6th October 2023

What should be disclosed as a product cost when someone is investing in something?

Apologies in advance for what might come across as a dry subject for this blog, but this is such an important subject, and we feel that it’s vital you are armed with the arguments.

Investors / consumers need to know how much they will pay each year to the firm managing their investment. With an investment fund, that means how much of the value of their investment they hold is going to be paid to someone else to manage this for them, which they would not have to pay if they had invested directly. Regulators are rightly concerned that the costs of managing investments are properly disclosed.

MIFID regulations, introduced in 2018, exist to protect investors / consumers by requiring firms to disclose all the costs that impact the value of the investment during the course of their investment being managed by the firm.

The key question being: “If I hold this product for one year, and the market value of its portfolio is unchanged, how much of my investment will be left?”. That figure must be disclosed and calculated in a consistent fashion across the industry.

Let’s start by quoting directly from the relevant bit of the arcana of MIFID regulations (underlining emphasis added by me):

50(2) “For ex-ante and ex-post disclosure of information on costs and charges to clients, investment firms shall aggregate the following:

(a) All costs and associated charges charged by the investment firm or other parties where the client has been directed to such other parties, for the investment service(s) and/or ancillary services provided to the client; and

(b) All costs and charges associated with the manufacturing and managing of the financial instruments.”

This underlined section is self-explanatory and perfectly reasonable.

Annex II Table 2 of the MiFID Org Regulation, reproduced in COBS 6 Annex 7 Table 2, explains in more detail the definition of “all costs and charges” under part (b) of the above. It includes the following wording (again, underlining emphasis added by me):

| Ongoing charges | All ongoing costs and charges related to the management of the financial product that are deducted from the value of the financial instrument during the investment in the financial instrument. | Management fees, service costs, swap fees, securities lending costs and taxes, financing costs. |

This means that portfolios that invest in other funds are required to aggregate those funds’ ongoing charge figures (OCF) within the single figure bundled OCF of that portfolio (whether the portfolio is itself a fund or a DFM bespoke portfolio or portfolio managed directly by a retail investor on a platform). In the wording above, the “product” is the portfolio holding the funds, and the “instrument” is the fund being invested in.

I will now explain why we feel so strongly that investment company costs do not meet the definition of an ongoing cost for the purposes of MIFID aggregation as outlined above.

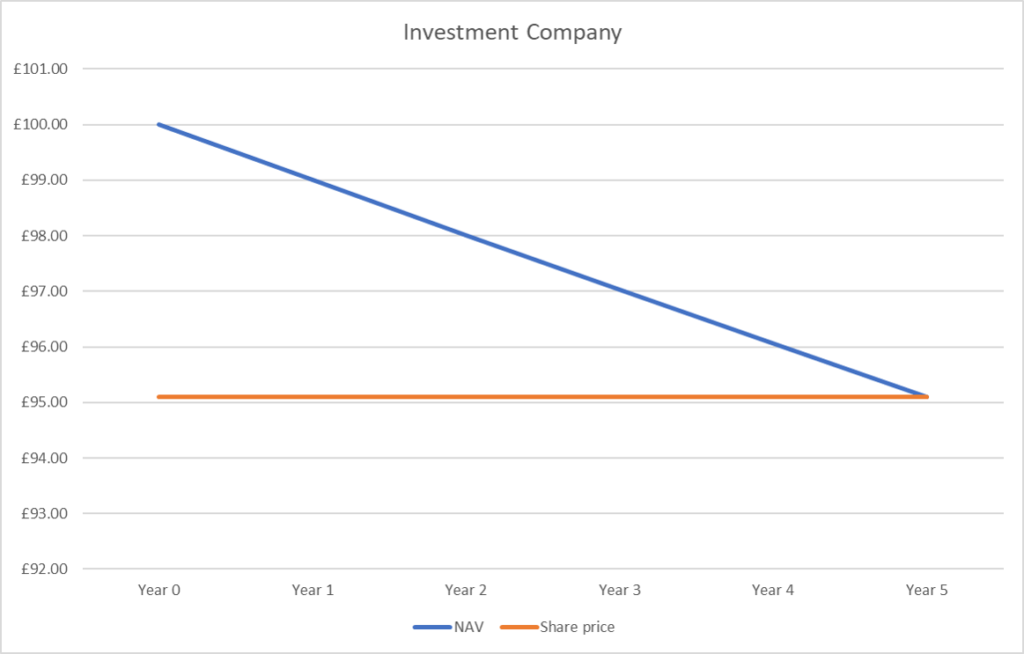

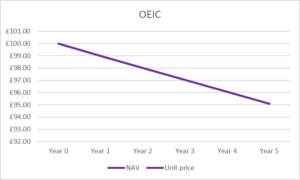

Assumptions: interest rates are zero, inflation is zero and the yield curve is flat at 0%. Two funds, both invest only in cash. One fund is an open-ended investment company (“OEIC”) whose ongoing charges are 1% and the other is a closed-ended investment company (“Investment Company”) whose ongoing charges are also 1%. The Investment Company has 5 years left to run. “Year 0” is the point of purchase. I have used this example because the market value of the assets being held will remain unchanged. Here is why the investment company cost should not be aggregated for cost disclosure purposes:

The investment company is listed, with a share price as well as a NAV/share. Stock markets enable foreseeable costs to be fully accounted for (or “discounted”) in the share price. Back to the MIFID definition. The “cost” (the impact on the value of the investment) in this context is zero – the share price remains the same through the period of investment. These costs have no bearing on “the value of the financial instrument during the investment in the financial instrument”. Restated, while the NAV is being impacted, the value of the financial instrument (which is a share of the investment company) is not.

With the OEIC, units are created and redeemed every day, and the investor invests at the NAV level. Each year, the value of the units (and the NAV – because they are the same thing) reduce by 1%. This is clearly a cost that has a bearing on “the value of the financial instrument during the investment in the financial instrument”. Restated, the NAV is being impacted, and the value of the financial instrument (which is a unit of the OEIC) is impacted in the same way.

Requiring the ongoing costs of investment companies to be aggregated in the product costs of portfolios that hold them thus amounts to the double-counting of those costs.

To be absolutely clear, saying that investment company costs do not meet the MIFID definition of costs does not mean we do not want to see full transparency and full disclosure of costs. Ultimately these are costs that are borne by the investor.

Prior to 2018, investment companies were not required to disclose ongoing costs expressed as a percentage of NAV (as they are in the PRIIPs KID). Additionally, these costs were not required to be aggregated in the cost figures of portfolios that held them. However, they were, of course, subject to UK Listing rules and had to publish reports and accounts (which was the case for the preceding 148-ish years) – common with listed commercial companies. We believe the regulator is absolutely right to want to see increased transparency from the pre-2018 position because investment companies have idiosyncratic characteristics, which make them akin to open-ended funds in some respects.

Hence, we’d like to see the calculation of ongoing costs for investment companies codified (e.g. along the lines of the Association of Investment Companies existing guidance on an appropriate methodology) and these costs expressed as a percentage of NAV regulated and mandated to be published in a readily available place – e.g. the factsheet.

In fact, we see the potential for the factsheet to become the go-to disclosure document for UK-listed investment companies and be of far more use and relevance for retail investors than PRIIPs Key Investor Documents (KID) currently are. In addition to ongoing cost disclosure, we could see other templated and regulated information requirements depending on the nature of the investment company’s activities. With PRIIPs being revoked, and with the KID disappearing, there is a fantastic opportunity to elevate the factsheet to an even more important document with regulatory gravitas. This would arguably increase transparency and make cost disclosure far less misleading and confusing.

In summary, we would like to mandate all investment companies to disclose an ongoing cost figure, expressed as a percentage of NAV, using the AIC’s guidelines on calculating this figure. This could be published in a readily available document (e.g., the factsheet). Meanwhile, we would like it accepted that these costs do not meet the MIFID definition of costs for the purposes of aggregation in cost figures of portfolios that hold them.

In short: disclose. Don’t Double Count.

This forms the basis of our campaign alongside other passionate investment company stakeholders including shareholders, investment advisers, directors, brokers, and industry bodies, politicians and parliamentarians.

Ben Conway – Head of Fund Management

For professional advisers only. This article is issued by Hawksmoor Fund Managers which is a trading name of Hawksmoor Investment Management (“Hawksmoor”). Hawksmoor is authorised and regulated by the Financial Conduct Authority. Hawksmoor’s registered office is 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. Company Number: 6307442. This document does not constitute an offer or invitation to any person, nor should its content be interpreted as investment or tax advice for which you should consult your financial adviser and/or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. Any opinion expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represents the views of Hawksmoor at the time of preparation and may be subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. FPC1259.