13th April 2022

The Hawksmoor Distribution Fund celebrated its 10th anniversary on the 13th of April 2022 joining an increasingly exclusive club of UK funds that have been managed by the same team for a decade or more. Landmark birthdays are often a time to pause and consider past achievements and lessons learnt, but also an opportunity to look to the future.

Looking back

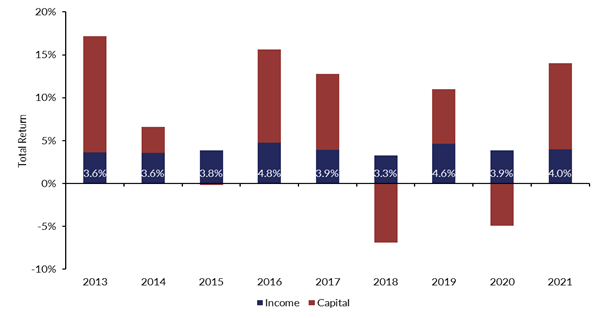

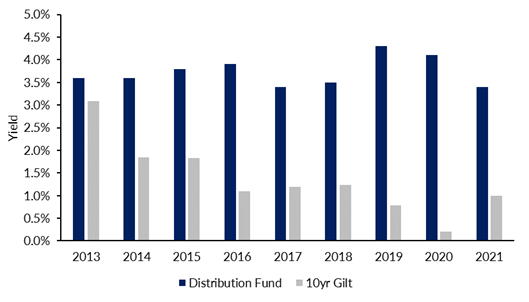

Since launch in April 2012 the Hawksmoor Distribution Fund has met its twin objectives of delivering an attractive level of income, whilst also achieving strong capital growth over the medium to long term. The consistency of Distribution’s yield over time, both in absolute terms and relative to the income returns available from global equity and bond markets has been particularly pleasing.

Source: FE Analytics, 31/12/2021.

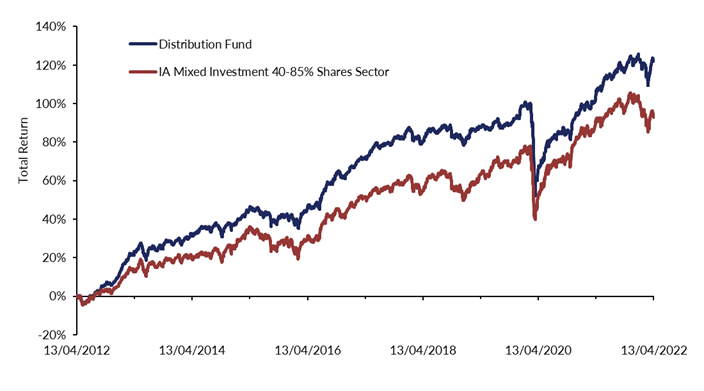

Crucially, generating premium yield has not come at the expense of capital growth with Distribution delivering top quartile total returns versus the IA Mixed Investment 40-85% Shares Sector since launch.

Source: FE Analytics: 13/04/2012 to 13/04/2022.

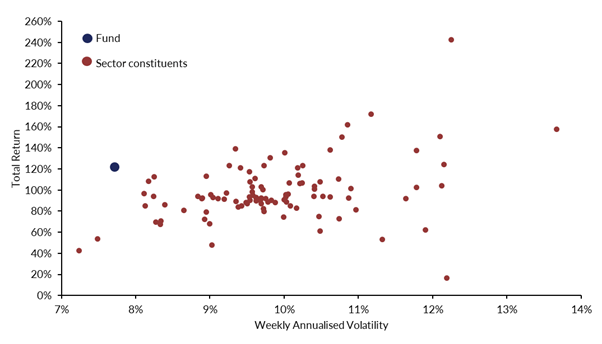

Whilst we are steadfastly focussed on the stated objectives of the Fund, we appreciate that some investors will consider success or otherwise through the lens of relative returns. Distribution is a true ‘Balanced Income’ fund which happens to sit in an incredibly disparate sector where many of the constituents have permanently high allocations to equity risk. The fact that Distribution has outperformed peers during a period of outsized equity returns (MSCI World +246.1%) despite running with average listed equity exposure of 45.8% is, we believe, remarkable and testament to our highly active, valuation conscious investment process. This approach, combined with an avoidance of big macro forecasts and resulting high levels of diversification have also resulted in excellent risk adjusted performance, with the Fund one of the least volatile in its sector.

Source: FE Analytics, 13/04/2012 to 13/04/2022.

As discussed, consistency with regards to income generation is important, but so too is the consistency of total returns. Yes, there will be bouts of relative underperformance, particularly during periods characterised by ebullient equity markets, but since launch Distribution has outperformed the 40-85% sector in 9 of its 11 discrete periods (part 2012, each calendar year since, 2022 year to date). Only 6 other funds in that sector can boast the same and all of those have exhibited significantly higher volatility.

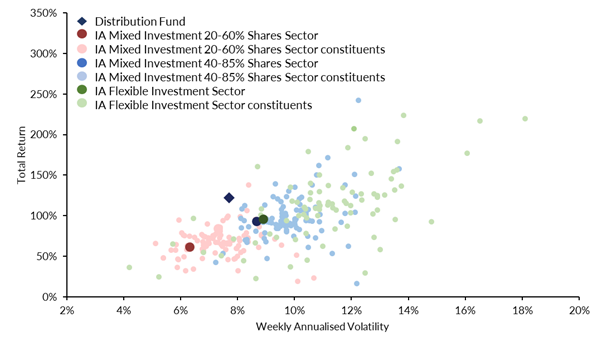

With relative returns in mind, it’s worth qualifying the decision taken at launch to place Distribution in the 40-85% Sector. The primary reason for this was because we did not want to be constrained by the restrictions of the 20-60% Sector, which require funds to hold at least 30% in fixed income and cash. We felt this lack of constraint would maximise the potential to deliver on the Fund’s raison d’être of delivering both income and capital growth.

In this sense, Distribution’s performance might be best considered in the context of other income focused multi-asset funds or those that are managed with a truly balanced asset allocation. On both fronts, Distribution stands up well with the chart below highlighting the Fund’s excellent risk adjusted returns against a broader array of peers.

Source: FE Analytics, 13/04/2012 to 13/04/2022.

Looking ahead

The past 10 years have been characterised by a marked fall in the risk-free rate and other bond yields which together with pandemic induced dividend cuts and spiking inflation has resulted in the real yield on a traditional equity-bond portfolio going negative for the first time.

Much has been written about the paltry returns available from mainstream bond markets and risks to capital should rates continue to rise. Perhaps more importantly, we also worry that the efficacy of government bonds as a hedge to equity risk is significantly diminished by today’s low starting yields. The potential for bonds and equities to exhibit positive correlation is evidenced by long episodes of market history and indeed is how 2022 is shaping up with both asset classes delivering negative YTD returns so far.

Low bond yields, expensive mainstream equity markets and the diminishing real yield available from a traditional multi-asset portfolio poses serious problems for investors of all stripes in terms of both future return expectations and diversification.

Underpinned by a well-established investment process, we strongly believe that Distribution is well placed to deal with these problems. As unconstrained, benchmark agnostic investors we are able to zero weight expensive, low yielding markets, even very large ones like developed market government bonds. Our nimble size and expertise in investment trusts also gives us access to a broader opportunity set including a range of real assets and other alternatives.

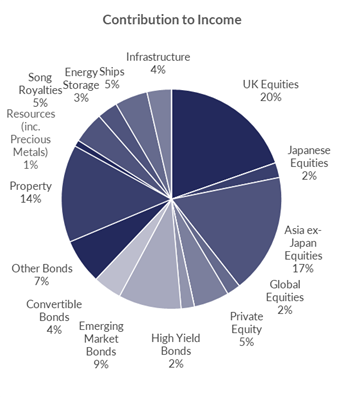

Distribution currently has significant exposure to these more idiosyncratic investments including ships, property, song royalties, digital infrastructure and energy storage which all throw off very attractive levels of income as well as capital growth potential. In many cases these assets have low economic sensitivity and low correlation to other financial assets so have the potential to offer stable, well-defined returns but also portfolio diversification benefits. We are not macro investors but do recognise that the range of probable outcomes with regards to inflation are probably broader than they have been in a long while. The fact that many of our real assets have contractual index-linked cash flows has further appeal should inflation prove less transitory than many market participants currently believe.

The use of these real assets combined with a targeted, unconstrained approach within listed equity and public bond markets has enabled us to deliver a stable level of yield despite the collapse in the risk-free rate.

Source: Alpha Terminal and internal, 2013 to 2021.

This has been achieved without having to ‘stretch for yield’ or take undue risk. Indeed, almost half of Distribution’s income is sourced from the sort of alternative assets discussed above.

Source: FE Analytics and internal, 31/03/2022.

Despite the challenges posed by low bond yields and expensive equity markets we remain optimistic about the prospects for the Hawksmoor Distribution Fund and believe it has relevance for a range of different investors. Income has always been an important component of total return providing a foundation of relative stability against inherently volatile capital values, whilst the compounding power of income reinvested is regarded by some as the 8th wonder of the world. Following a protracted period of outsized capital gains from many of the world’s major markets, this bedrock of income may well be more important going forward than ever.

A fund with a prospective yield of 3.95% can provide this foundation whilst our dynamic approach and ability to access a wide range of still attractively valued assets provide confidence that we can continue to compliment this income with decent capital growth in the years ahead, just as we have in the past.

Ben Mackie – Fund Manager

This financial promotion is issued by Hawksmoor Fund Managers which is a trading name of Hawksmoor Investment Management (“Hawksmoor”). Hawksmoor is authorised and regulated by the Financial Conduct Authority. Hawksmoor’s registered office is 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. Company Number: 6307442. This document does not constitute an offer or invitation to any person, nor should its content be interpreted as investment or tax advice for which you should consult your financial adviser and/or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. Any opinion expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represents the views of Hawksmoor at the time of preparation and may be subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. FPC217.

Source: MSCI. Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent.