January 2018

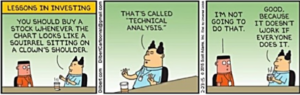

The cartoon here is a gentle dig at the use of technical analysis (the practice of using historic information on price and volume to predict future returns) to make investment decisions. While this quarter’s thought piece is not intended to debate the merits of technical analysis, people who know us well will be aware that we do not use it to make investment decisions ourselves. Our conviction lies in trying to ensure that every asset in which we invest (via investment trusts and open-ended funds) is cheap at the time of purchase. By ‘cheap’ we mean that it possesses a margin of safety because its purchase price does not adequately reflect the likely prospects for the asset’s fundamentals. Moreover, we like to invest with managers who share our own philosophy and we are thus wary of any fund manager who relies too heavily on the reading of charts to make purchase or sale decisions over and above fundamental analysis.

So why have we just initiated small starter positions in two ‘Managed Futures’ funds within our Vanbrugh Fund? The cognoscenti will know that this subset of funds attempt to profit from the identification of trends in prices across many asset classes over various time horizons as long as those trends persist. As soon as the trend is broken, such funds are guaranteed to lose money from the part of the portfolio following that particular trend until the sophisticated models behind them tell the managers to close the position and wait for a new trend to emerge. At no point do fundamentals come into the analysis. In other words, at first glance investing in a Managed Futures fund is a clear divergence from our investment process.

The decision to invest in Managed Futures comes at the end of a long process of seeking to further efficiently diversify the portfolio – after a long period during which we have attempted to reduce risk via several other avenues. These have included lowering the exposure to certain types of investment trusts (e.g. those that deploy a lot of leverage), investing in gold (via funds investing in gold equities) and select absolute returns funds, and minimising exposure to long dated bonds. Traditionally long dated bonds have provided multi-asset portfolio managers with the means to diversify the portfolio away from equities. However a long period of loose monetary policy, and the recent years of quantitative easing, have seen the yields on bonds fall perilously low. These assets offer no margin of safety and render them abnormally expensive at a time when equities are similarly over-valued, thus undermining their use as portfolio diversifiers. Illustrating the extraordinary environment for fixed income assets, investors were very recently offered the opportunity to lend £250m to the University of Oxford for 100 years at an interest rate of just 2.5%. Even more surprising was that demand for the bonds amounted to nearly £3bn and the University graciously agreed to borrow a further £500m, taking in £750m.

As we stated in the thought piece written for the 2nd quarter of 2017, for all our desire to achieve efficient diversification, our Funds of funds are not absolute return funds. Our process should generate good risk-adjusted returns through the cycle, with an emphasis on capital preservation – but we cannot guarantee we can control short-term volatility. Indeed, one of our great strengths – the use of investment trusts to access less liquid asset classes that cannot (or should not) be accessed via open-ended funds – is also a source of weakness (albeit temporary) in bear markets. Investment trusts can act like equities for short spaces of time. This can be true even for those trusts that hold less risky assets such as in-demand physical property let to a high quality tenant or secured loans to high quality borrowers. Prices of investment trusts can fluctuate – sometimes quite wildly in extreme market conditions – resulting in the opening up of discounts to the net asset value of trusts’ portfolios. On the one hand, this is an excellent buying opportunity for investors like us, but the fact remains that Vanbrugh has a significant allocation (29%) to investment trusts and we were cognisant of the potential volatility that might result.

We believe Managed Futures funds can help protect Vanbrugh’s portfolio from these price fluctuations – not just in the investment trust part of the portfolio, but across the other holdings that might be uncomfortably, albeit temporarily, highly correlated to falling equities at the beginning of a significant market correction. Before alighting on Managed Futures funds, we considered a whole host of investment strategies. For example, our thought piece in Q2 alluded to the eye-watering cost of portfolio insurance via ownership of put options currently. We also considered strategies that fund management groups market under the banner “liquid alternatives” – such as merger arbitrage, volatility arbitrage, convertible arbitrage, and relative value long-short funds. Eventually we chose Managed Futures for their ability to make strong positive absolute returns during long bear markets. Very few funds or strategies can achieve that. Managed Futures funds unemotionally (by definition they are unemotional since they deploy systematic analysis of trends by computers) detect a trend – even if that is down – and lock on it.

We are very aware of these funds’ limitations. At turning points in markets, they are likely to perform poorly temporarily and they can be very volatile themselves. Their drawdowns can be substantial – but crucially should occur at a time when the rest of the holdings in Vanbrugh’s portfolio are not also seeing large drawdowns. Our initial position across two holdings totals less than 1%, although we are likely to increase this gradually. We have invested with one of the world’s leading Managed Futures fund providers based in the US and another much smaller fund run by a UK boutique, to whose manager we have excellent access. Both run different strategies that are themselves uncorrelated but both should perform well during a persistent market correction without costing us much while we wait.

We have chosen not to introduce Managed Futures funds to our Distribution Fund, in which we already own a gold equities fund. To introduce further positions designed to protect capital in the event of a prolonged market down-turn would risk deviating too far from the Fund’s key objective of providing an above average level of income to its investors. Indeed, we have always been at pains to point out that meeting this objective typically involves taking a higher level of risk through a market cycle than we would take within Vanbrugh’s portfolio.

To conclude, there is no magic bullet to the problem of adequately diversifying your portfolio so it performs well in 100% of market outcomes. In the current environment, with valuations of liquid risk assets so rich and with so many investors wishing to insure their portfolios against market falls, the cost of instruments normally used to provide this protection is so high that it would strip any portfolio of its gains during normal market conditions. Nonetheless, we have sought by introducing an allocation to Managed Futures to improve the diversification of Vanbrugh’s portfolio, and increase its resilience in the event of a sustained downturn in financial markets. As such, we believe the introduction of Managed Futures funds will further improve Vanbrugh’s risk-adjusted returns through the market cycle.

Ben Conway – Senior Fund Manager

This financial promotion is issued by Hawksmoor Fund Managers which is a trading name of Hawksmoor Investment Management (“Hawksmoor”). Hawksmoor is authorised and regulated by the Financial Conduct Authority. Hawksmoor’s registered office is 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. Company Number: 6307442. This document does not constitute an offer or invitation to any person, nor should its content be interpreted as investment or tax advice for which you should consult your financial adviser and/or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. Any opinion expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represents the views of Hawksmoor at the time of preparation. They are subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. HA2219.