13th October 2023

We’ve been banging on about the extreme value in our Funds for a while now and it’s about time to reward our patient investors with some performance that backs up our confidence. An obvious retort to our enthusiasm is how can we be so confident in prospective returns when fellow investors who we regard highly are commenting that the macro environment is so worrisome that they have the tin hats on and have record low equity exposure. Can we both be right? We believe we can.

Our contention is that in aggregate, which is where the big asset managers and the macro investors play (often because they are forced to for liquidity reasons), stock markets are expensive. The continued ascent of the US equity market has left most commentators and investors this year wondering how the world’s most efficient stock market has been able to perform so well when the risk-free rate continues to climb. The answer is of course the Magnificent 7 (the largest 7 stocks in the US) which have all benefited from various positive narratives (the latest being AI) and account for all the performance of the US index (the next 493 companies in the S&P 500 Index are essentially flat on the year), and by extension explains the strong performance of global equities given almost 70% of the MSCI World Index is comprised of US equities. The valuation of the US equity market is historically high, trading on a cyclically adjusted PE ratio of 27x (Source Liberum August 2023) compared to the long run average of 17.2x going back to 1900. If we were only investing in the aggregate stock market, we would also be unenthused by those prospects.

But we are not investing in indices. Our relatively small size and expertise allows us to build portfolios that consist of funds investing in assets that are trading at historic low valuations that have a higher probability of delivering a positive return from this point. Hang on, you just said positive returns, don’t you mean relative because surely if equity markets in aggregate fall, you will be happy with relative returns? Ok, perhaps we are expecting too much but there is some evidence that backs up this view.

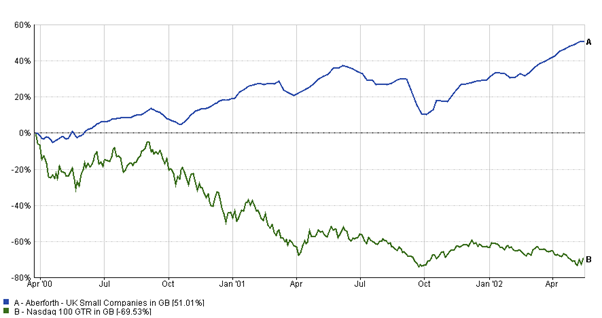

In the aftermath of the 1999/2000 TMT bubble, the Nasdaq Index (the most recent example of a stock market bubble) fell by 70% from the peak on 27th March 2000 to mid May 2002 and the index of the largest 100 companies in the UK fell by 17%, led mostly by Vodafone, the largest constituent at the time, which also fell by 70%. However, UK smaller companies funds that had a ‘value’ style, which led them to shun technology companies and own ‘old economy’ companies, performed excellently. One of our current positions, Aberforth UK Small Companies Fund, produced a remarkable positive 51% total return over that period as investors rotated away from tech and into classic Aberforth style companies.

Source: FE fundinfo, 27/03/2000 to 15/05/2002.

Aberforth keeps data going all the way back to their launch in 1991 so we can see that the PE ratio of its portfolio in 2000 was around 12x, while the broader UK equity market traded on 28x (Source: Liberum), the highest ever rating in the 100 years of UK market data. We think valuation is one of the key determinants of future returns and empirical evidence like that proves that a valuation orientated investment philosophy works (we fully acknowledge that valuation is not a short-term indicator of future returns but does work over the long term). Today Aberforth’s portfolio trades on a PE of 7x, illustrating how unloved that cohort of UK smaller companies are. In fact, the broader UK equity market is also attractively valued trading at around 10x. While UK smaller companies are highly exposed to the UK economy, which isn’t performing fantastically well at the moment, most companies are well capitalised, paying dividends and enjoying structural growth tailwinds. We are confident that this value cannot hang around forever as otherwise the de-equitisation trend will accelerate as companies buy back their own shares, take themselves private or are acquired by private equity, which will then push prices higher.

The reason it has been a tough year for performance in both absolute and relative terms is because assets we believed were cheap at the start of the year have just got cheaper (fallen in value but without an equivalent deterioration in fundamentals) while the Magnificent 7 have driven the valuation of global equity indices even more expensive. It is typical of our style and process that we ‘lean in’ to assets as they get cheaper and this is why our historic track record contains a small number of periods when we underperform at the end of weak/bear markets (and we underperform the end of bull markets as we do the opposite and shy away from expensive assets as they get more expensive).

This UK smaller companies example is just one of a number of areas where the value on offer is at odds with the lofty valuations of global equity markets and gives us encouragement that the next few years will be really strong in both absolute and relative terms for our funds. We are fully aligned with investors in the funds so we are certainly sharing the emotional journey of the last couple of years, but on a personal level, I wouldn’t want my savings invested anywhere else at the moment.

Daniel Lockyer – Senior Fund Manager

For professional advisers only. This article is issued by Hawksmoor Fund Managers which is a trading name of Hawksmoor Investment Management (“Hawksmoor”). Hawksmoor is authorised and regulated by the Financial Conduct Authority. Hawksmoor’s registered office is 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. Company Number: 6307442. This document does not constitute an offer or invitation to any person, nor should its content be interpreted as investment or tax advice for which you should consult your financial adviser and/or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. Any opinion expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represents the views of Hawksmoor at the time of preparation and may be subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. FPC1271.