29th October 2021

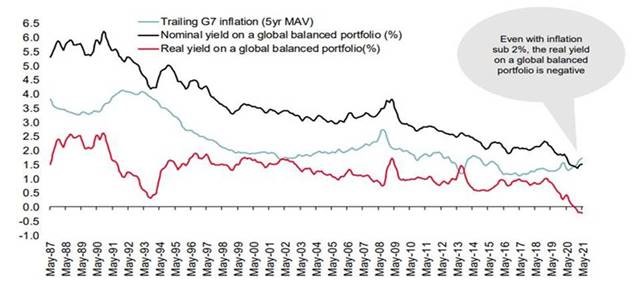

We came across this interesting chart the other day from the ever excellent Andrew Lapthorne of Societe Generale, showing how the real yield (i.e. adjusted for inflation) on a traditional equity-bond portfolio has recently gone negative for the first time.

Source: Societe Generale, 15/06/2021.

This is perhaps not surprising given government bond yields have been heading relentlessly lower over the past 5 decades. The latest leg down has been aided by the extraordinary monetary policy we have seen since the aftermath of the Great Financial Crisis, which has ramped up to a whole new level in response to the pandemic. Incredibly over 60% of the global fixed income market today yields less than 1%, with huge swathes delivering negative nominal yields. The yields available from many equity markets have also shrunk as a result of the rampant bull market we have been in for the last 12 years which have pushed prices and valuations to extreme levels, whilst pandemic induced dividend cuts have not helped either.

The evolution of the real yield available from a traditional, balanced portfolio is striking and poses a serious problem for investors of all stripes. Income of course has always been an important component of total return, providing a foundation of relative stability versus inherently volatile capital values, whilst the compounding power of income reinvested is regarded by some as the 8th wonder of the world. For investors and savers in decumulation, income is of particular importance. Yes, it’s possible to adopt a total return approach and set up regular standing orders part-funded from capital, but whilst this works fine when asset values are going up, it can have a pernicious impact on principal when markets are falling.

In this environment what are investors and savers to do? Shrugging one’s shoulders and accepting a negative real return doesn’t seem a particularly palatable option. Perhaps we could take on more credit or equity risk to maintain an acceptable level of income – although this would leave capital increasingly vulnerable to drawdowns. With credit spreads at pre-pandemic tights and corporate bond yields at all-time lows we would, however, question whether investors are being adequately compensated for taking this additional risk anyway. Investing in developed market corporate bonds feels a bit like picking up pennies in front of a steamroller right now, whilst the European high yield market (also known as junk bonds) which offers a yield of 2.7% is, to us, the very definition of the word ‘misnomer’.

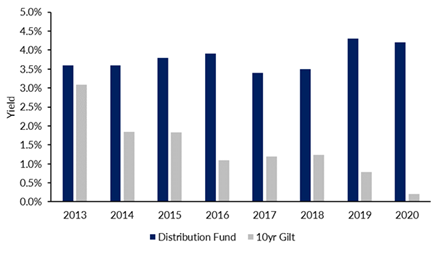

For nimble investors with a willingness to embrace alternative assets and investment trusts, there is another way. Our very own Distribution Fund (which has a historical yield of 3.4%) has significant exposure to more idiosyncratic investments like ships, property, song royalties, digital infrastructure and energy storage, which all throw off very attractive levels of income. In many cases these assets have low economic sensitivity and low correlation with other financial assets. This means the cash flows that underpin the dividend payments have a stability and predictability that is hard to find in more mainstream equity and bond markets. Some of these investments also have leases or contractual cash flows which are linked to inflation, providing protection should inflation prove less transitory than many market participants currently believe.

When the Distribution Fund was launched almost 10 years ago, we made the decision to place the fund in the IA Mixed Investment 40-85% Shares sector. The primary reason for this was because we did not want to be constrained by the restrictions of the 20%-60% sector, which require funds to hold at least 30% in fixed income and cash. We felt the lack of this constraint would maximise the potential to deliver on Distribution’s raison d’etre, which is to provide an attractive level of income alongside capital growth.

Long term relative performance has been good with the Fund first quartile since launch, although it has lagged in certain periods, particularly those characterized by ebullient equity markets. This is perhaps no surprise given Distribution and its overriding mandate as a balanced income fund, tends to have materially lower equity exposure than many sector peers. Does this frustrate us? Perhaps a little, but we will always remain laser focused on delivering the Fund’s key objectives rather than trying to outperform what is an incredibly disparate sector.

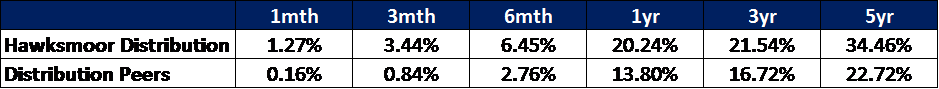

Distribution’s risk-adjusted performance is perhaps best considered in the context of other income focused multi-asset funds, and on this basis, Distribution stands up very well indeed. In the interests of modesty, we won’t name the 8 funds who we regard as Distribution’s peers, but have created an equally weighted basket of them to compare the performance against our Distribution Fund in the table below.

Source: FE Analytics, 28/10/2021.

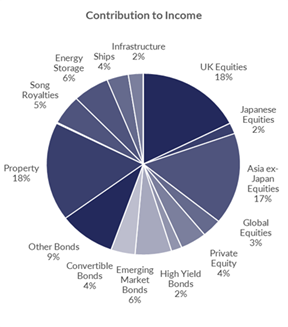

Whatever the impact on relative performance, our decision to place Distribution in the 40-85% sector ultimately gives us the flexibility and ability to construct a portfolio with very diversified sources of income. The chart below shows that around 52% of Distribution’s income comes from the sort of alternative assets discussed above.

Source: FE Analytics and internal, 30/09/2021.

This exposure, combined with a highly selective approach in listed equity and bond markets has allowed us to continue to deliver an attractive and stable level of income for our investors in a risk controlled manner, despite the deterioration of yield elsewhere.

Source: Alpha Terminal and internal, 2013 to 2020.

Ben Mackie – Fund Manager

This financial promotion is issued by Hawksmoor Fund Managers which is a trading name of Hawksmoor Investment Management (“Hawksmoor”). Hawksmoor is authorised and regulated by the Financial Conduct Authority. Hawksmoor’s registered office is 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. Company Number: 6307442. This document does not constitute an offer or invitation to any person, nor should its content be interpreted as investment or tax advice for which you should consult your financial adviser and/or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. Any opinion expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represents the views of Hawksmoor at the time of preparation and may be subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. HA4611.