 (subject to MIFID research restrictions – contact Stifel if you want access) a couple of which we expand on here.

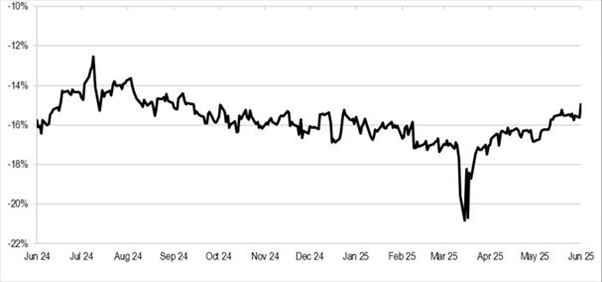

Average investment trust sector (ex 3i) discount over the past year.

Source Stifel/Datastream 20/06/2025

The most obvious reason for an individual trust’s discount to widen or narrow is linked to the balance of demand and supply. It isn’t quite true that share prices go up (discounts narrow) when there are more buyers than sellers as for every buyer there is a seller. More accurate is that prices rise when there are more determined buyers than sellers. Or as Stifel points out, this latest episode of narrowing discounts could be more to do with fewer determined sellers following the end of the tax year. While it doesn’t make sense on a fundamental basis to be selling an asset that has got cheaper, we can understand why many investors such as discretionary wealth managers were selling those trusts with the biggest losses (mostly alternatives that have disappointed in the higher interest rate environment) to offset gains elsewhere due to the low annual CGT allowance. The demand side of the equation from traditional investment trust investors is more opaque however. Ultimately, in the absence of a new constituency of buyer (DC pension schemes, please come on in, the water’s lovely!), supply has to shrink.

An improved balance of buyers and sellers has been supported, however, by the ongoing corporate activity in the sector that is helping to reduce the supply of shares – something we have long flagged as a prerequisite to a healthier sector in the long run. It is therefore great to see M&A happening across conventional trusts as well as the alternatives.

Starting with the conventional trusts who are facing an existential threat from open-ended equivalents or active ETFs. Whether activist investors like Saba were the catalyst or not, the enhanced discount management policies and mergers of equals has had a material impact. While we view share buybacks as primarily a capital allocation decision, we are starting to see evidence that share buybacks can narrow discounts, but only if the programme is conducted in decent size and is relentless. The odd small buyback does not make a dent in a stubbornly wide discount. In addition to more aggressive share buybacks, mergers of similar mandates are regular occurrences now and we saw two separate European equity mergers just recently with Fidelity European Trust announcing a proposed combination with Henderson European Trust, and European Assets Trust potentially merging with European Smaller Companies Trust. While there are benefits of scale and liquidity that might attract new shareholders, simply merging two discounted trusts together does not automatically narrow discounts. Crucially, both deals include a partial cash exit that overall will reduce the supply of shares and may help both new entities rerate post merger.

Given the illiquid nature of the underlying assets, reducing the number of shares in the alternatives sector has been harder to achieve. Most property, private equity and infrastructure trusts are in constant share buyback mode but are limited by their ability to dispose of assets to keep buybacks going for longer or to be more aggressive. M&A therefore represents the most significant method to shrink the supply across the sector. Recent take-private deals for BBGI Infrastructure and Care REIT will put cash back in the pockets of investors that are likely to recycle it back into equivalent vehicles. While those 100% cash bids provide a short-term sugar rush for the sector, if all constituents of the alternatives sector were taken private, investors like us would bemoan the lack of investment opportunities that genuinely diversify equity and bond exposures within a multi-asset strategy. As would those investors with dedicated property or infrastructure mandates. Therefore an interesting development in recent weeks is the shift by boards and shareholders to favour mergers with listed peers instead of selling to a private buyer. Just in the last couple of weeks we have seen Warehouse REIT opt for a merger with Tritax Big Box over a private bid by Blackstone, and the Assura board rejected a private bid from KKR and accepted a merger with Primary Health Properties. The common feature of all these proposed mergers is the cash element of the deal that reduces the number of shares in issue and allows recycling of capital back into discounted peers. Of course, the financial terms of these particular merger proposals trumped the private bids giving shareholders further reasons to support them.

In the infrastructure world, shareholders seem relaxed about the dominance of take-privates and lack of mergers, probably because there are simply too many sub-scale trusts after the glut of issuance during the low interest rate environment. Last year, Atrato Onsite Energy was taken over by private equity but it seemed to be an isolated example. However, this year Harmony Energy has been acquired by Foresight’s private funds after a bidding war with Drax, and the most recent news is the bid for Downing Renewables & Infrastructure by a Downing-managed private fund. As above, this is positive in the short term with the money likely to be recycled back into peers which continue to trade on wide discounts, very high yields and have the potential of being the next bid candidate. Hence, discounts are starting to narrow here too. Mergers haven’t happened yet but, just like what is happening in the property sector, consolidation seems the next step.

It is impossible to disaggregate how much each of the above factors has contributed to the broad discount narrowing. In actual fact, they might have nothing to do with it since the market backdrop has been positive with UK equities doing well and investment trusts are a big constituency of the FTSE 350 Index. As Stifel say, “a market rally can float all boats”. Regardless of what is narrowing the discounts, boards and managers cannot sit on their hands and rely on external market factors for a rerating. Shareholders need to keep the pressure on boards and managers to continue with proactive and self-help measures in their pursuit of the halcyon uplands of premium ratings and the ability to issue shares and for the IPO market to come alive again.

Daniel Lockyer – Senior Fund Manager

For professional advisers only. This article is issued by Hawksmoor Fund Managers which is a trading name of Hawksmoor Investment Management (“Hawksmoor”). Hawksmoor is authorised and regulated by the Financial Conduct Authority. Hawksmoor’s registered office is 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. Company Number: 6307442. This document does not constitute an offer or invitation to any person, nor should its content be interpreted as investment or tax advice for which you should consult your financial adviser and/or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. Any opinion expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represents the views of Hawksmoor at the time of preparation and may be subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. FPC25443