06th January 2023

I was thinking how best to describe the different returns across asset classes in 2022 so consulted a well-known online search engine for inspiration (does anyone own an actual dictionary anymore?). I settled on ‘topsy turvy’ on account of the definitions including upside down, complete confusion and great disorder. I think these terms best describe 2022 for investors that allocate across asset classes according to historic risk or volatility factors.

If, at the start of 2022, you posed the question “If large cap UK equities will finish the year up nearly 5%, what will gilts do?”, I don’t think many would have said down 24% (iShares UK Gilts All Stocks Index). What’s more, UK equities were less volatile than gilts in 2022! Not many backward-looking risk or volatility analysers would have calculated that based on the last 40 years of data! We know that the positive performance of large cap UK equities was skewed by the energy sector’s strong showing, but that won’t matter when the numbers are plugged into the risk-profiling tools. It will be fascinating to know whether 2022 returns will impact the risk scores of different sectors and assets, i.e., will gilts be regarded as higher risk today than they were at the start of 2022, even though the prospective returns for a 10 year gilt from a starting nominal yield of 3.5% now compared to 1% a year ago are arguably more attractive? But then prospective returns or current valuations do not feature in most risk analysis tools.

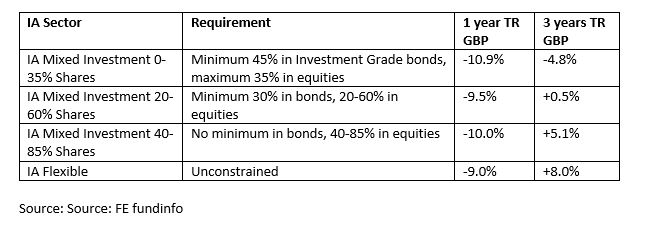

For investors in multi-asset funds, whether active or passive, returns were also contrary to expectations last year. In May last year I wrote “Foundations Built on Sand” – Click here to view -which centred on the flawed model of using low yielding bonds as the core foundation of low risk portfolios. In that article I highlighted the issue of the IA Mixed Investment sectors where the main eligibility requirements for inclusion in the respective sectors is a certain allocation to bonds and equities. Looking at the returns of those sectors last year and, given the poor performance of government and corporate bonds, it is unsurprising that the ‘lower-risk’ IA Mixed Investment 0-35% Shares Sector has underperformed the other ‘higher-risk’ sectors last year and is significantly behind them over 3 years – see table below.

Further, it is striking how similar the returns of the sectors were last year. The composition of the average fund in the 40-85% sector is likely to be very different to the average fund in the 0-35% sector but they have produced roughly the same returns. We would argue the reason for this is that there has been an increasingly high allocation to growth equities within the equity allocations of mixed-asset funds, which, as long-duration assets, are highly correlated with bond yields. So, when yields rose as they did last year, bond and equities (ex-energy) have fallen together. Judging one year’s performance in isolation is not ideal so I’m not calling for an overhaul in the way these sectors are constructed, but rather than simply saying last year was an aberration, which is what I have read somewhere, I would much rather see last year regarded as an opportunity to reassess the ongoing appropriateness of using simple equity and bond allocations or backward looking volatility measures as the main ways for assessing risk. We owe it to the investors who have been hurt the most in recent years, the most cautious, as they have lost the most money and, as their investment horizons are likely to be shorter, now have less time to recoup those losses.

For completeness, our funds performed relatively well in 2022. Vanbrugh was down 5.1%, Distribution -6.7% and Global Opportunities -8.5% which are at least in the right order according to risk/time horizons. We find it hard to be too congratulatory when our clients lose money, but in a year where almost every asset class produced negative returns, protecting capital better so we can then build from that higher base is one way of compounding long-term outperformance. Vanbrugh remains the number 1 fund in the IA Mixed Investment 20-60% Shares sector since launch in 2009 and is top quartile over 10 years, 5 years, 3 years and 1 year. Distribution is top quartile since its launch in 2012 and Global Opportunities has outperformed its IA Flexible sector in each discrete calendar year since launch in 2018, resulting in cumulative top quartile performance since launch. Doing something different to the majority of the industry is clearly leading to different and better returns for our investors, so even though we want all investors to have a better experience, we don’t want too many adopting our common-sense, valuation-led investment approach!!

Wishing you all a prosperous 2023 from all at HFM.

Daniel Lockyer – Senior Fund Manager

For professional advisers only. This article is issued by Hawksmoor Fund Managers which is a trading name of Hawksmoor Investment Management (“Hawksmoor”). Hawksmoor is authorised and regulated by the Financial Conduct Authority. Hawksmoor’s registered office is 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. Company Number: 6307442. This document does not constitute an offer or invitation to any person, nor should its content be interpreted as investment or tax advice for which you should consult your financial adviser and/or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. Any opinion expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represents the views of Hawksmoor at the time of preparation and may be subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. FPC749.