Renewable energy sources have experienced a surge in popularity in recent years. The likes of wind and solar power were once viewed as being expensive, inefficient and unable to cater for a meaningful proportion of a nation’s power demands. These notions are being quashed by factors including climate change and falling costs, augmented by an increase in public awareness of environmental issues.

Growing market

Our recent article Net Zero demonstrated that the energy sector has accounted for much of the progress to date towards achieving the UK’s net zero carbon emissions target by 2050. According to the Department for Business, Energy and Industrial Strategy (BEIS), Q2 2019 was the first quarter during which coal has generated less than 1% of the UK grid mix since the 19th century. The UK’s reduction in fossil fuel usage has corresponded with renewable sources of energy supplying a greater share of power generation. Furthermore, there is an overarching increase in demand for energy from consumers, which will ultimately place more dependence on renewable energy to help balance the grid. The renewable share of UK energy has been steadily increasing, as shown in Chart 1.

Chart 1: Renewable Share of UK Energy Generation (%)

Source: BEIS (https://www.gov.uk/government/statistics/energy-trends-section-6-renewables)

Gone with the wind

A wind farm is perhaps one of the first things that comes to mind when one thinks of renewable energy. Each turbine atop a tower converts the mechanical energy of (typically three) rotor blades into electrical energy. An on-site substation links the wind farm to the distribution network, with a meter recording how much electricity is exported to the grid. Owners of such wind farms generate revenue by selling this electricity under Power Purchase Agreements (PPAs), typically to large utility firms.

However, wind farms can be expensive to build. The UK government introduced subsidy schemes such as Feed-in Tariffs (FIT) and Renewable Obligation Certificates (ROC) to encourage development. The long-term, contracted nature of PPAs provides certainty for both the seller and buyer of electricity and, combined with subsidies, provides an incentive for the construction of further renewable energy infrastructure.

Offshore wind farms typically harness higher wind speeds compared to those onshore and face less opposition to development, but are more expensive to construct. At the time of writing, the UK has approximately 10,000 wind turbines, with 80% being onshore.

Coming to light

Very simply, solar power is the conversion of energy from sunlight into electricity. This can be achieved in many ways, the most common of which is photovoltaics (PV). The PV effect converts solar radiation into direct current electricity by using semiconductors – when the sun hits the semiconductor within a PV cell (typically silicon crystals), electrons are freed and form an electric current. Such technology is generally employed on a panel (hence solar panels), where PV cells are connected to each other and mounted on a modular frame. In turn, multiple connected modules form an array.

Solar PV utilizes the most abundant renewable energy source on the planet, and can be applied in both commercial and residential settings. The small scale of the latter allows people to both produce and consume their own electricity.

Subsidies

Introduced in 2002, ROCs have been instrumental in the development of large-scale renewable energy projects, obliging UK electricity suppliers to generate more of their supply from renewable sources. They are tradeable and index-linked to RPI. Effectively they are bought by utility firms alongside the power they purchase, and used to demonstrate to Ofgem that they have met their obligations.

In 2010, FITs were introduced to cater for small-scale renewable energy projects up to 5 MW. The owner of an accredited renewable project receives index-linked (to RPI) payments from a utility firm for both the power purchased and that used by the owner themselves.

Both schemes are now closed to new projects but continue to apply to existing accredited projects. The UK government’s main mechanism for supporting renewable energy projects is now the Contracts for Difference (CfD) scheme. Introduced in 2014, owners of accredited projects bid for contracts. Successful bidders receive an index-linked (to CPI) rate over 15 years reflecting the difference between the ‘strike’ price of power they produce and the ‘reference’ market price – thereby subsidising the potentially higher cost of low-carbon power generation.

Government-backed subsidy schemes have certainly encouraged the development of renewable energy projects, and costs have come down to such an extent that the UK’s first subsidy-free wind farm is expected to become operational in September 2020.

Developments

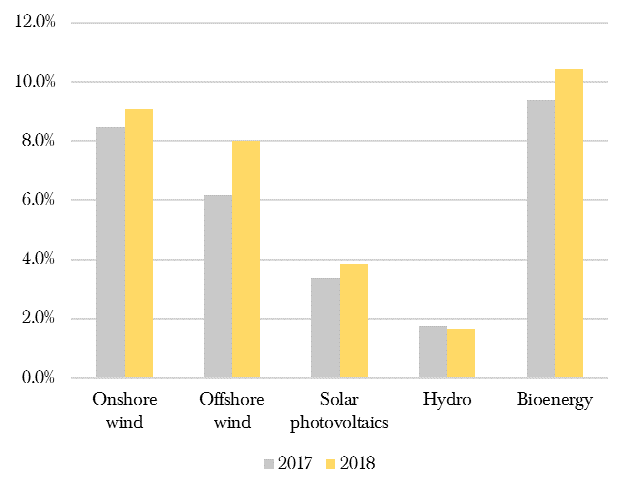

These subsidies have been successful in encouraging the development of renewable energy projects in the UK. Installed capacity across wind, solar, hydro and bioenergy projects rose by 10% in 2018, and the total proportion of UK electricity generation from these renewable sources has been on an upward trend in recent years, rising from 24.5% in 2016 to 33.0% in 2018.

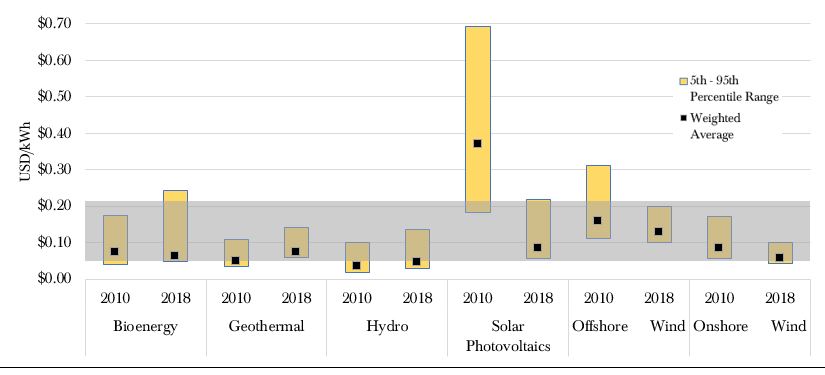

Furthermore, the cost of power produced by renewables has been falling. The Levelized Cost of Energy (LCOE) of renewables has fallen to such an extent that in some markets it simply makes economic sense, let alone environmental sense, to favour renewable energy. Chart 2 shows the LCOE of renewable energy sources in 2010 and 2018, highlighting the significant reduction in costs and increased competitiveness with fossil fuels (represented by the grey strip) over this period.

Chart 1: LCOE of Utility-scale Renewable Technologies

Source: © IRENA 2018

Investment opportunities

With a growing market for renewable energy, falling costs and increasing public awareness of environmental issues, we believe there are some interesting investment opportunities in this area. The UK investment trust market contains a small cohort focused on renewable energy. JLEN Environmental Assets owns and operates projects across the wind, solar, anaerobic digestion and waste and wastewater sectors. Targeting a total return of 7.5-8.5% per annum, the portfolio is located almost exclusively in the UK. The Renewables Infrastructure Group (TRIG) seeks to provide investors with long-term, stable dividends whilst preserving the capital value of its portfolio. Relative to JLEN, TRIG has more wind power and increasing developed European exposure including Sweden and France. Greencoat UK Wind has a deliberately simple structure, focusing on a single asset class (95% onshore) in a single geography. An attractive feature of this trust is its clear mechanism of reinvesting in the portfolio alongside the payment of dividends. It has a first-mover advantage in its sector and a strong performance record since launch in 2013.

At the time of writing, each of these trusts provides a dividend yield of between 4.9% and 5.7%.

James Clark and Ben Luck – Members of the Hawksmoor Research Department

Important Information

This document does not constitute an offer or invitation to any person. The information and opinions herein are compiled from sources believed to be reliable at the time of writing and are given in good faith, but no representation is made as to their accuracy (completeness or correctness). Any opinion expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represents the views of Hawksmoor at the time of preparation and may be subject to change, Past performance is not a guide to future performance. The value if an investment and any income from it can fall as well. You may not get back the amount you originally invested.

Hawksmoor Investment Management Limited (“Hawksmoor”) is authorised and regulated by the Financial Conduct Authority. Hawksmoor’s registered office is 2nd Floor, Stratus House, Emperors Way, Exeter Business Park EX1 3QS. Company No.: 6307442. HA3507

FOR PROFESSIONAL ADVISERS ONLY AND SHOULD NOT BE RELIED UPON BY RETAIL INVESTORS