19th September 2025

We have been talking about the merits of blending to potential investors for some years and specifically the improved risk adjusted returns that can be harvested by combining passive multi-asset solutions with truly active ones such as those managed by Hawksmoor. A picture (or chart) says a thousand words.

Source: FE fundinfo, 18/02/2009 to 30/06/2025. 40% equities represented by MSCI World All Cap, 60% bonds represented by ICE BofA Global Broad Market Hedge GBP. See MSCI and ICE disclaimers below. UCITS OCF used in table. Instruments used in calculating the OCF of the passive equity bond portfolio are Fidelity Index UK, Fidelity Index US, Fidelity Index Europe, Fidelity Index Japan, Fidelity Index Emerging Markets and iShares Global Aggregate Bond.

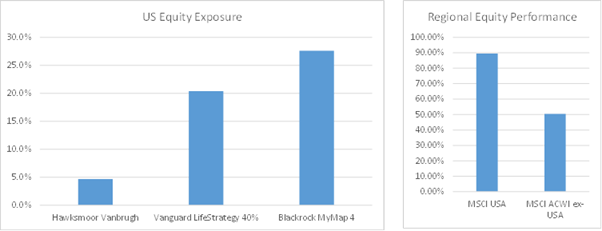

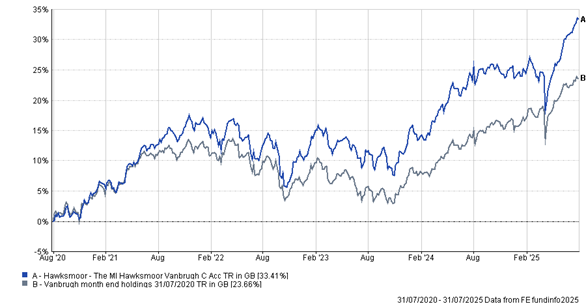

As part of our analysis for one client, we have recently compared the 5-year performance of our Vanbrugh fund with that of a well-known provider of passive multi-asset solutions. The latter runs with a home bias, but weights are otherwise relatively static driven by the slow evolution of exposure within global market cap weighted indices such as MSCI ACWI. Its portfolio construction methodology, despite the home bias, inevitably results in a significant exposure to US equities which represent over two thirds of world equity indices. In a world where wealth managers and other domestic investors seem to be abandoning the home bias, we’ve included in the charts below another well-known provider of passive multi-asset solutions which tends to be managed more in line with market-cap weighted indices and has even more of the portfolio in US equities as a result. Vanbrugh (and our other multi-asset funds), in contrast, has a low allocation to US equities which is informed by our disciplined and well-established valuation conscious investment process. As the charts below demonstrate, having lower exposure to US equities has been a major headwind to our relative returns when considering the extent to which the US has outperformed other regional markets. Despite these headwinds, Vanbrugh is still well ahead of the passive solutions of choice.

Source: Provider factsheets, (lhs). FE fundinfo, 5 years to 09/09/2025 (rhs)

Source: FE fundinfo, 5 years to 09/09/2025

The purpose of this post is not to denigrate the passive approach. We know there are historic periods where it has outperformed our actively managed funds and are confident there will be investment regimes and environments where it outperforms our funds in the future. Nothing to see here. No one has solved investment and the whole point of blending is to find best in class complementary approaches which when combined improve an end investors risk adjusted returns.

The focus here, instead, is to elucidate on how our funds have been able to deliver strong relative returns despite having such low exposure to the dominant US equity market. The key drivers can be distilled into 4 interrelated factors: dynamic portfolio management; access to a broad investment universe; the use of active managers; and a focus on idiosyncratic sources of return. It also hopefully leaves readers with a sense that the opportunity cost of embracing contrarianism and owning a Hawksmoor Fund is actually negative with our portfolios all delivering attractive absolute and relative returns regardless of the stylistic and factor headwinds that might have been blowing.

Dynamic portfolio management: The Hawksmoor Funds are actively managed with evolution in underlying exposures driven by changes in market valuations and relative return prospects. These shifts in positioning can be dramatic at times, particularly during periods of heightened volatility, which contrasts with the more strategic and benchmark aware allocations of most passive multi-asset solutions. The chart below compares Vanbrugh’s performance with the returns that would have been delivered had the 4 of us fund managers relocated to a cave and made no changes to the positioning of 5 years ago. Dynamic management has added value.

Source: FE fundinfo, 5 years to 09/09/2025

Broad investment universe: The Hawksmoor Funds fish in a deep and broad pool. Yes, we own equities and bonds, but we also have significant exposure to a host of alternative assets including illiquid private markets which we own via closed-ended investment trusts. These sorts of assets cannot be accessed via trackers or, by extension, passive multi-asset funds. Having a broader investment universe ultimately improves the probability of finding individual investments that can contribute to the return objectives of the Fund at any given point in the cycle, whilst also bringing diversification benefits. Infrastructure and other real assets, for example, have added 180bps to Vanbrugh’s performance YTD. Material exposure to gold miners which form a tiny part of global equity indies have added a further 160bps. As benchmark agnostic, unconstrained investors we are happy to take conviction positions in these sorts of smaller, more niche areas if justified by return prospects, allowing them to be significant drivers of overall fund returns.

Use of skilful active managers: Our equity and bond allocations are populated almost exclusively by actively managed funds (we do use ETFs to gain exposure to short dated gilts and US TIPS). The majority of these have outperformed the relevant index tracker net of costs during our holding period and have therefore been additive to returns. We’ll leave that statement of fact there and leave the whole active versus passive debate for another time, other than to reiterate our strong belief that the probability of skilful active managers outperforming increases in periods when valuation dispersion within markets is high, as is the case today.

Idiosyncratic returns: We are on the constant lookout for alpha gems but finding them often means departing from the well-trodden path. Investment trusts, in particular, are a source of differentiated returns for our Funds, partly due to the aforementioned access they offer to diversifying alternative asset classes and private markets. Discount volatility and the inefficiencies of the sector also present trading opportunities which can add incrementally to the P&L. Finally, the sharp de-rating of investment trusts in 2022 (especially alternative ICs) combined with Boards that are increasingly cognisant that entrenched discounts cannot be met with complacency have fostered an environment where investors such as ourselves can seek to effect change through constructive engagement. Encouraging boards and management teams to think more deeply about capital allocation or, in more extreme circumstances, to engineer a corporate event (take privates, managed wind-downs etc.) can expedite the realisation of shareholder value in a manner that is totally independent of moves in broader markets. The ability to harvest uncorrelated returns is a wonderful thing, especially at times where global equity and bond markets offer questionable value (at the index level anyway).

Our investment process with its broad investment universe, unconstrained portfolio construction, use of active managers, often contrarian positioning and access to idiosyncratic drivers of return leave us confident that the alpha generation of the past is repeatable going forward. For those of you who like beta with your alpha, those factors also mean the Hawksmoor Funds blend fantastically well with more vanilla, passive multi-asset solutions.

Ben Mackie – Senior Fund Manager

For professional advisers only. This document is issued by Hawksmoor Fund Managers which is a trading name of Hawksmoor Investment Management (“Hawksmoor”), the investment manager of the MI Hawksmoor Distribution Fund (“Fund”). Hawksmoor is authorised and regulated by the Financial Conduct Authority. Hawksmoor’s registered office is 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. Company Number: 6307442. The Fund’s Authorised Corporate Director, Apex Fundrock Ltd (“Apex Fundrock”) is also authorised and regulated by the Financial Conduct Authority. This document does not constitute an offer or invitation to any person, nor should its content be interpreted as investment or tax advice for which you should consult your financial adviser and/or accountant. The information and opinions it contain have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. Hawksmoor, its directors, officers, employees and their associates may have a holding in the Fund. Any opinion expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represents the views of Hawksmoor at the time of preparation and may be subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. FPC25520.

Source: MSCI. Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent.

Source: ICE. The index data referenced herein is the property of ICE Data Indices, LLC, its affiliates (“ICE Data”) and/or its Third Party Suppliers and has been licensed for use by Hawksmoor Investment Management Limited. ICE Data and its Third Party Suppliers accept no liability in connection with its use. See https://www.hawksmoorim.co.uk/ice-dataindices-disclaimer/ for a full copy of the Disclaimer.