As a team we spend most of our time looking ahead, considering the best ways of generating future returns for our investors. We also think it is dangerous to pay too much attention to short-term relative performance where overly obsessive scrutiny might impact decision making and impair our focus on delivering on the long-term objectives of the Funds. All that said, looking back can be a useful exercise where highlighting what went well, what went poorly and learning from any mistakes can augment the investment process going forward.

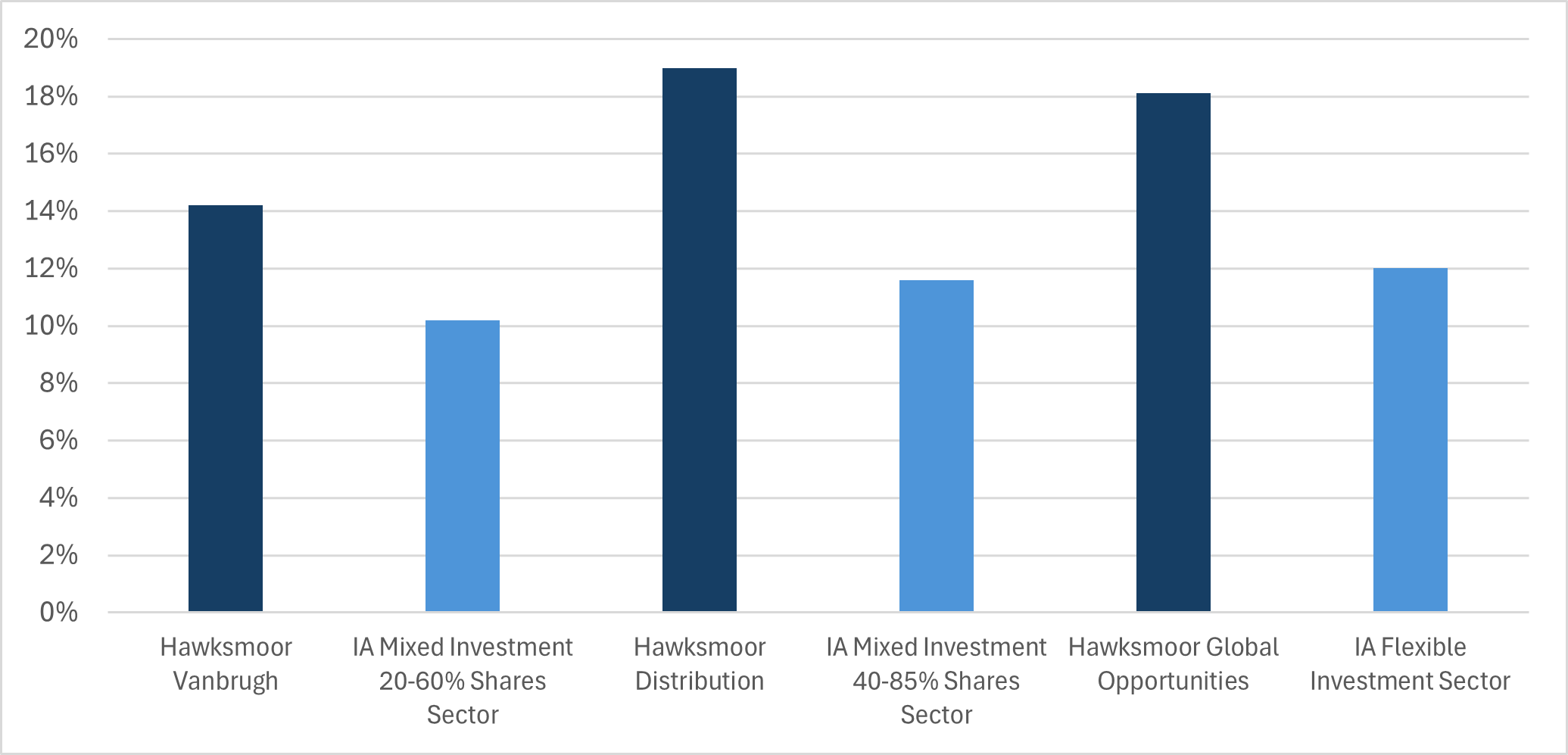

In this spirit, we review how the Hawksmoor Funds fared in 2025. Pleasingly Vanbrugh, Distribution and Global Opportunities all generated healthily positive returns of 14.2%, 19.0% and 18.1%, respectively. All 3 delivered first quartile performance and were meaningfully ahead of their respective IA sectors with Vanbrugh outperforming by 4.0%, Distribution by 7.4% and Global Opportunities by 6.1%.

Source: FE fundinfo 31/12/2024 to 31/12/2025

2025 was a strong year for equities with MSCI World +18.4%. US equities were +17.3% in local currency, but in stark contrast with recent years, lagged other major markets, a development exacerbated for sterling investors by a weaker dollar (-6.9%). Looking further under the bonnet, small caps lagged pretty much everywhere (other than Japan), extending what was already an unusually protracted period of underperformance. Value was the place to be in Europe, Japan and the UK, but yet again trailed in the US where the mega-cap growth stocks and AI narrative continued to dominate. The period ended with increasing concerns regarding a potential AI bubble with heady valuations, heavy capex and circular financing arrangements the focus of investor concerns.

In fixed income, government bonds eked out positive total returns with coupons complimented in most jurisdictions by gently lower yields. Japan was the notable outlier with a return to inflation driving a sharp increase in the 10-year yield to multi-decade highs. Curves steepened across developed markets with rate cuts dampening the short end lower and concerns regarding fiscal largesse pressuring the long end higher. Investment grade credit (+6.2%) and high yield (+8.1%) outperformed sovereigns owing to higher carry and ongoing spread compression which saw the year end with credit spreads close to historic tights.

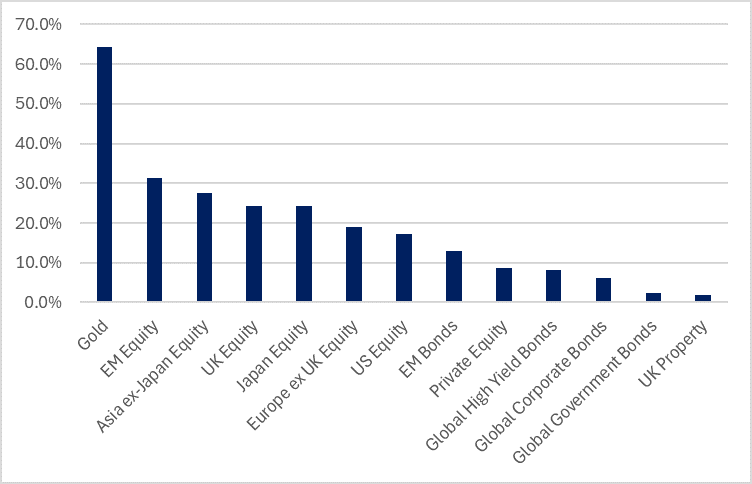

Source: FE fundinfo 31/12/2024 to 31/12/2025

The Hawksmoor Funds typically preserve capital well on the downside, so to outperform peers to the extent they did in the midst of a rampant equity bull market is unusual and warrants further scrutiny. Importantly outperformance was not driven by the portfolios taking excessive equity risk. Indeed, averaging 35% and 49% over the course of the year, Vanbrugh and Distribution’s traditional equity allocations were towards the lower end of their respective sector ranges (20-60% and 40-85%). Similarly, all 3 funds delivered outperformance whilst exhibiting lower volatility and lower drawdowns than their IA sectors, with each boasting materially superior Sharpe and Sortino ratios.

As regular readers will know, our process is completely unconstrained with fund selection and asset allocation driven by valuation and return prospects as opposed to the weights in an arbitrary benchmark. Digging into the key positive and negative drivers’ of 2025 performance illustrates this philosophy in action with the key takeaway being just how different the Hawksmoor Funds are positioned relative to more benchmark aware, traditional approaches.

Positives

- Non-US value equities: Our low allocation to US equities has been a howling headwind for a number of years, but in 2026 turned into a gentle but refreshing tailwind with the US underperforming most other major markets over the course of the year. In sterling terms Europe was +26.2%, EM +24.4% and Japan +16.0%, whilst the much-despised UK market delivered total returns of 24.2%. Cheap starting valuations, it seems, can help drive stellar returns even when sentiment and flows are at rock bottom. UK equities in particular benefited from heightened M&A and buybacks as trade buyers, private equity and the companies themselves moved to take advantage of the bargains on offer, even as domestic wealth managers continued to flee. The Funds also benefited from the bias towards value managers, a long-standing tilt in the portfolios predicated on relative valuation where the premium multiple applied to quality-growth stocks has been compressing ever since the heady and unsustainable hights hit in late 2021. AI related stocks have, of course, continued to perform well, but seem to be pricing in lots of good news and ignoring the fact that the range of probable outcomes for many of the theme’s dominant stocks is unusually wide. The moral of 2025’s story is that it was possible to make great returns without taking the valuation risk and heroic blue-sky assumptions associated with the AI trade.

- Precious metals: In a world of heightened geo-political risk, macro volatility and fiscal incontinence, gold can play a wonderful portfolio construction role, acting as a hedge in a range of scenarios, not least investor concerns around fiat debasement. Significant exposure to the complex was a major driver of Fund returns with gold bullion up 53.0% and our favoured fund of gold miners up 188.8%. Wary of any one investment becoming too big a driver of overall risk and returns, exposure was very actively managed, ensuring position sizing remains appropriate. That said, the themes supporting the spot price are well entrenched, whilst the miners still trade on pitifully low valuations suggesting there is more to play for. Judging by the flow data, Western investors remain on the sidelines, suggesting few signs of irrational exuberance.

- Investment trust special situations: Wide discounts within the investment trust sector are throwing up significant opportunities for discerning investors with a willingness to pursue a more activist agenda. Whilst we’ve always communicated with investment trust Boards, 2025 was another year of significant engagement activity. The stubbornness of discounts and Boards’ increased willingness to listen to shareholders has resulted in a more conducive environment for engagement with a marked increase in buybacks (a record £9.8bn in 2025, 30% higher than 2024), tender offers, managed wind-downs and other corporate activity (a record 26 mergers, acquisitions or liquidations). The Funds benefitted from a number of takeovers in the alternative investment trust space with BBGI Infrastructure, Downing Renewables & Infrastructure Trust, Care REIT, PRS REIT and Urban Logistics all bid for in the year. The fact that most of these deals came at levels significantly above prevailing share prices highlights the value on offer in the sector. We expect more of the same in 2026.

- Core Plus infrastructure: Cordiant Digital Infrastructure (CORD) and 3i Infrastructure (3IN) were both up 22% in 2025, underpinned by strong NAV progression, and outperforming MSCI World. Looking through the lens of risk adjusted returns and considering the defensive nature of the underlying assets (low economic sensitivity, contracted revenues) and the performance looks all the more impressive. A higher interest rate environment has seen investor preferences pivot away from bond proxies to infrastructure portfolios that can deliver attractive levels of growth alongside income, with the core plus names like CORD and 3IN commanding tighter discounts than social infrastructure peers.

- Active fund selection in fixed income: Returns from fixed income indices were more subdued but still attractive in an absolute sense and relative to recent history. Fiscal worries and the prospects of yield curve steepening and tight credit spreads posed bond investors with duration risk on the one hand and credit risk on the other. Keen to guard against these twin evils, we adopted a defensive posture within the fixed income component of the portfolios, shortening duration and increasing credit quality. Despite these de-risking moves our actively managed bond funds strongly outperformed, whether that be Man Sterling Corporate Bond (+11.0%) taking advantage of valuation dispersion in credit markets, TwentyFour Income (+11.9%) harvesting the complexity premium present in securitised credit or Morgan Stanley EMD Opportunities (+15.6%) exploiting the inefficiencies of EM debt markets.

Negatives

- Shipping: Following a big positive contribution in 2024 our shipping exposure was weak in 2025 with Tufton Oceanic and Taylor Maritime down 4.5% and 10.3% respectively, driven by concerns over trade and a cyclical demand slowdown as well as US dollar weakness. Softer NAVs were exacerbated by modest discount widening. The longer-term investment case, predicated on a structural reduction in supply driving charter rates and vessel values higher over time still stands.

- Renewables: Detracted from returns with disappointing operational performance and downward NAVs compounding already poor sentiment leading to further discount widening. Below budget generation and downward adjustments to power price forecasts did most of the damage from a NAV perspective and reminded already disgruntled investors of the various moving parts and opaque nature of valuations. With many of these trusts sub-scale and trading on wide and entrenched discounts, the probability of corporate activity remains high, whilst ongoing individual asset disposals at NAV validating levels should offer some reassurance. Despite the volatility, the investment thesis of clipping double-digit dividend yields whilst we wait for sentiment to improve or more drastic solutions to emerge remains intact.

- UK small-cap equities: Have lagged large-cap peers for a number of years with 2025 extending the run of underperformance. The likes of Aberforth Smaller Companies and Teviot UK Smaller Companies delivered positive absolute returns but were 15.0% and 19.5% behind the broad (large cap) index respectively. The HFM Funds have a significant bias to smaller companies owing to relative valuation where the normal small-cap premium has evaporated. Passive flows and market structure are perhaps distorting price discovery in this less liquid part of the market and might in the shorter term dampen the valuation signal for future returns. That said, we remain confident that the small-cap factor can reassert itself at some point, particularly given elevated M&A, and believe low starting multiples at the very least, offer a considerable margin of safety.

2025 was a good year with all three funds delivering strong absolute returns whilst also materially outperforming their IA sectors. Meaningful contributions from gold miners, UK equities and specific investment trust special situations, all small components of mainstream benchmarks, resulted in differentiated performance versus passive multi-asset solutions and more index aware ones. Although 2025 is now in the past, it’s important that we learn lessons from some of the things that didn’t work. The vagaries of Renewable Infrastructure NAVs, a more granular analysis of the underlying assets within renewable portfolios, and how that makeup might impact disposals and corporate activity, probably being top of the list.

2026 Outlook

It might seem odd being bullish when there is plenty of press coverage of AI bubbles, fiscal largesse, sluggish economic growth, stubborn inflation and geopolitical risks. If we only invested in global market-cap weighted equities or global government bonds and corporate bonds from the largest issuers (as many passive multi-asset investors do), then we might be more concerned. But we are truly multi-asset investors with loads of attractively valued areas in which to invest. This point was made recently by the excellent Ben Inker at GMO in his 4Q 2025 Quarterly Letter (link here). Inker compares the current AI bubble (and he believes it is a bubble) to the 2000 Internet Bubble observing that they are both very narrow in their respective areas of overvaluation. This contrasts with the much broader bubbles of the Great Financial Crisis in 2008 and the Everything Bubble in 2021; when they burst there were few places to hide. The structure of today’s market with lots of passive flows funnelling capital into a very concentrated area of global equities (mega cap US tech companies) is leaving plenty for agnostic investors to invest in that should still generate attractive total returns whether the AI bubble bursts or not. That is exactly how we are investing with very low allocations to US equities and zero exposure to the so-called Magnificent 7 stocks in Vanbrugh and Distribution (we just have the BlueBox Global Technology fund in Global Opportunities).

Actively managed funds investing in equity markets outside the US remain good value even though they have rerated from a low base a year ago. The precious metals sector has been a very big contributor to our returns in 2025, but we believe the conditions that led to last year’s stellar returns are still in place today and we remain exposed. In fixed income, even though credit spreads across the asset class are at or near record tight levels, the all-in yields are attractive and imply a likelihood of positive prospective total returns, especially for actively managed funds able to invest beyond the mainstream (see link here to Dan’s recent ‘Spread ‘em’ crescendo). In addition, while government bond yield curves could steepen further to reflect the market’s concerns over the lack of fiscal prudence in the largest economies, ‘risk free’ yields at the short end are high enough to offer diversification benefits for the first time in ages.

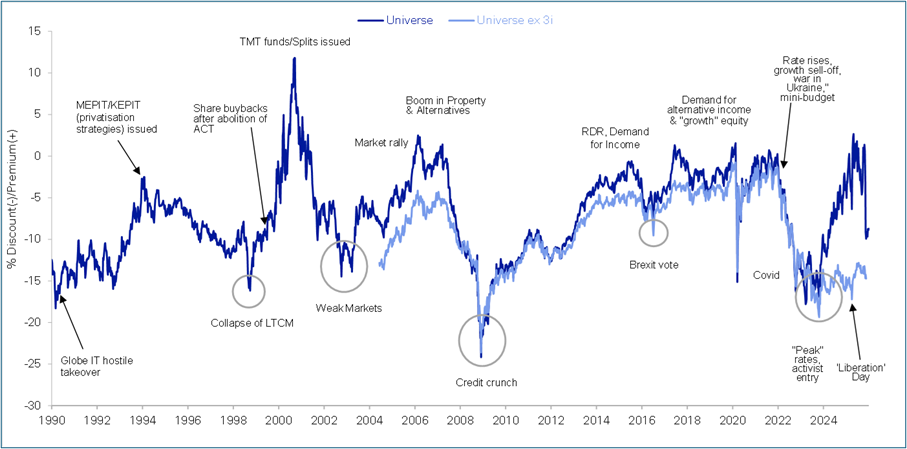

And then we have the investment trust sector where we believe we are on the cusp of some great returns as the headwinds of the past few years ease. The discount for the sector as a whole (ex 3i) has remained at the current c.15% level for the last 3 years, the longest period it has remained this wide, disproving those who view the sector’s malaise as cyclical.

Source: DB Numis 31/12/2025

There are plenty of reasons for optimism. Chief among them is the news that investment trusts are no longer subject to the erroneous aggregation of their expenses that we hope will bring large swathes of the investment community back to the sector. Alternative asset classes like private equity and parts of the infrastructure sector are priced very attractively at the current wide discounts but look even more attractive now that they don’t incorrectly inflate the ongoing costs of the funds that own them. We hope some new buyers will come in and increase the demand side of the equation and we expect more self-help initiatives to resolve the oversupply. Last year saw plenty of corporate activity that we think is merely a springboard for an M&A boom in the coming year(s).

Last year’s M&A in the conventional trusts was mostly uncontroversial. As recently introduced conditional tenders, continuation votes and exit opportunities start appearing on the horizon, discounts should narrow and the weakest will naturally fall by the wayside bringing supply and demand into equilibrium at tighter discounts. On top of that we have activists with increasing ownership on many shareholder registers that will not be shy in recommending drastic action.

However, the alternative space still needs a lot of attention and should keep the various corporate finance teams very busy over the next year. Although the HICL and TRIG merger didn’t succeed, that alone shouldn’t dissuade other boards from doing deals provided lessons have been learned from that episode. As we said previously, both these boards were well-meaning and looking to find a solution to meet the needs of today’s largest investors who demand scale and liquidity. Investment trusts must ensure relevancy alongside LTAFs and other semi-liquid private funds that are able to receive large inflows (even if they can’t guarantee a full exit quickly). While HICL’s proposed mandate drift into renewables was a huge stumbling block, and HICL shareholders understandably blocked the deal, we think everyone needs to be more open-minded and imaginative when it comes to potential corporate transactions, especially in the renewable infrastructure sector where there are too many similar and sub-scale trusts. Ultimately shareholders must not let perfect be the enemy of good.

Shonil Chande at Panmure Liberum has written a tremendous and very in-depth research note (tome) on the renewables sector that we managed to read during the quieter days of the Christmas period. He makes some very good points about why the sector is unloved (too many moving parts, inconsistent reporting, government intervention and poor disclosure) and what boards and managers could and should do to help investors get comfortable with the sector again. Like us, he believes the sector needs to move on from being regarded as a pure bond proxy given the recent record of NAV and dividend cover erosion and be allowed to reinvest in certain projects that will generate NAV growth. Such a transition will likely require a dividend cut and/or an adoption of a new strategy such as a broader investment mandate that might be painful for the shares in the short term and therefore will need very understanding shareholders to succeed. Given the current discounts, high yields and scope for more corporate activity, and maybe lower interest rates, we find it hard to envisage the sector trading on a wider discount this time next year.

Our resolute focus is now on how we generate returns in the years ahead. Investing is the race that is never won and it’s important that we always think about the journey of the next new investor in our Funds. Pleasingly, despite the recent strong performance of the funds with their unit prices hitting all-time highs in December, we still believe the portfolios to be brimming with value.

The Hawksmoor Fund Managers Team

Jan 2026

This document is issued by Hawksmoor Fund Managers which is a trading name of Hawksmoor Investment Management (“Hawksmoor”), the investment manager of the MI Hawksmoor Distribution Fund (“Fund”). Hawksmoor is authorised and regulated by the Financial Conduct Authority. Hawksmoor’s registered office is 2nd Floor Stratus House, Emperor Way, Exeter Business Park, Exeter, Devon EX1 3QS. Company Number: 6307442. The Fund’s Authorised Corporate Director, Apex Fundrock Ltd (“Apex Fundrock”) is also authorised and regulated by the Financial Conduct Authority. This document does not constitute an offer or invitation to any person, nor should its content be interpreted as investment or tax advice for which you should consult your financial adviser and/or accountant. The information and opinions it contain have been compiled or arrived at from sources believed to be reliable at the time and are given in good faith, but no representation is made as to their accuracy, completeness or correctness. Hawksmoor, its directors, officers, employees and their associates may have a holding in the Fund. Any opinion expressed in this document, whether in general or both on the performance of individual securities and in a wider economic context, represents the views of Hawksmoor at the time of preparation and may be subject to change. Past performance is not a guide to future performance. The value of an investment and any income from it can fall as well as rise as a result of market and currency fluctuations. You may not get back the amount you originally invested. FPC26611

Source: MSCI. Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent.

Source: ICE. The index data referenced herein is the property of ICE Data Indices, LLC, its affiliates (“ICE Data”) and/or its Third Party Suppliers and has been licensed for use by Hawksmoor Investment Management Limited. ICE Data and its Third Party Suppliers accept no liability in connection with its use. See https://www.hawksmoorim.co.uk/ice-dataindices-disclaimer/ for a full copy of the Disclaimer.