April 2020

Due to the current coronavirus pandemic we now find ourselves in a truly unprecedented environment involving a near-complete shutdown of many large economies across the world. This has had a severe impact on financial assets, and we discussed this in detail in our last quarterly commentary.

Our Distribution Fund seeks to generate an attractive total return with a risk profile between that of our Vanbrugh and Global Opportunities Funds, whilst providing a level of income above a composite index of financial assets. In this note we would like to specifically address the impact of the coronavirus on the Distribution Fund’s income.

Many companies have recently announced either cancellations or deferral of dividend payments, some landlords are no longer receiving rent and some debt obligations are in danger of not being serviced. All of which adds up to understandable anxiety for our investors – many of whom may rely on the income our Distribution Fund generates.

We would like to reassure investors in our Distribution Fund that our high level of diversification works in our favour when it comes to continued generation of income. We attempt below to deliver some guidance as to what to expect in terms of income from the Fund over the coming months.

What is the payment schedule?

As a reminder, the Distribution Fund generates four quarterly income payments, with payment dates on 31st March, 30th June, 30th September, 31st December. The corresponding “ex-dividend” dates are 1st February, 1st May, 1st August and 1st November. This means that the 31st March payment reflects income accrued to the Fund over November, December and January.

The Fund receives income from its investments at different times: some holdings pay income monthly, some quarterly, some only twice a year. This means that we collect more income in some months than others, with January, July and August being particularly fruitful months.

The payment investors received from the Fund on 31st March 2020 would have been unaffected by the coronavirus, and was a “business as usual payment”. The next payment on 30th June (ex-dividend date 1st May) will reflect the income the Fund collected in February, March and April, so will be the first to reflect recent travails.

What are our income expectations?

The huge number of (virtual) meetings we have conducted over the past few weeks has enabled us to come up with an estimate of what we think the Distribution Fund will pay over the coming quarters. We must stress that we cannot give you full certainty over the income payments the Fund will generate – the length of the lockdowns in various countries remains unknown and it is still too early to truly know the long-term impact on economies and businesses.

Having spoken to many fund managers and conducted hundreds of hours of due diligence, we now have a good idea of what income our Fund will generate from April through to June. In order to be conservative (but not unrealistically so), we have projected the assumed haircuts to dividend payments until Q1 2021 – so we can give you a projected yield for a full year, starting 1st April.

The headline is that we expect the Distribution Fund to produce a yield of 3.95% over the next 12 months (c. 25% lower than it might ordinarily be). Note that the 30th June payment is always a lower payment than other quarters, so do not be alarmed if the “run rate” at this point looks low. We have also modelled our projected income on a month by month basis if you need that level of detail (please get in touch if you do).

For the sake of absolute transparency, we would be very happy to run you through our assumptions on the haircuts we have applied to our holdings’ income generation, but generally speaking here are the types of cuts we have assumed for the next 12 months of dividends:

- 50% for equity income funds, particularly those investing in the UK

- 25-30% for equity income funds with a bias to certain sectors and/or that generate some income from call-overwriting

- Varying amounts for investment trust holdings (e.g. some trusts have revenue reserves, others are Real Estate Investment Trusts whose rental income may be largely unaffected)

- Smaller amounts for funds invested in corporate bonds

- No reductions in dividends for funds holding assets that should be immune (e.g. song royalties)

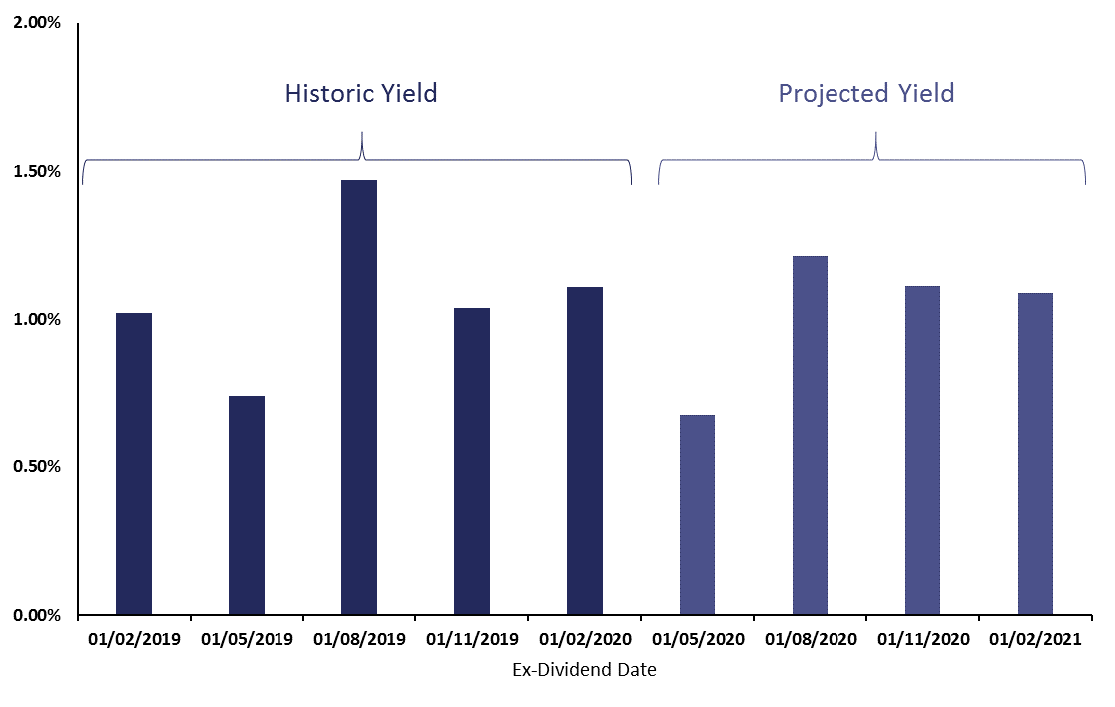

The chart below shows the historic yield on the Fund by quarter and the projected yield by quarter, using the unit price at the 31st March 2020 and the projected income payments using our assumptions.

Source: Internal. 01/02/2019 to 01/02/2021. C Inc units.

How are we protecting the Fund’s income?

We have been able to protect the Fund’s income profile to a large degree by taking several measures which include:

- Increasing credit exposure. Corporate management are clearly prioritising bond holders over shareholders – cutting dividends to make sure they can meet coupon payments

- Increasing exposure to equity funds that write call options – that is those that sell call options on their underlying holdings. This generates extra income from the option premia received, as it is independent of whether the underlying company ceases paying dividends

- Maintaining high exposure to REITs. These have to pay out 90% of their earnings to shareholders and many of those we own are relatively immune from the current coronavirus-generated economic headwinds

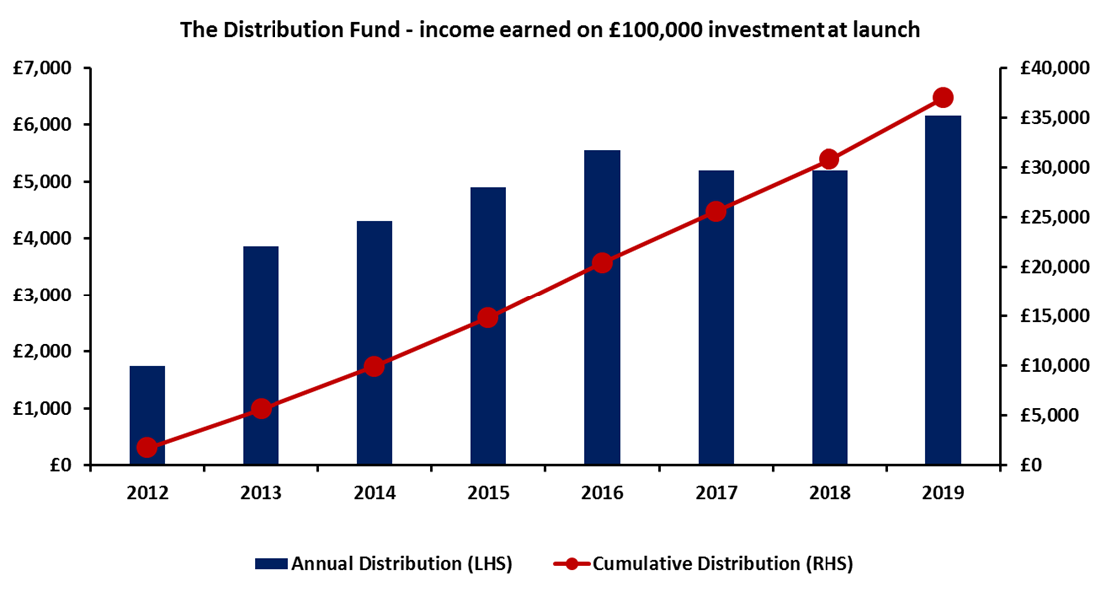

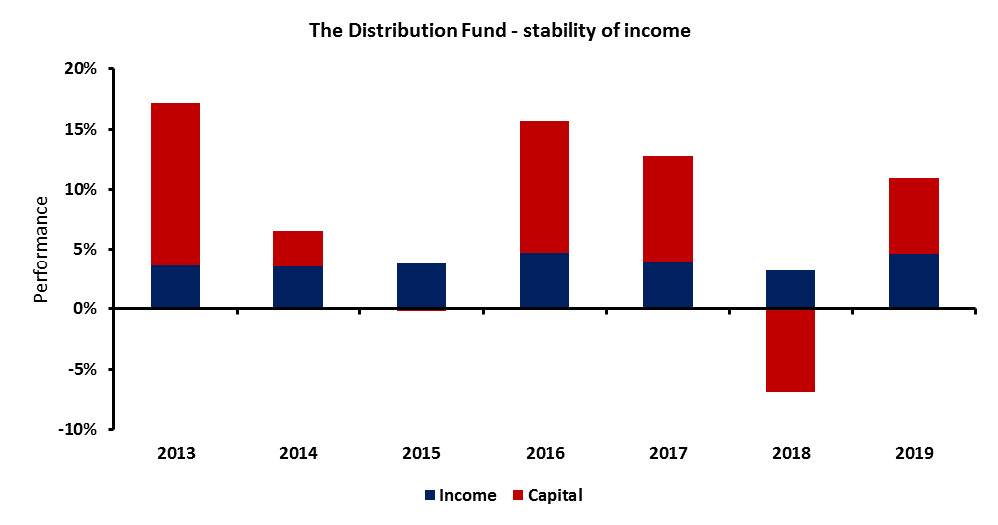

Our Distribution Fund celebrates its 8th birthday this week. Since launch it has achieved a strong record of delivering a high and consistent level of income:

Source: Internal. 13/04/2012 to 31/12/2019. C Inc units.

Source: FE Analytics GBP C Inc. Annual from 31/12/2012 to 31/12/2019.

We understand that you are going through enough stress at the moment without income generation being a contributing factor. Although we will not be able to match previous levels of income we hope that this note goes some way to reassuring you that the next twelve months will still see a healthy level of distributions. If we can be of further assistance, please do not hesitate to get in touch.

This financial promotion is issued by Hawksmoor Fund Managers which is a trading name of Hawksmoor Investment Management (“Hawksmoor”). Hawksmoor is authorised and regulated by the Financial Conduct Authority. Hawksmoor’s registered office is 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. Company Number: 6307442. This document does not constitute an offer or invitation to any person, nor should its content be interpreted as investment or tax advice for which you should consult your financial adviser and/or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. Any opinion expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represents the views of Hawksmoor at the time of preparation and may be subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. HA3785.