September 2023

With the latest rates available on easy-access cash ISAs being more than 4%, we have heard from several IFAs that they have been getting questions from their clients along the lines of ‘why should I bother investing when I can now get an attractive return on cash for the first time in over a decade?’

This is an excellent question. Obviously, we are not financial advisers and don’t pretend to be. We don’t know underlying clients’ individual circumstances that will influence how appropriate or not cash is for them. Instead, we will frame the answer to the question from our perspective as fund managers and the objectives of the funds that we are aiming to achieve namely, at the most basic level delivering a positive return after the impact of inflation and charges over 3–5-year periods.

We are very confident in being able to deliver post-charges inflation busting returns over the next 3-5 years for our investors across the funds, and by extension are also very confident of beating the returns that cash accounts offer. Below we explain some of the reasons why.

Why are we excited about our funds’ return prospects compared to cash?

1. Actively managed credit funds offer superior return prospects to cash.

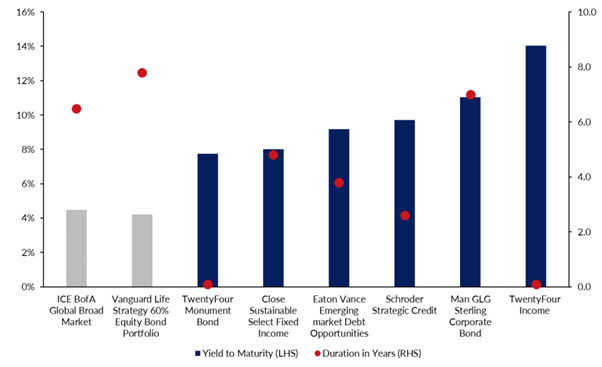

The below chart shows the yield to maturity for a range of actively managed credit funds and their duration (interest rate sensitivity) compared with the yield available on the Northern Trust Sterling Fund (a money market fund in which the cash balances in our Funds are parked). The most powerful explanatory factor of future bond returns is starting yields which are higher today than they have been in many years.

We can invest in high quality, actively managed funds offering annual return prospects in many cases double (or more) the current cash yield. We don’t need to take excessive credit or interest rate risk to do this: TwentyFour Monument Bond is AA- rated (same credit rating as the UK government!) with effectively no interest rate risk; Man GLG Sterling Corporate Bond and Artemis Corporate Bond are BBB rated (investment grade) with 6-7 years duration; Schroder Strategic Credit and Man GLG High Yield Opportunities are BB rated (just below investment grade) with around 3 years duration.

Source: Fund Factsheets and ICE, 30/09/2023.

The high starting yields offer a big margin of safety over the return that cash offers, meaning that even if there are some credit defaults in the funds we are confident that the returns will comfortably beat cash. The exposure to fixed income in our Funds has increased materially in the past year, reflecting the much-improved opportunity set.

2. Attractively valued equities offer excellent long-term return prospects.

We have crunched some numbers using data provided by broker Liberum looking at starting equity valuations and subsequent average nominal (not adjusted for inflation) annualised returns (over 3, 5, and 10 years) from the UK equity market, shown in the chart below.

Source: Liberum. Data from 1927-2023

Currently, the UK equity market is trading on a price-to-earnings multiple of around 10x. The average annualised return over subsequent 3, 5, and 10 years from that starting point has been 10-15% a year, between double and triple the current annual yield available on cash. We are investing in actively managed funds with valuations materially below that of the wider market, and are even more confident in return prospects as a result.

It is worth stressing that past performance isn’t a guide to future performance, and the above is showing the average annualised subsequent return around which there has been wide divergence.

Alongside attractively valued UK equities, our portfolios also provide exposure to attractively valued Japanese equities that are also benefiting from improvements in corporate governance, Asian equity portfolios at or close to all time low valuations offering attractive starting dividend yields of 4-6%, long term growth opportunities through private equity, Indian equities and thematic equities including insurance.

3. Selective opportunities in investment trusts and alternatives

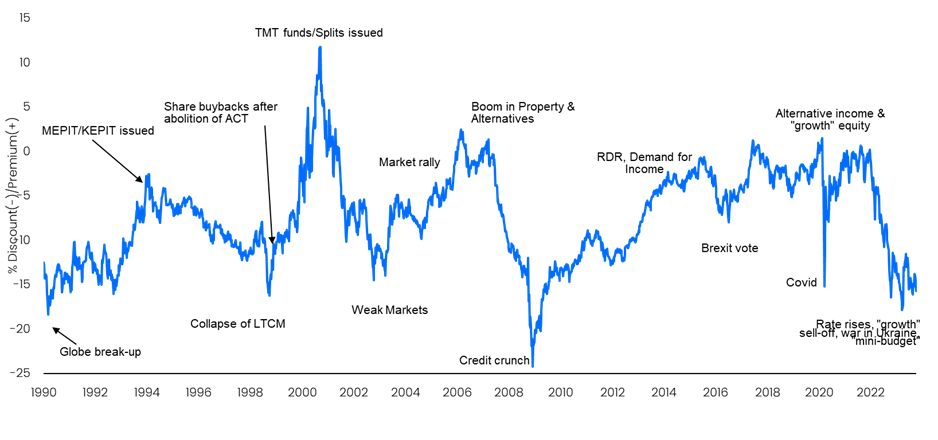

The past 12 months has been a torrid period for the investment trust sector for a variety of reasons, with headwinds ranging from the great repricing of fixed income, a change in cost disclosure rules, and consolidation within the wealth management industry which is forcing some divestment of less liquid investment trusts.

The below chart shows how the average discount of the investment trust universe is close to it’s widest in over 33 years of data, surpassed only by the trough during the great financial crisis.

Source: Numis, October 2023

This has created some excellent opportunities that we are able to exploit. We have exposure to investment trusts with attractive net asset values that are trading on wide discounts, and where there are near term catalysts for value realisation. The average discount of the investment trust universe is around -17%, but the weighted average discount of the investment trusts in our three funds is significantly wider at -29% for Vanbrugh, -31% for Distribution, and -29% for Global Opportunities. It is worth saying that the absolute level of exposure to investment trusts within our funds is lower than historic average at 23%, 25% and 32% respectively, in part due to the very targeted nature of our exposure and the extreme value elsewhere meaning we are not reliant on discounts to narrow for the Funds’ performance to improve.

We have stepped up our engagement with investment trust boards to ensure that shareholders best interests are being acted on and are confident in the discount narrowing opportunities for several of our trusts over the next 3-5 years as many approach continuation votes that could see them wound up and cash returned to shareholders at NAV less costs.

4. Investors in the Funds are paid to wait for the capital performance to improve.

The distribution yields on all three Funds are close to all-time highs. Vanbrugh is yielding over 3.5% and Global Opportunities over 2% despite neither being income focused. Distribution’s prospective yield is over 4.5% so over the course of the next year investors should receive a similar yield to cash while also accessing a portfolio that we believe has significant potential to deliver attractive capital growth over the medium term.

The dangers of putting all your eggs in the cash basket

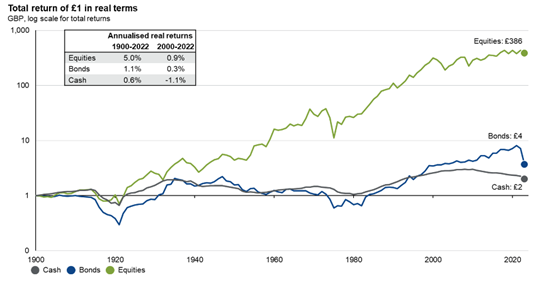

Returns on cash have risen rapidly over the past 12 months as the Bank of England has raised interest rates numerous times to combat multi-decade high inflation rates. However, the return from cash accounts remains below inflation and is eroding capital in real terms.

Should inflation finally get under control and come back down towards the BoE target of 2%, then the BoE is likely to start cutting interest rates at which point the return on cash accounts will fall and may continue to be below inflation.

Falling interest rates would be a positive environment for owning assets with duration (interest rate sensitivity) such as corporate or government bonds or riskier assets like equities, which tend to benefit when interest rates fall (prices rise). An investor in cash would miss out on these returns, at the same time as the return they are getting on cash is falling.

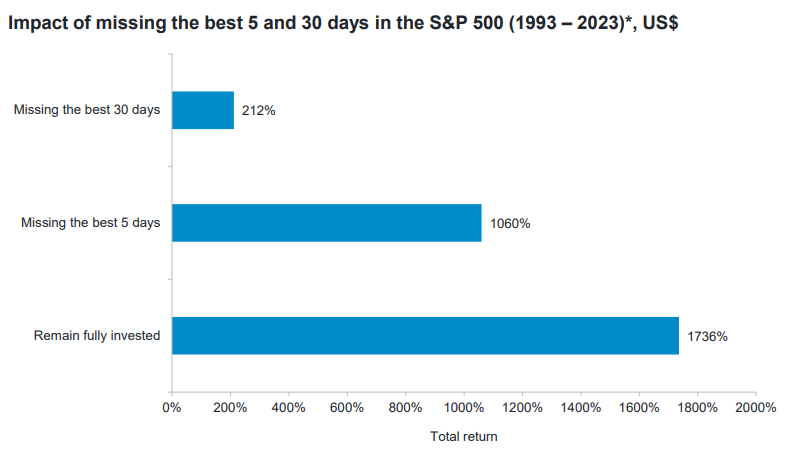

Finally, we would remind long terms savers and investors of the old adage “it’s about time in the market, not timing the market”.

Source: Fidelity International, March 2023. *Total return data from 31/12/1992-16/08/2023.

Yes, financial markets might experience volatility and drawdowns in the year ahead, but history shows us that over any reasonable timeframe, assets like equities and bonds deliver superior real returns versus cash. There might be a few crystal ball owning individuals out there who manage to call the top of the market perfectly, move into cash and then reinvest at the bottom but if they do exist, we’re yet to meet them. The future is inherently unpredictable after all. The empirical evidence detailed in the charts below highlights the return damaging dangers of employing this sort of timing strategy and more importantly illustrate the merits of staying invested. For those with an appropriate time horizon this investment principle carries weight at the best of times, but is particularly true today and with regards to the Hawksmoor Funds given the compelling value that currently exists within our portfolios.

Source: JPM Guide to the Markets 30/09/2023.

Dan Cartridge – Assistant Fund Manager

This financial promotion is issued by Hawksmoor Fund Managers which is a trading name of Hawksmoor Investment Management (“Hawksmoor”). Hawksmoor is authorised and regulated by the Financial Conduct Authority. Hawksmoor’s registered office is 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. Company Number: 6307442. This document does not constitute an offer or invitation to any person, nor should its content be interpreted as investment or tax advice for which you should consult your financial adviser and/or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. Any opinion expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represents the views of Hawksmoor at the time of preparation and may be subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. FPC1215.