13th May 2022

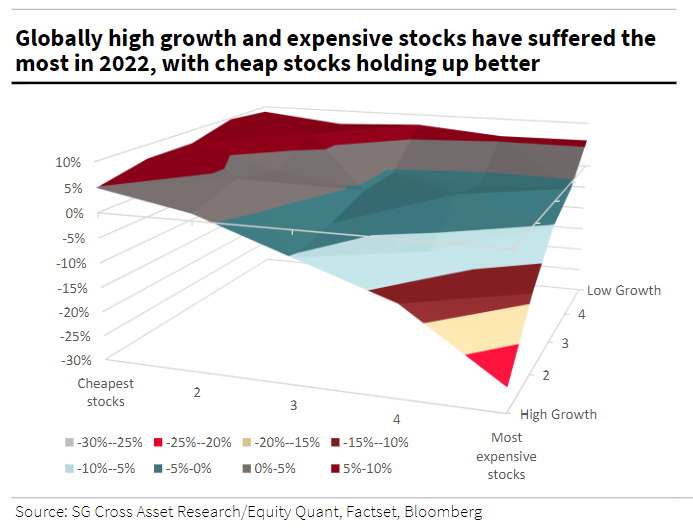

Sometimes one chart says it all:

The following chart, constructed on May 9th by the excellent quantitative research team at Soc Gen led by Andy Lapthorne, perfectly describes what is going on in equity markets year to date:

You will note that cheap stocks are clearly outperforming expensive stocks (but most are still falling) and expensive stocks are falling a lot. Meanwhile “high growth” stocks – which overlap with expensive stocks – are falling a lot compared to “low growth stocks”.

Headline indices are faring badly (e.g. the S&P 500 is currently undergoing the second worst start to a year ever) because the large cap names that by definition, dominate indices happen to be both expensive and higher growth. Meanwhile, the bond market is currently undergoing the worst drawdown in history. It is important to highlight just how extraordinary current market conditions are for investors.

Throw into the mix very high levels of inflation, and it is currently almost impossible to generate positive real returns (after taxes and charges) by holding a diversified portfolio of financial assets. Cheap stocks are falling in price probably because investors are wary of a global economic recession. Who knows if that will occur (or is already occurring) – we think many equities have more than-priced this in. But cheap stocks can always get cheaper, and just as expensive assets overshot to the upside, the same can and will happen with cheap assets. One note of warning: some equity investors seek haven in an inflationary environment in companies that have pricing power, deep moats and franchises (and other buzz words and phrases!). This doesn’t necessarily translate into inflation protection for the investor if those companies are expensively valued. The same is true of bonds with explicit inflation-linkage. A UK Inflation-Linked bond held to maturity that has a negative real yield guarantees that level of return regardless of the out-turn for inflation.

We believe at times like these is important to do 3 things:

- Communicate with clients and let them know what is going on. Sometimes generating positive real returns from investment portfolios is impossible over periods as short as a year.

- Stick to your investment process. The best growth investors should have told their clients that their process can subject investors to sharp drawdowns necessitating a longer time horizon if the purchase decision wasn’t timed well. You do not want to see these investors start to change their process because it is performing poorly. Meanwhile, if your process necessitates owning cheap assets (like ours) and they are falling in price – don’t be afraid to buy more if you have done your homework.

- Work hard and don’t stare at the screen. We have a disciplined process that focuses on valuation and we’re always fully invested. When asset prices fall, all other things being equal, we become more excited. We keep checking in with managers and testing our and their conviction.

We are optimistic. Some of the best fund managers in the industry, many of whom we have known and trusted for over a decade, are saying their portfolios have only been this cheap once or twice in their careers (stretching back 40 years in some cases). Our portfolios are also exposed to assets that have low or no economic cyclicality. And finally, we have just started to see the first green shoots of value in plain vanilla fixed income. We are therefore gently increasing duration (exposure to longer dated bonds with low credit risk) for the first time in close to a decade. It is in markets like these that you can sow the seeds for strong returns in the future – we are currently out in the fields.

Ben Conway – Head of Fund Management

For professional advisers only. This financial promotion is issued by Hawksmoor Fund Managers which is a trading name of Hawksmoor Investment Management (“Hawksmoor”). Hawksmoor is authorised and regulated by the Financial Conduct Authority. Hawksmoor’s registered office is 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. Company Number: 6307442. This document does not constitute an offer or invitation to any person, nor should its content be interpreted as investment or tax advice for which you should consult your financial adviser and/or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. Any opinion expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represents the views of Hawksmoor at the time of preparation and may be subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. FPC297.