22nd October 2021

I have just returned from a 3-day roadshow, visiting Belfast, Edinburgh and Durham, and presenting to financial advisers on the benefits of diversification and using every available weapon in the multi-asset arsenal. This means looking beyond the standard building blocks of most multi-asset portfolios: liquid equities and bonds, which, as you will have heard us argue, are very expensive and using them to meet the true client objective (growing their wealth in real terms after taxes and charges) is consequently very challenging.

But first, let me say how much I admire the hardy people I presented alongside at these roadshows. I don’t do this anywhere near as often as they do and it’s amazing how chipper and healthy they remain. While I absolutely love meeting advisers and telling them about what we do, there is no way my waistline could cope. My step count was shocking, I ate too many full English breakfasts, and next time I know to bring along a foldable pair of trainers and some gym kit in my carry-on luggage.

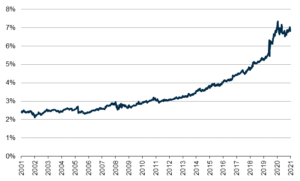

But I digress, I wanted to share with you these stats that Numis kindly put together for us. The first chart shows the percentage of the MSCI UK Index that investment trusts represent:

Source: Numis, 17/10/2021.

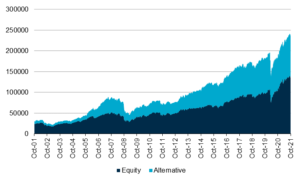

From just 2% 20 years ago, they now represent over 7% of the UK equities market. The growth in investment trusts exposed to alternative assets is particularly notable:

Source: £m, Numis, 17/10/2021.

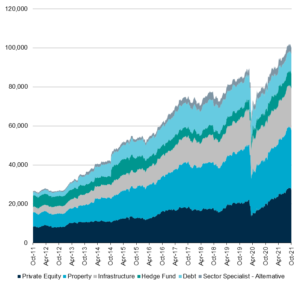

The breakdown of alternatives is as follows:

Source: £m, Numis, 17/10/2021.

And finally, it is worth noting the growth by number of trusts. The charts above mask the fact that there are now over 200 investment trusts catering to alternative assets. Some trusts are not huge, with market caps in the hundreds of millions of pounds range. This further accentuates the point that a multi-asset investor who wants to make use of all the potential weapons in his/her armoury must keep an eye on total AUM. Beyond a certain point, the only investments that such funds can hold in meaningful size are the most liquid, which, for the time being anyway, are those least likely to contribute to client objectives. The types of exciting opportunities available to us now include owning ships, energy storage and digital infrastructure among others – all of which offer meaningful diversification benefits not available to larger multi-asset investors, and cannot be owned in open-ended funds.

Hence, one of the key messages from our roadshow was that if a multi-asset investor wants to maximise their chance of meeting the client objective, knowledge of investment trusts is essential. This is especially true given our view that liquid fixed income cannot play the equity-diversifying role it has historically. The investment trust universe is replete with better diversifiers, with low economic sensitivity and crucially, far higher return expectations.

All too often, investment management firms forget that investing is about the minimum objective of growing wealth after the impact of inflation, taxes and charges. Bonds are talked about as diversifiers to equities. But with c. 60% of the global fixed income market yielding less than 1%, how on earth will this help grow investors’ wealth once we account for inflation and charges – let alone the significant chance of permanent losses.

Next week I hand over the roadshow baton to Ben Mackie, who will be hitching up our West Country horse and cart and touring Scotland (Glasgow, Falkirk and Aberdeen). If you are in the region and want to see him, please give us a shout.

Ben Conway – Head of Fund Management

This financial promotion is issued by Hawksmoor Fund Managers which is a trading name of Hawksmoor Investment Management (“Hawksmoor”). Hawksmoor is authorised and regulated by the Financial Conduct Authority. Hawksmoor’s registered office is 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. Company Number: 6307442. This document does not constitute an offer or invitation to any person, nor should its content be interpreted as investment or tax advice for which you should consult your financial adviser and/or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. Any opinion expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represents the views of Hawksmoor at the time of preparation and may be subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested.