21st May 2021

In mid-November we were so excited by the relative and absolute value in our portfolios that we held an ad hoc webinar encouraging new investors to consider buying our funds – effectively we were calling for the period of underperformance to come to an end. We focused on Our Distribution Fund since, of all our funds, it had been the worst affected by the events of 2020, and we saw the most latent value in the portfolio thanks to its many alternative income investments. That show of confidence has proved to be correct with the performance of all three funds beating their respective IA sectors over the past 6 months.

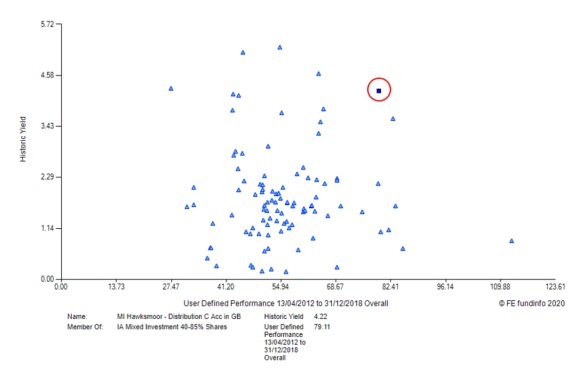

For the first 6.5 years of the Distribution Fund’s existence, its mandate to deliver an above average level of income had not been a constraint to (sector-leading) performance:

Source: FE Analytics

The above chart is a scatter plot of the funds in Distribution’s sector (IA Mixed Investment 40-85% Shares) showing the yield of each fund against performance from 13th April 2012 (launch) until the end of 2018. There is not a relationship. Our Distribution Fund is circled.

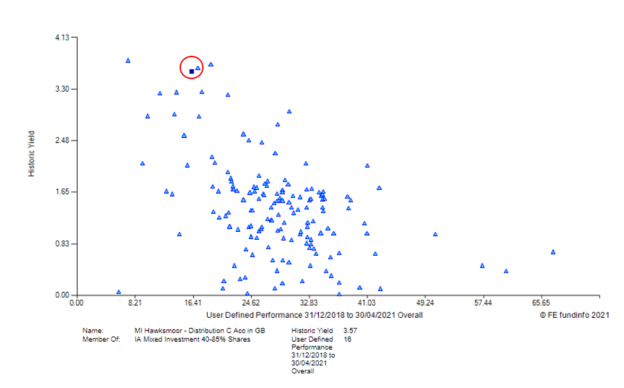

Now look at the period since then:

Source: FE Analytics

It appears that the higher a fund yielded, the poorer the total return. This is the flip side of the growth/quality stock mania we have seen. While certain areas of asset markets have been left very expensive by incredible capital returns, other assets, whose returns were always going to come mostly from income have been left behind.

This brings us to the first point of this week’s blog. There was never anything wrong with the investments with which we chose to populate our funds. They were just out of fashion. It has been a bit of a head scratcher because investments that generated healthy levels of income in a low risk way should have been popular when income investors are so poorly served by bank deposits, government bonds and corporate bonds. But if you can make 1000% capital returns from digital currencies created as a joke or story-stocks led by strong personalities, who needs income taxed at higher rates than capital anyway?!

The second key point is why we remain so excited about our funds. Long run equity returns (and I mean REALLY long run: 120 years plus) are around 6-7% per annum. And yet the past 40 years have been a golden age, where returns have been several hundred basis points higher than that. This has driven valuations to very high levels. And we all know that bonds are constrained by mathematics to struggle to deliver the past 40 years’ returns too.

And yet we can find investments – not necessarily equity or bond investments – that should deliver 10% per annum nominal returns, or others with prospects of 5-6% real returns – primarily via dividend streams from the investment company structure in which they are held. These investments do not involve scary leverage, or eye-watering fees, or huge credit risk, or high duration, and in some cases they even have long datasets which illustrate they are trading at valuations that are cheap relative to their own history. Many of these investments also exhibit low economic sensitivity and/or derive their cash flows from long term contracts, providing a high degree of visibility with regards to likely future returns. We’ve discussed our liking for ships recently, but we could also talk about songs, certain areas of property, project finance, asset backed securities, digital infrastructure, and I could go on. The awful stresses of spring 2020, when liquidity in the investment company market effectively disappeared (but the underlying assets performed brilliantly – making it even more stressful) are now long behind us.

We have recently been doing due diligence on many relatively new launches, and have also been watching a bench of investment companies launched last year. These involve investable asset classes that have often long existed in private form but are now being made available to investment company investors. Before you ask, do not worry, we are very cynical, and are always wary about being the investor that the smart money sells to!

Our primary source of stress today is currently how to fit all these good ideas in our portfolios. This is a great problem to have and one that might come as a surprise, given how many major asset classes currently trade on lofty valuations. But please don’t mistake this excitement for expectations of high double-digit returns. For example, we have a high degree of confidence of mid to high single digit per annum returns over the next 3-5 years from the Distribution Fund’s portfolio. We suspect this will compare very favourably to other investments and multi-asset funds (especially those with structurally high fixed equity and bond content). Remember: long run returns from equities alone are 6-7% real (or 8-9% nominal). Mid-to-high single digit returns from a multi-asset portfolio with under 50% equity (and taking significantly less risk) would be fantastic. Do not let your expectations for future returns be conditioned by the past 40 years. Valuation always matters in the end.

Ben Conway – Head of Fund Management

This financial promotion is issued by Hawksmoor Fund Managers which is a trading name of Hawksmoor Investment Management (“Hawksmoor”). Hawksmoor is authorised and regulated by the Financial Conduct Authority. Hawksmoor’s registered office is 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. Company Number: 6307442. This document does not constitute an offer or invitation to any person, nor should its content be interpreted as investment or tax advice for which you should consult your financial adviser and/or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. Any opinion expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represents the views of Hawksmoor at the time of preparation and may be subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. HA4330.

Source: MSCI. Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent.