25th June 2021

What’s the opposite of clickbait? Answer: writing a blog that argues US equities are expensive.

Telling investors that the world’s best performing major equity market of the last decade is expensive will probably lead to yawns, eyes glazing over and utterances of “broken records” and “stopped clocks”.

So, while I am about to tell you why we don’t own any US-dedicated equity exposure, what I won’t say is that every single US stock is expensive. Indeed, 4% of Vanbrugh, 4% of Distribution and a positively lofty 8% of Global Opportunities (our 3 multi-asset funds) are invested in US equities. We do like certain areas, like healthcare and insurance, which we access via specialist funds invested only in those sectors. With many companies in these sectors happening to be listed in the US, we do inevitably get some US equities exposure.

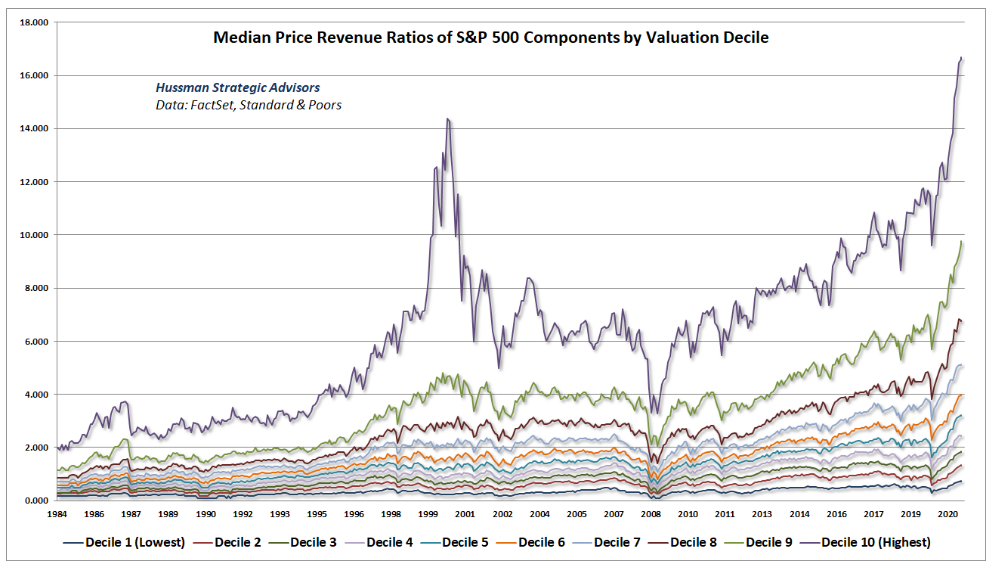

BUT, I have to show you this chart. It is reproduced by kind permission of John Hussman (whose “Market Comments” are great reads – see www.hussmanfunds.com). John and his colleagues use available data on the US equities market to analyse valuation better than anyone we have come across. The following chart shows you the price to sales ratio of the each decile of the S&P 500 going back to 1984.

Source: John P. Hussman, Hussman Investment Trust.

The deciles are ordered by valuation. Decile 10 the most expensive cohort, Decile 1 the least. By this measure, every single cohort of stocks in the US, no matter how cheap they are relative to the market today, is trading well above previous historic highs – even the dotcom bubble. This really is extraordinary and we make no apologies for being extremely wary as a result. At the heart of our process is a focus on absolute valuation – not relative. Not only is the US expensive relative to other markets, but expensive relative to its own history too.

There are well-made arguments to attempt to justify this. For a start, this measure considers price to sales, and not price to earnings. Thus price to sales can be historically high but price to earnings doesn’t have to be if profit margins are higher. One could appeal to quality of earnings, or the remarkable market position of American companies. But the beauty of a price to sales ratio is that it is very hard to manipulate. Earnings can be manipulated higher with clever accounting tricks (not expensing options compensation to employees is a classic one), or the accounting of costs as extraordinary or one-off, or many other methods. Revenues can admittedly be manipulated higher it is true, but it is much harder to do so consistently. John Hussman’s work also looks at other measures of valuation that account for various anomalies and it won’t surprise you to learn that these measures give a similar picture.

So next time you are confronted with someone selling you a fund with a high exposure to US stocks, I’d urge you to pause and remember this one chart. It is true; great companies can be expensive and still perform well – over a long enough time horizon. However, in the interim, that level of valuation is a very difficult headwind to fight against. We have no problem with funds with high exposure to US equities if the following conditions are met:

- the managers recognise the high valuation;

- the managers recognise that this high valuation may result in a period of potentially steep price falls – even if the quality of the companies in the portfolio mean that eventually (e.g after many years) prices will recover.

Our skillset lies in identifying assets with a margin of safety. With a few exceptions, US equities lack that margin of safety and this explains our continued low exposure. We have a process guided strongly by valuation and we stick to it.

Ben Conway – Head of Fund Management

This financial promotion is issued by Hawksmoor Fund Managers which is a trading name of Hawksmoor Investment Management (“Hawksmoor”). Hawksmoor is authorised and regulated by the Financial Conduct Authority. Hawksmoor’s registered office is 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. Company Number: 6307442. This document does not constitute an offer or invitation to any person, nor should its content be interpreted as investment or tax advice for which you should consult your financial adviser and/or accountant. The information and opinions it contains have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. Any opinion expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represents the views of Hawksmoor at the time of preparation and may be subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. HA4389.