Look for the girl with the sun in her eyes,

And she’s gone.

– The Beatles, Lucy in the Sky with Diamonds (1967)

In The Adventures of Tom Sawyer, Mark Twain tells us that in order to make a boy covet a thing it is only necessary to make the thing difficult to attain. De Beers successfully harnessed this concept by convincing the world that diamonds were exceedingly rare. In fact, diamonds are one of the most common gems: their market scarcity is artificially induced by tight control of supply. Were they as common as Budleigh Salterton’s pebbles, would diamonds still have been Ms. Monroe’s best friends? The risk for the industry today is that diamonds can be cheaply mass-produced in laboratories at finer quality than even nature’s best efforts.

The value of a business is intrinsically linked to this concept of secured rarity. It can be more confident of sustaining attractive levels of profitability where it owns assets that are unique and nonreplicable; where its advantages are shared, a race to the bottom on margins is often inevitable.

Our interest is emerging threats, especially from technology, that are introducing abundance into previous scarcity, and thus diminishing the value of outdated business models.

The Communication Revolution

We are in the midst of a technological revolution that is fundamentally about communication. Businesses that are at risk are those that have previously profited from a scarcity created by the absence of easy communication flow.

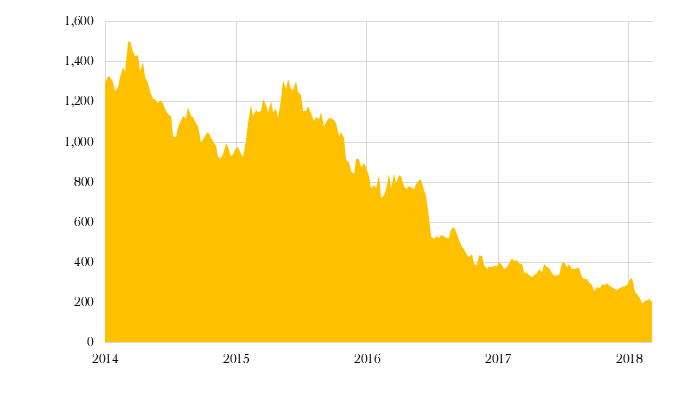

Estate agents could charge high fees before rightmove.com (et al.) because it was difficult for seller to find buyer: today online-only models are popping up that can sell your house at a fraction of the price (PurpleBricks for example estimates its fees are up to three-quarters cheaper than traditional agencies). That partly explains why Countrywide, the UK’s largest estate agency group and once valued at £1.5bn, has lost around 85% of its worth since 2014 (Chart 1)

Chart 1: Market value of Countrywide PLC, £m

Source: FactSet, 1st Jan 2014 to 9th March 2018

Plenty of room at the Hotel California

Elsewhere, sites like Airbnb allow anyone with a spare room to be an hotelier, which diminishes the scarcity of places to stay. Notice again that this is an issue of communication: before Airbnb there was no easy way for the availability of your second bedroom to be widely publicised to travellers.

The hotel industry has continued to expand capacity in recent years amidst record numbers of visitors, particularly from Asia. The stage is set for excess supply, especially as Airbnb matures and extends its reach. In December, Airbnb had a 7.6% share of overnight stays in London, which was up from 2.8% the year before (Source: Colliers).

Middlemen

In the past month alone, Toys R Us has called in the administrators, Carpetright and Mothercare warned they are at risk of breaching covenants on their loans, New Look announced the closure of hundreds of stores and Maplin collapsed into insolvency. Contrary to the Europhile headline writers, this is not a corollary of the Brexit referendum result but a structural change in how the world shops: compare and contrast with the growth rates of online-only shopping firms ASOS and its peers.

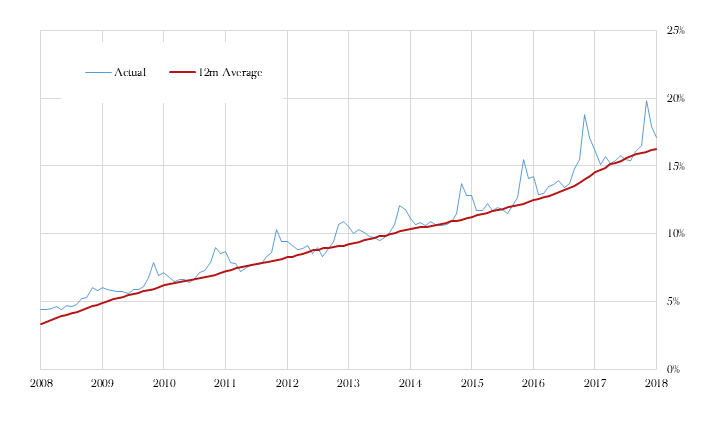

Chart 2: UK Internet sales, % of total retail sales

Source: Office for National Statistics

The internet and Amazon introduce easy product and price comparison and an ability for producers to transact directly with customers. Further, Amazon all but destroys anyone’s pricing power – and cements its own monopoly – by ensuring it has the lowest price of any channel. If the only value your business was adding was to connect the makers of things with the buyers of things, you face obsolescence. The convenience value of physical High Street locations is trumped by the ease of the infinite shop online (Chart 2).

The obvious question: who is next? One only needs to mention the Amazon threat to send shivers down stock price spines. More recently questions are being asked about the pharmaceutical distribution sector. Amazon has so far remained tight-lipped, but we must assume a disruption of that market is a matter of “when”, not “if”.

Consumer Brands are in trouble

Even further up the supply chain, for producers and brands too we can see similar implications and threats. Barriers to entry are tumbling: it has never been easier to set up a supply chain, advertise and sell on a global basis. Fundamentally, these are all issues of communication.

Equipped with greater information and choice, consumers are rejecting the consistency and omnipresence of the Big Brands in favour of the niche, the local, the product with the higher quality ingredients, the product that doesn’t destroy the planet… Big Brand? Big Bland.

Basically, there are no entry barriers

Peter Ter Kulve, Chief Transformation Officer, Unilever

Examples are numerous: America’s best-selling ice-cream pint last year was Halo Top – a privately-owned low-sugar high-protein product that was a kitchen experiment just seven years ago. The major corporates are struggling to catch-up, but notably no longer enjoy the competitive advantages and entry barriers of the past.

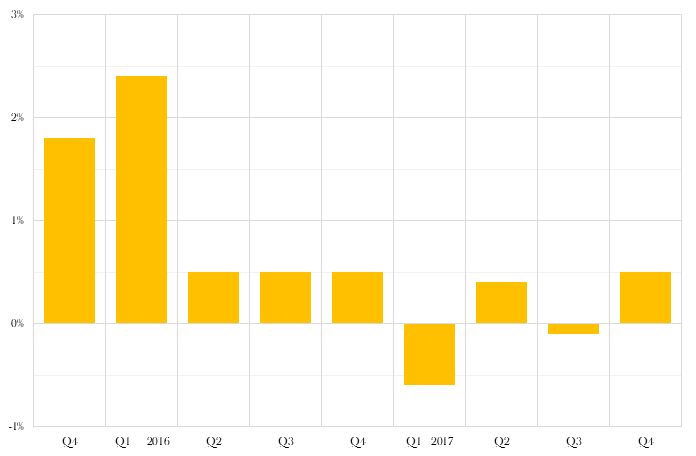

Shampoo battles (in a market share context, of course) used to be the duel of Procter & Gamble and Unilever; today they also face armies of niche high-end offerings through online subscription services like Birchbox. Meanwhile, Sainsbury’s expects its own-brand product to be as good as the branded market leader. In short: the competitive landscape for consumer goods has intensified such that sales growth is increasingly difficult to attain (Chart 3).

Chart 3: Unilever underlying sales growth, %

Source: Company data (Q4 2015 – Q4 2017)

Who can add value?

This path winds on to ask where unique business assets can still be found, if at all. Our prime fishing ponds include those where products and intellectual property can be protected, where there are high barriers to entry, and where a firm owns an asset that would be almost impossible to replicate. Below we offer examples across the market size spectrum.

Take pharmaceutical group Indivior, which has a 25-year history working in addiction treatment. The strength of its patents and research expertise grant us greater confidence in our estimates for Indivior’s future sales. This year it is launching Sublocade, the first ever once-monthly medication for opioid addiction, which has huge potential in the fight against an epidemic that affects around 29 million people.

Now consider small-cap Avon Rubber, a manufacturer and supplier of gas masks to the US military. The defence industry has notoriously high barriers to entry given the security clearance required just to get a foot in the door. As with Indivior above, Avon Rubber invests heavily in R&D and is deservedly regarded as the market leader in its niche.

Non-replicable business assets include market reputations (as above), networks of individuals or companies, specialist data and unique properties. It would be impossible, for example, to replicate BHP Billiton’s portfolio of mines. Elsewhere, Informa justifies the high price it is paying for UBM on its unique exhibition contracts.

Conclusion

Industrial revolutions are not single events in time but a process that can take decades as businesses, consumers and governments slowly adapt. Our relatively newfound ways to communicate and access information is clearly a force of disruption: we have highlighted challenges for the hotel industry, retail, distribution, and consumer brands, though this list is certainly not exhaustive.

We argue that using the perspective of secured rarity can help investors to identify businesses that are able to maintain attractive levels of profitability. At its heart, the rationale is to seek companies that genuinely create value, which ultimately is the only means to deliver sustainable returns.

Ian Woolley – Senior Investment Analyst

Health Warning/ Disclaimer

This document should not be interpreted as investment advice for which you should consult your independent financial adviser. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. Any opinion expressed, whether in general or both on the performance of individual securities and in a wider economic context, represents the views of Hawksmoor

at the time of preparation. They are subject to change. Past performance is not a guide to future performance. Hawksmoor Investment Management Limited (“Hawksmoor”) is authorised and regulated by the Financial Conduct Authority. Hawksmoor Investment Management Limited is registered in England No. 6307442 and its registered office is at 2nd Floor, Stratus House, Emperors Way, Exeter Business Park, Exeter EX1 3QS. HA2326

FOR PROFESSIONAL ADVISERS ONLY AND SHOULD NOT BE RELIED UPON BY RETAIL INVESTORS