30th September 2022

You will know that the investment process of the Hawksmoor Fund Management team requires us to be agnostic in our views of the macroeconomy. We try to construct portfolios that can weather macroeconomic storms and bask in more clement conditions. However, no investor can legislate for the shock that resulted from the announcement of the UK’s mini-budget on Friday 23rd September.

We will not comment on policy or politics. Clients do not invest with us to read another opinion piece on what makes good policy. But we will say that we have just witnessed what we suspect was the quickest and steepest repricing of UK financial asset risk ever. As a result, capital may well have been permanently destroyed for many savers across the nation.

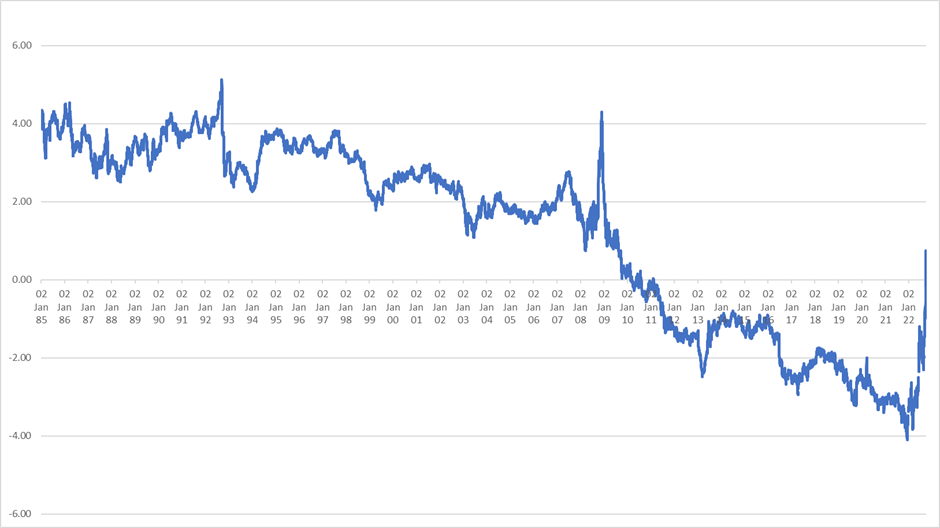

Take the below chart, which shows 5-year real yields for UK inflation-linked bonds over 37 years.

Source: Bank of England website

The 5 year real yield just rose by 159 bps in 1 week. The 10 year real yield rose 163bps over the same period. This is astonishing. On the 9th December last year, the 5 year real yield was -4.1%. Today it is 0.75%. That’s an increase in 4.85% in 10 months. This is also astonishing.

Nominal yields have also increased by similarly barely believable amounts, but we focus on real yields for a reason. Investors care most about real returns. If nominal increases in yields are due to rising inflation, then real yields will be static and investment vehicles that compensate for rising inflation with linked cashflows can cope with this.

The problem is that barely any investment can cope with rising real yields offered by bonds backed by the government. In the GFC, the last time we saw such a dramatic move, the issue was primarily one of liquidity that was quickly solved by massive monetary stimulus. This time the increase in real yields over the past few months seems to have been caused initially by more hawkish central bank policy and then on top of that by an apparent loss of confidence in the government’s ability to fund itself in the wake of the mini-budget.

There have been few places to hide. Real assets (which should price off of real not nominal yields) have been particularly badly hit – which is entirely understandable. In addition, bonds as an asset class are acting in a more volatile fashion than equities – will this finally put paid to the notion that risk parity funds work or the notion that bonds are always an effective hedge to equities?

We also wonder why equities have not been more badly hit. Equities are meant to be long duration assets – it is somewhat baffling they haven’t repriced to a greater degree. Our process requires us to respond when valuations change – including relative valuations. We have just made substantial changes to our portfolios. We now believe the relative attraction of corporate bonds demands we increase weights, and this is mainly being done at the expense of equities. But we also must not shy away from the impact on financial assets of real yields increasing so far and so fast. There is no guarantee they will return to previous lows, and we must all react accordingly.

On the positive side, the opportunities we are seeing make us confident we are improving the risk/return profiles of our funds substantially, thanks particularly to the repricing of risk across fixed income markets.

Ben Conway – Head of Fund Management

For professional advisers only. This article is issued by Hawksmoor Fund Managers which is a trading name of Hawksmoor Investment Management (“Hawksmoor”). Hawksmoor is authorised and regulated by the Financial Conduct Authority. Hawksmoor’s registered office is 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. Company Number: 6307442. This document does not constitute an offer or invitation to any person, nor should its content be interpreted as investment or tax advice for which you should consult your financial adviser and/or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. Any opinion expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represents the views of Hawksmoor at the time of preparation and may be subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. FPC567.