21st October 2022

When we meet prospective investors for the first time, we believe it’s important to do 2 things: 1) explain what we think our ‘edge’ is and 2) illustrate the circumstances in which our funds will underperform their peers.

Our edge is easy to explain, and there’s nothing particularly extraordinary about it. We have a disciplined process which we stick to, we work very hard and there’s four of us (which is a very well-resourced team), and we constrain our capacity to safely access as many investable assets as possible. Another edge is the ability to invest for the long-term, and this is inextricably linked to the second point above: telling our investors when we will underperform.

The fund management industry can be very good at telling investors why a certain fund is so brilliant. But investors really want to know when a fund won’t perform so well. In fact it is preposterous not to so inform an investor. The idea that a fund can always perform well is nonsense. It is tantamount to stating the fund manager has solved investment. Knowledge of a fund’s weakness can help the investor either blend the fund with another, that will perform in an entirely different way to address that weakness, or stick with the fund when it does underperform (assuming the underperformance occurs in circumstances the manager predicted).

Having the luxury of a long time horizon while running a fund that offers daily liquidity really is the holy grail of fund management. The best returns only come when a fund manager has the confidence to be able to ride out some temporary drawdowns and confidently apply his/her investment process. Imagine trying to invest to avoid ANY drawdowns. The most extreme example is holding cash in an instant access account– which will earn you very close to nothing.

One of our favourite sayings at HFM is from Ecclesiastes:

“Those who wait for perfect weather will never plant seeds;

those who look at every cloud will never harvest crops”

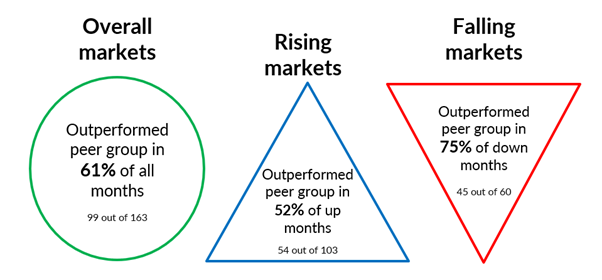

This is exactly what we feel like today. I started by saying that most of the time we outperform our peers in falling markets (thanks to our very diversified portfolios and emphasis on valuation) – indeed we have outperformed sharply falling markets for most of the year. But occasionally we underperform our peers in falling markets. Here’s the pattern of our Vanbrugh fund performance over the past 13.5 years:

Source: FE fundinfo, 28/02/2009 to 30/09/2022.

Using unpleasant industry jargon: today we are catching knives: we are buying cheap assets that are getting cheaper. Exactly the same conditions we saw in the summer of 2011.

The two main times we underperform are when bull markets get mature (and we are unwilling to own expensive assets that get even more so) and in bear markets when assets have become cheap (but become more so). Thus, we are preparing our investors to watch for underperformance in these weaker markets (just as we did from 2018 as the bull market matured). But we urge our clients not to be disheartened.

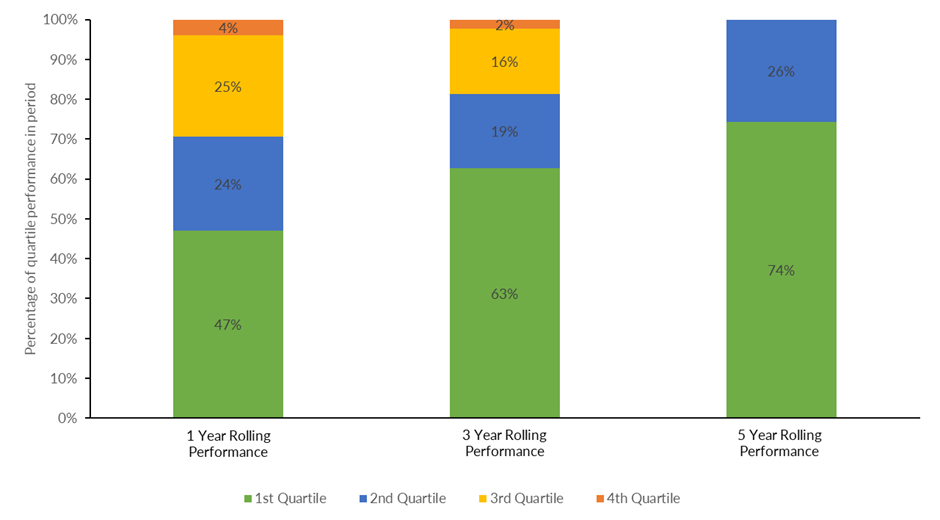

If they need reassurance, we use the following chart;

Source: FE fundinfo, quarterly from 31/03/2009 to 30/09/2022. Relative to IA Mixed Investment 20-60% Shares Sector. May not sum to 100% due to rounding error.

This chart shows the experience of investors in our Vanbrugh fund over various rolling periods. For example it shows you that over every 1-year rolling period since Vanbrugh’s launch in 2009 (taking each rolling 1 year period to be the start of every quarter since March 2009), investors have suffered 4th quartile performance 4% of time and 3rd quartile performance 25% of the time. The longer an investor holds us, the lower the probability of suffering underperformance. In fact, to date, Vanbrugh has never underperformed its peers over any 5-year rolling period (to each quarter end) and of these periods 74% have been 1st quartile performance.

The lesson: if you buy our funds just ahead of a period of poor performance, please be reassured that eventually our process and discipline kicks in. We are truly grateful for the patience our investors afford us: it is only because of this that we can invest in the way we do: with the longer time horizons that give us the best chance of performing well, as long as we remain disciplined within our investment process and continue to work hard.

We are TRULY excited about the portfolios today. We are out in the fields in the pouring rain planting seeds and getting caked in mud. But we know that one day we’ll be gleaning a fantastic harvest in the bright Devon sunshine. While we regret any anxiety we cause our investors while underperformance in falling markets lasts, we are increasingly excited about future return prospects.

Ben Conway – Head of Fund Management

For professional advisers only. This article is issued by Hawksmoor Fund Managers which is a trading name of Hawksmoor Investment Management (“Hawksmoor”). Hawksmoor is authorised and regulated by the Financial Conduct Authority. Hawksmoor’s registered office is 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. Company Number: 6307442. This document does not constitute an offer or invitation to any person, nor should its content be interpreted as investment or tax advice for which you should consult your financial adviser and/or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. Any opinion expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represents the views of Hawksmoor at the time of preparation and may be subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. FPC633.