10th September 2021

A report from Jefferies’ excellent investment trust analyst Matt Hose, dropped into our inboxes this week. The subject was listed private equity (PE) investment trusts – a topic close to HFM’s heart.

We have always held exposure to listed PE in our Funds and one of the very largest positions across the range is Oakley Capital Investments (OCI). We like private equity, as good managers can take advantage of tools at their disposal that managers of public equities do not have.

In this week’s Crescendo, we thought it was worth using some of Matt’s analysis to illustrate why this is such a compelling opportunity.

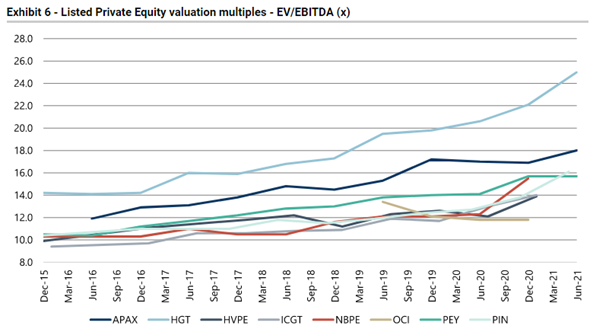

Oakley, which invests in European technology, consumer and healthcare sectors, has delivered NAV returns (after charges) of 16% per annum for the past 5 years (vs European equities in the 8.5%-ish range). This has been achieved despite no valuation expansion in the assumptions they use to value their portfolio of private companies (the opposite is true over the last few years in fact). When private companies are valued, it is usual to look across to public markets, and thus private equity has benefited from the significant increase in public market valuations. Have a look at the multiple expansion of some of their peers, courtesy of Matt Hose:

APAX (APAX Global Alpha), HGT (HG Capital Trust), HVPE (HarbourVest Global Private Equity), ICGT (ICG Enterprise Trust), NBPE (NB Private Equity), OCI (Oakley Capital), PEY (Princess Private Equity), PIN (Pantheon International)

Source: Companies/ Jeffries,

While some of this multiple expansion can be explained by a sector mix effect (for example, investing more in sectors that have higher ratings – e.g. software), most of it cannot be. Oakley has always been conservative in this way – reflected in the fact that the average uplift to book value when they exit an investment is 44%, and was as high as 89% in 2019. Meanwhile the shares trade on a discount to the arguably very understated NAV of 21%.

In today’s interim results, the Company noted that the portfolio is valued on just 12.3x EV/EBITDA, with net debt just 3.5x EBITDA. Most PE investment trusts gear up to 5x. Indeed, these multiples are the second lowest across the peer group. In other words, the margin-of-safety with an investment in Oakley is very wide: they use less leverage to generate their NAV growth and do not mark their portfolios aggressively higher in line with public markets – leading to big uplifts on exit and less downside risk should public markets cheapen.

The cherry on top is that OCI’s Board is acutely aware of how cheap their share price currently is. They have bought back a huge number of shares (and cancelled them – i.e. they won’t be reissued) – increasing NAV per share for remaining shareholders. Oakley’s partners have also been increasing their own personal shareholdings. Between Board members and partners, they now own c. 11% of the shares.

So the investment case is simple:

- An asset class that delivers strong returns

- Managed by a manager with a sector-leading track record

- Accessed via an investment trust trading on a sector-wide discount of 21%

- With a Board that is buying back shares aggressively (in a sector where buybacks are rare)

- With insiders having recently added to their holdings creating material alignment with shareholders

- With a NAV that is likely to be materially understated judging by prior uplifts on exit

- And finally with a portfolio that is very conservatively valued with barely any re-rating having been assumed over the past few years, using relatively low levels of debt.

To us, Oakley Capital Investments sticks out a long way amongst a group of very high quality investment trusts.

Ben Conway – Head of Fund Management

This financial promotion is issued by Hawksmoor Fund Managers which is a trading name of Hawksmoor Investment Management (“Hawksmoor”). Hawksmoor is authorised and regulated by the Financial Conduct Authority. Hawksmoor’s registered office is 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. Company Number: 6307442. This document does not constitute an offer or invitation to any person, nor should its content be interpreted as investment or tax advice for which you should consult your financial adviser and/or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. Any opinion expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represents the views of Hawksmoor at the time of preparation and may be subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. HA4537