2nd September 2022

Three weeks ago we wrote about our preference for smaller funds: Small is beautiful. The blog got a good amount of attention – and some people took this to mean that we were arguing that small funds are more likely to outperform. This article (see here) in Citywire used Morningstar research to show that small funds actually underperform on average. So, I’m going to use this blog to clarify what statements we believe you can make about smaller funds.

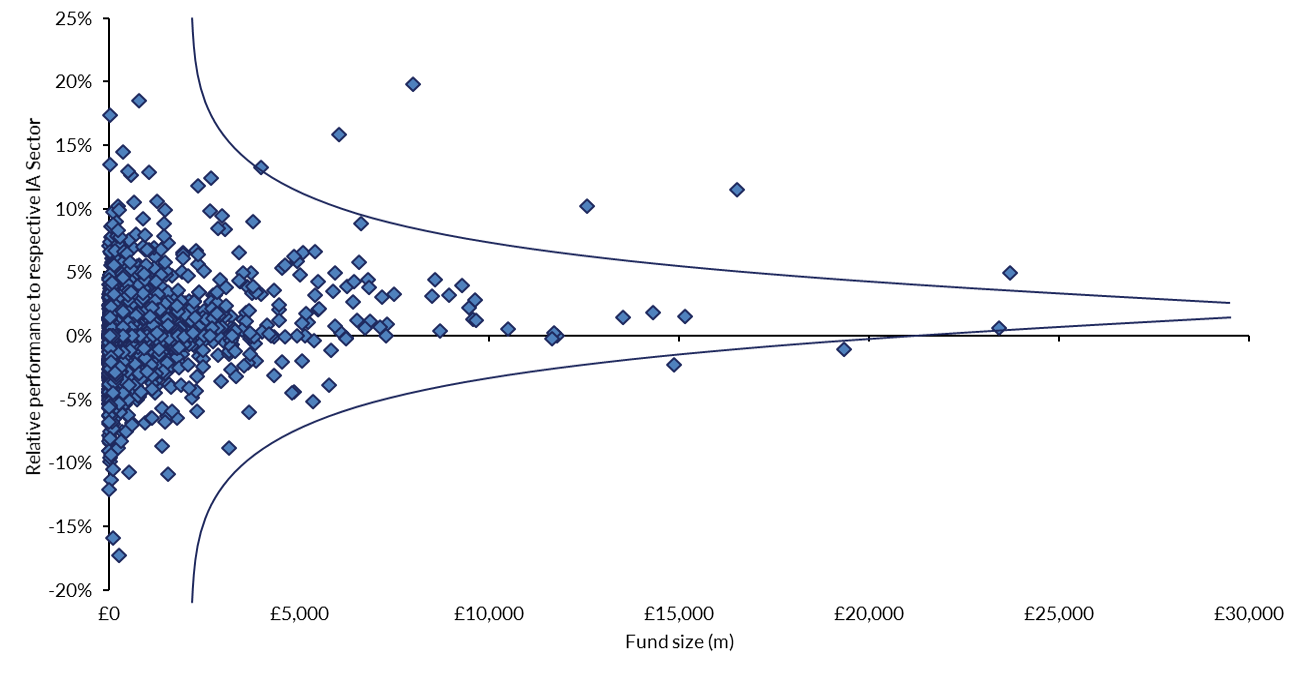

We use the following chart in many of our presentations:

Source: FE fundinfo, IA defined sector funds excluding Pimco GIS Income, size: £53bn, rel perf: 2% and iShares VII Core S&P 500 UCITS ETF, size: £44bn, rel perf: +1%, 31/12/2016 to 31/12/2021.

Each dot is a fund in an IA sector with clearly identifiable peer group (so it excludes sectors like Flexible and Unclassified). A dot that sits above the zero horizontal axis has outperformed peers over 5 years. The further to the right the dot is, the larger the fund. What this chart shows, is that to find funds that outperform by a lot, you have to look at smaller funds. But there are just as many smaller funds that underperform by a lot. This is pretty intuitive. The larger a fund gets, the closer to its (presumably market cap-weighted) benchmark it has to look, and thus the lower the likelihood of big deviations of relative performance. Smaller funds can be managed by highly skilled managers running concentrated portfolios that possess all the attributes Dan talked about in our blog three weeks ago. However they can also be beset by the hurdles of higher fixed costs (i.e. fees that eat into performance to a greater extent than larger funds) and could simply be on-the-shrink as redemptions hit due to undeniably poor performance.

We have never argued that being small is a sufficient condition for significant outperformance, but we do believe it is almost always a necessary one.

However, it takes a great deal of hard work in the form of research and due diligence on the part of the fund selector to find the gems and not the duds. Indeed, this is what our own investors are paying for. The amount of work involved is also a reason why we think selecting such funds is best left to professionals, unless you have a great deal of time to do the necessary research.

Indeed, in a recent podcast that focused on the active vs passive debate, hosted by JB Beckett (see here), the active team (of which I was a part) argued that passive or index funds are a great option for retail investors who don’t have the time to devote to fund selection. Indeed, the active vs passive debate has become depressingly hackneyed. Supporters of active funds have never stated that active funds on average beat passive funds. But we do believe that, as with anything in life, with hard work comes rewards. In this case, hard work increases your likelihood of finding a fund that will materially outperform – and it is worth concentrating on smaller funds.

Thus we will continue to devote a good deal of our time to researching managers, paying special attention to smaller funds or those with limited track records, in the hope of generating superior returns for our investors. That is, after all, our job.

Ben Conway – Head of Fund Management

For professional advisers only. This article is issued by Hawksmoor Fund Managers which is a trading name of Hawksmoor Investment Management (“Hawksmoor”). Hawksmoor is authorised and regulated by the Financial Conduct Authority. Hawksmoor’s registered office is 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. Company Number: 6307442. This document does not constitute an offer or invitation to any person, nor should its content be interpreted as investment or tax advice for which you should consult your financial adviser and/or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. Any opinion expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represents the views of Hawksmoor at the time of preparation and may be subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. FPC509.

IA defined sector funds: Asia Pacific Excluding Japan, Asia Pacific Including Japan, China/Greater China, Commodity/Natural Resources, Europe Excluding UK, Europe Including UK, European Smaller Companies, Financials & Financial Innovation, Global, Global Corporate Bond, Global EM Bonds – Blended, Global EM Bonds – Hard Currency, Global EM Bonds – Local Currency, Global Emerging Markets, Global Equity Income, Global Government Bond, Global High Yield Bond, Global Inflation Linked Bond, Global Mixed Bond, Healthcare, India/Indian Subcontinent, Infrastructure, Japan, Japanese Smaller Companies, Latin America, North America, North American Smaller Companies, Property – Other, Specialist, Specialist Bond, Sterling Corporate Bond, Sterling High Yield, Sterling Strategic Bond, Targeted Absolute Return, Technology & Telecoms, UK All Companies, UK Direct Property, UK Equity Income, UK Gilts, UK Index Linked Gilts, UK Smaller Companies.