16th April 2021

It has been said that the definition of a special situation is a good investment gone wrong. This has certainly crossed our minds numerous times when considering one of our largest holdings in our three Funds, Phoenix Spree Deutschland (PSDL), over the last couple of years.

I’ll quickly summarise the recent history of the Berlin residential property sector for readers who choose to spend their time thinking about more interesting things. The strong demand dynamics of the Berlin rental market have been in place for a few years, due to a large inward migration to Berlin from other parts of Germany and beyond because of its more vibrant and thriving economy, yet much more affordable housing. In addition there is a low supply of suitable homes for young professional workers and families, given the outdated and unfashionable properties more reflective of the legacy of the communist East German regime. Add in the stringent planning laws, and the result is a market with strong rental growth potential.

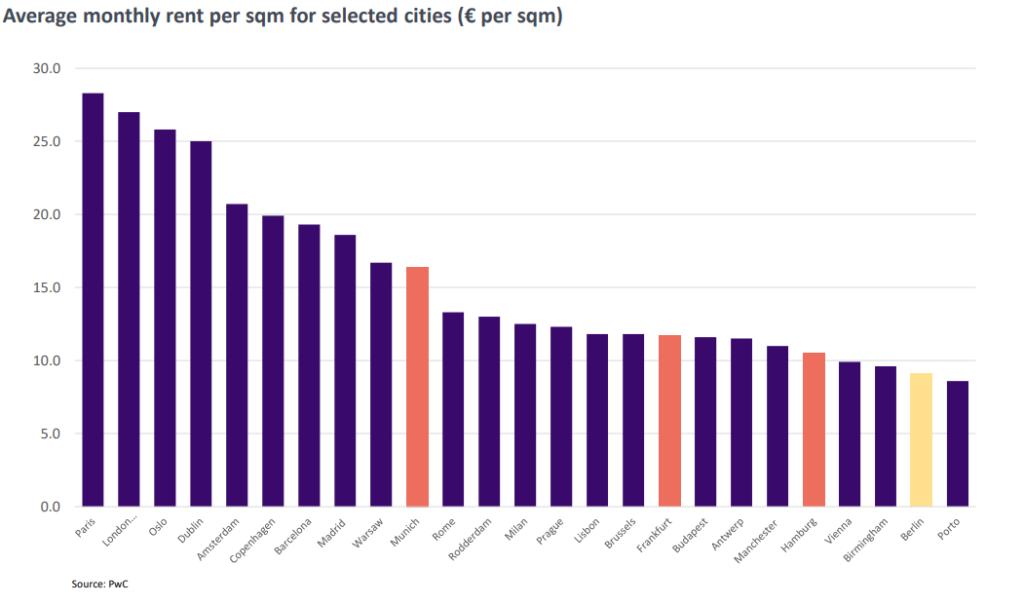

Fearing their native population was being priced out of the market, even though the rents in Berlin are a fraction of those in other European capital cities (see chart below), the Berlin state government went ‘rogue’ and introduced a rent freeze, known locally as the Mietendeckel. Thus the structural growth tailwind supporting the investment case for PSDL, a Berlin landlord, came to an abrupt halt in 2019 and we had to reassess our conviction in it.

Source: Phoenix Spree Deutschland.

As we have said before, our property exposure within our Funds is not just about wanting something other than equities or bonds, or just any old exposure to bricks and mortar for ‘diversification for diversification’s sake’. Each of our investments has to have a specific angle and role to play in our portfolios. It could be their bond-like characteristics with inflation-linked rents (such as Supermarket Income REIT, Civitas Social Housing REIT and Impact Healthcare REIT), the equity-like returns from deeply discounted REITs (such as BMO Commercial Property and Regional REIT), or those that have strong capital growth potential (such as Urban Logistics REIT and PSDL).

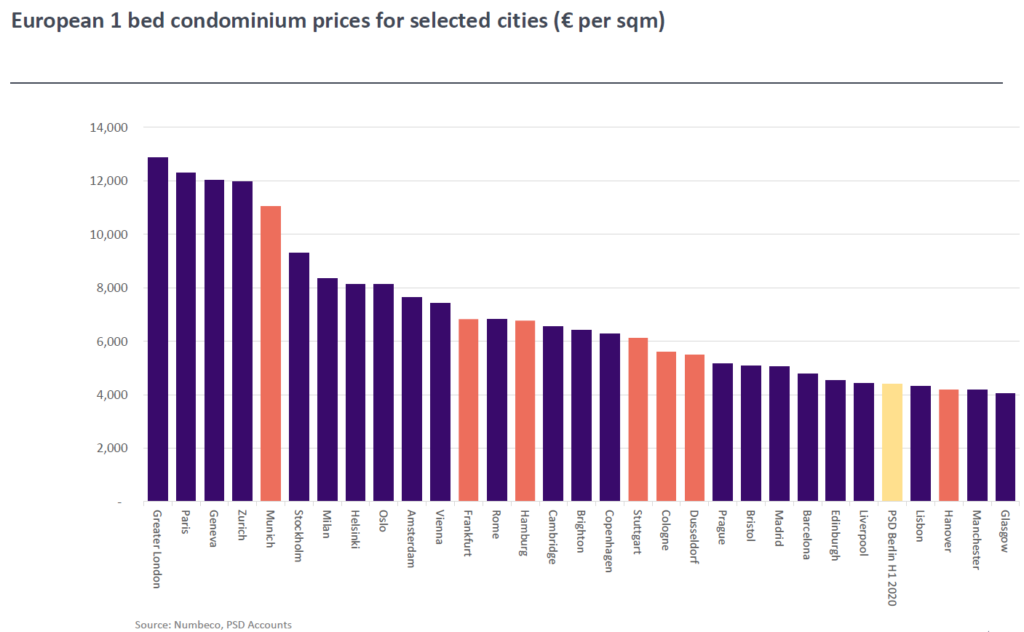

The classification for why we own PSDL has therefore not really changed, even though we can also classify it as a special situation. This is because the return profile has been delayed somewhat by the imposition of the Mietendeckel, which everyone, apart from the Berlin state government, has long believed to be unconstitutional. While we all waited for the Federal Court to overturn the Meitendeckel, the managers of PSDL were already working on a plan B. This involved sorting the properties they own into condominiums and selling them in a hot market as history shows that rent freezes cause house prices to rise. See the chart below showing that prices for condominiums also remain below most other European cities, despite the properties in PSDL’s portfolio commanding a 20% premium to their pre-condominium-conversion state.

Source: Phoenix Spree Deutschland.

Meanwhile we have become more engaged with management and the board to work towards a strategy that would narrow the persistent 30% discount of the past 2 years. The long-awaited decision by the German Federal Court arrived yesterday, which, as expected, overturned the Meitendeckel, declaring it void. PSDL’s share price has jumped back to the pre-Meitendeckel levels in response, but still trades on a significant and undeserved discount. Even with this positive news clearing much uncertainty, there remains plenty of work for us to do to get this back to a profitable investment for our investors – given it has represented a huge opportunity cost when mainstream assets have gone up significantly in the past two years. We remain confident that our patience and efforts will be rewarded further and that the shares will continue to rerate at a time when other assets perhaps have less potential to rise further.

Daniel Lockyer – Senior Fund Manager

This financial promotion is issued by Hawksmoor Fund Managers which is a trading name of Hawksmoor Investment Management (“Hawksmoor”). Hawksmoor is authorised and regulated by the Financial Conduct Authority. Hawksmoor’s registered office is 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. Company Number: 6307442. This document does not constitute an offer or invitation to any person, nor should its content be interpreted as investment or tax advice for which you should consult your financial adviser and/or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. Any opinion expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represents the views of Hawksmoor at the time of preparation and may be subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. HA4266.